As the crypto community emerges from the 2022-2023 crypto winter, a focal point looms on the horizon—the anticipated Bitcoin halving event in 2024. Beyond a mere milestone, this guide plunges into the intricacies of what awaits, delving into key facets such as halving dates, its repercussions on prices, and the broader implications for the crypto landscape.

Introduction to Bitcoin Halving

At the core of Bitcoin lies its decentralized architecture and the process of mining. The intricate proof-of-work (PoW) process involves powerful computers solving complex mathematical problems to verify transactions, with miners rewarded in Bitcoin. Enter the Bitcoin halving—a coded 50% reduction in these mining rewards, strategically embedded into Bitcoin’s monetary policy by its elusive creator, Satoshi Nakamoto.

Bitcoin Halving Cycle

With the intent to curb inflation and bolster scarcity, Bitcoin experiences halving approximately every four years, precisely after every 210,000 blocks are mined. This pivotal reduction in rewards enhances Bitcoin’s scarcity, elevating its stock-to-flow ratio and bestowing upon it an enduring preciousness.

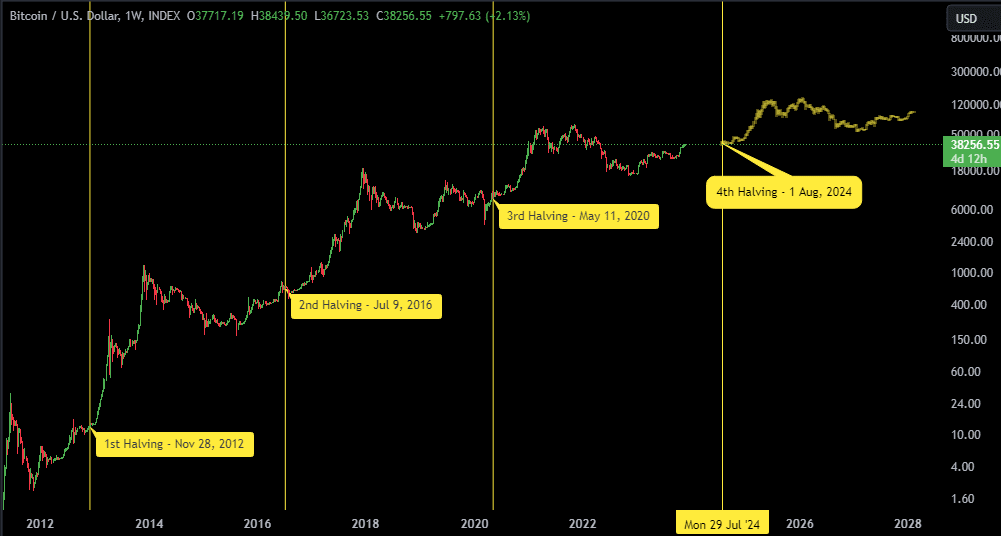

The History of Bitcoin Halving

Since its debut in 2009, Bitcoin has undergone three halving events—in 2012, 2016, and the most recent in 2020. The fourth is looming in 2024, slated to unfold at block height 840,000, with the fifth anticipated in 2028.

Technological Significance

The 2024 halving is poised to influence the rate of new Bitcoin entering the market, diminishing rewards from 6.25 to 3.125 BTC. This reduction acts as a catalyst, compelling miners to optimize their operations for profitability, potentially triggering advancements in more energy-efficient and potent mining hardware.

source:x.com

Economic Significance

Historically, Bitcoin halving events have sparked market scarcity, propelling prices upward. Analysts conjecture that the 2024 halving, following the 2022 crypto winter and the 2023 economic downturn, could witness Bitcoin scaling all-time highs. This scarcity, coupled with Bitcoin’s deflationary nature, attracts investors seeking a reliable store of value in times of inflation.

The Halving Cycle and Bitcoin’s Price

The halving cycle choreographs Bitcoin’s price dynamics through discernible phases:

Accumulation Phase: Preceding halving events, users accumulate BTC, fostering price stagnation or a mild uptrend extending for 13 to 22 months.

Bull Run Phase: Post-halving, Bitcoin embarks on bullish trends persisting for 10-15 months, culminating in all-time highs. Brief pullbacks might punctuate this trajectory, but the overall trend remains bullish.

Bear Run Phase: Past bull runs conclude with pullbacks or corrections, typically spanning about 600 days and signaling the cycle’s denouement.

Impact on Miners

Mining Bitcoin demands substantial resources, and halving the rewards further impacts miner profitability. Energy-intensive processes necessitate miners to adapt during periods of reduced rewards, navigating the delicate balance between costs and earnings.

Is Bitcoin Halving Good or Bad?

The impact of halving is nuanced, reflecting both positive and challenging dimensions. On the affirmative side, it accentuates Bitcoin’s scarcity, potentially fostering an increase in its value. However, the short-term volatility in prices and diminished miner profitability present challenges. Additionally, concerns emerge about network security, as fewer miners might persevere, leading to the consolidation of mining power and potential vulnerabilities.

In summation, the 2024 Bitcoin halving transcends a mere event; it marks a recalibration of Bitcoin’s economic and technological parameters. As the crypto community braces for this significant occurrence, the intricate dance between scarcity, innovation, and market dynamics continues to shape the future of the world’s leading cryptocurrency.

Unleash Your Potential with HyroTrader

Embark on a journey of exploration in crypto trading with HyroTrader—the premier crypto prop firm offering funding for crypto traders on Binance and ByBit. Serving as an FTMO alternative for real crypto traders, HyroTrader provides funded accounts and personalized support. Join us to navigate the evolving crypto landscape successfully.

First crypto prop firm, Funding for crypto traders, FTMO alternative for real crypto traders, Crypto proprietary trading firm, Crypto funded accounts, Funded accounts for crypto traders, Funded accounts on Binance, Funded accounts on ByBit.