Swing trading has long been a profitable strategy for experienced traders, catching medium-term moves that unfold over days or weeks. Now, swing trading prop firms have opened the door for crypto traders to amplify those gains by trading with significantly larger capital.

If you’re adept at swing trading and are exploring the world of crypto prop trading, this comprehensive guide is for you. We’ll dive deep into how you can leverage a proprietary trading firm’s resources to boost your crypto swing trading, what to look for in a prop firm as a swing trader, and advanced tips to maximize your success.

By the end, you’ll understand how to marry your swing trading skills with the advantages of a crypto-focused prop firm – potentially accelerating both your profits and your trading career.

Swing Trading in a Crypto Prop Firm Environment

Crypto markets operate 24/7 and often exhibit strong trending moves, making them ideal for swing trading. Swing trading involves holding positions for longer than a single day, sometimes several days or even a few weeks, to capture significant price swings. In the context of a crypto prop trading firm, swing trading means you’re using the firm’s capital to open trades and hold them to ride these larger moves. This combination can be powerful: you apply your skill in spotting multi-day crypto trends, and the prop firm provides the funding and infrastructure.

One key difference in crypto swing trading is the round-the-clock nature of the market. Unlike stock traders, crypto swing traders don’t have market closures each day – a trade can continue moving at 3 AM on Sunday just as it might on a Wednesday afternoon. For the experienced swing trader, this continuous market presents both opportunity and the need for discipline. With a prop firm involved, you have to be mindful of the firm’s risk parameters even as you let a winning trade run overnight or through the weekend.

Another aspect to consider is how swing trading vs. day trading plays out in a prop firm setting. Day traders often make many short-term trades and flat their positions by the end of the day, while swing traders hold positions longer to target bigger profits per trade.

Prop firms traditionally catered to day traders with strict daily loss limits and sometimes discouraged holding trades overnight. However, in crypto prop firms that truly support swing trading, you’ll find rules flexible enough to allow multi-day holds and even encourage traders to aim for larger gains over time. The crypto prop firm benefits when you profit consistently, so a good one will accommodate your swing strategy rather than force you into a purely intraday mold.

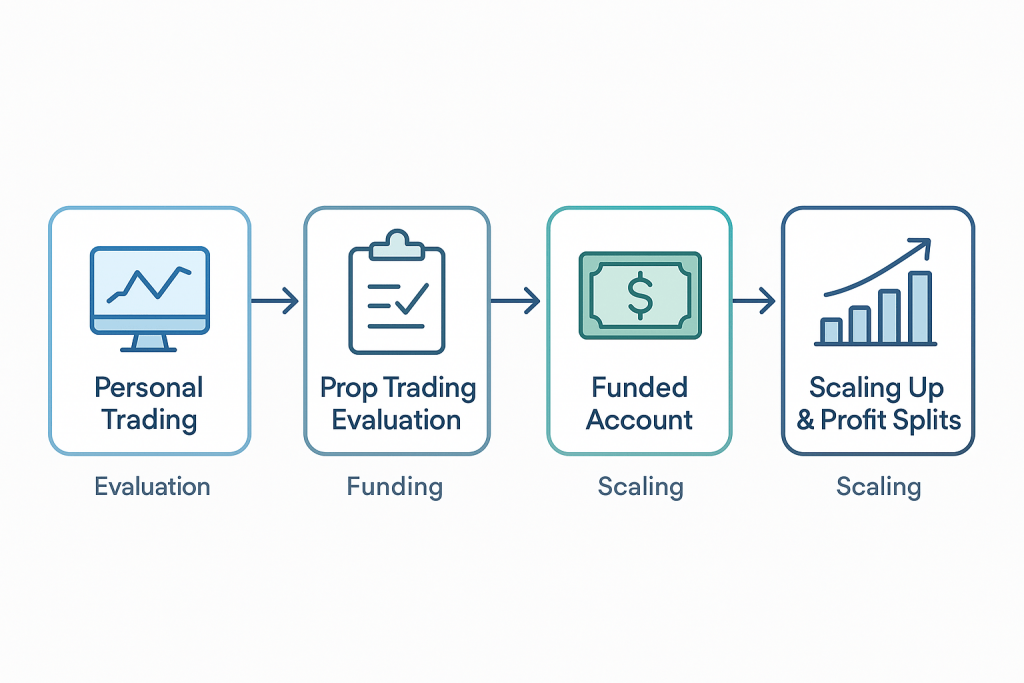

For swing traders used to trading their personal accounts, joining a prop firm offers the enticing possibility of scaling up. Instead of being limited by your own capital, you could be trading with $50,000 or $100,000 provided by the firm, meaning that a 10% swing in Bitcoin’s price could yield far more in dollar terms than it would on a small personal account.

The profit split model (where a percentage of profits goes to the trader and the rest to the firm) still leaves you with a substantial payout, given the larger capital at play. In essence, a prop firm partnership allows experienced crypto swing traders to punch above their weight, taking bigger positions to capture the same swing trades they already excel at.

However, trading with a firm’s money also means added responsibility. You must prove your ability through an evaluation or challenge phase and then adhere to the firm’s risk management rules. This environment actually complements the ethos of swing trading: it rewards patience, discipline, and strategic planning – qualities that swing traders tend to have in spades.

In the next sections, we’ll explore the specific benefits and challenges of swing trading under a prop firm, and what features you should seek out to ensure the firm is a good fit for your style.

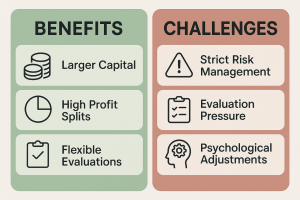

Benefits and Challenges of Swing Trading with Prop Firms

Swing trading with the backing of a prop firm can be a game-changer. But it comes with its own set of advantages and considerations. Let’s break down the major benefits you’ll enjoy, as well as the challenges you need to manage when trading as a funded swing trader.

Benefits of Prop Firm Capital for Swing Traders

1. Access to Larger Trading Capital

Perhaps the most obvious benefit is the jump in buying power. By passing a prop firm’s evaluation, you might get to trade a six-figure account immediately. This means your swing trading positions can be sized much larger than what your personal account might allow.

For example, if you normally trade with $5,000 of your own money and catch a 20% upswing on an altcoin, that’s a $1,000 profit. But with a $100,000 funded account, the same trade (with equivalent risk management) could net $20,000. The ability to profit from your strategy is magnified greatly when the prop firm provides the capital.

2. Leverage Crypto’s Volatility with Less Personal Risk

Crypto is known for its volatility – 15-20% price swings in a week for major coins like BTC or ETH are not uncommon, and smaller altcoins can move even more. As a swing trader, volatility is your ally, since you aim to capture a portion of these large moves. With a prop firm, you are effectively using other people’s money to harness this volatility.

Your personal financial risk is limited to the fee you pay for the evaluation/challenge (which many firms refund once you’re successful). This setup can be mentally liberating: you can trade confidently knowing that a string of losses won’t wipe out your own savings, as long as you respect the firm’s drawdown limits.

You still need to manage risk diligently, but the worst-case scenario in a prop arrangement is usually just losing the opportunity (failing the challenge or losing the funded account) rather than going into debt or losing your own nest egg.

3. High Profit Potential (Even After Splits)

Prop firms make money by splitting profits with you, but a good crypto prop firm will let you keep the lion’s share of those profits. It’s common to see profit splits like 70/30 or 80/20 (trader/firm), and some even go up to 90% in the trader’s favor as a reward for consistency. With such splits, you’re effectively keeping the majority of the reward while the firm takes a modest cut for providing capital and infrastructure.

For instance, if your swing trading yields $10,000 in a month on a funded account, at an 80% split, you keep $8,000, which is a fantastic return, especially considering you didn’t risk your own capital to generate it. In short, your upside is significantly amplified. Crypto’s big swings mean big profits, and generous splits ensure those gains mostly end up in your pocket.

4. Structured Growth and Scaling

Many prop firms provide a clear path to grow the account size if you trade well.

This is a huge benefit for swing traders who plan for long-term success. Instead of being stuck at a $100k account, you could, for example, be doubled to $200k, and then gradually increased to $500k or more as you hit performance milestones. This scaling opportunity means that a swing trader can dream bigger, potentially managing a seven-figure trading account over time.

All the while, the firm is supporting that growth because it’s mutually beneficial; the more you profit, the more they do too. This beats trading alone, where you’d have to continuously add your own money or profits to grow your account size slowly. With a prop firm’s scaling plan, a few months of good performance can fast-track you to trading amounts you might not have reached on your own for years.

5. Professional Environment and Support

Trading via a prop firm often comes with additional perks such as risk management tools, performance analytics, and even mentorship or community engagement. Best crypto prop firms will have dashboards that show your real-time profit/loss, risk metrics like drawdown, and other analytics. They may offer resources like a Discord community of traders, webinars, or coaches to help you sharpen your skills.

As a swing trader, having a community of like-minded traders and staff who understand crypto markets can be invaluable. It’s like getting an instant network and support system. If you’ve been trading solo, this environment can help you stay accountable and disciplined. Plus, the firm’s customer support can answer any platform or account questions, and in crypto, good support is crucial when you might be trading at odd hours or need a quick clarification on a rule before holding a trade through the weekend.

Challenges to Manage in a Prop Trading Program

While the benefits are enticing, it’s important to be aware of the challenges and adapt your swing trading approach accordingly. Here are some considerations and hurdles you might face when dealing with prop firms:

1. Evaluation Pressure and Rules

Before getting funded, nearly all prop firms require traders to pass an evaluation or “challenge.” This usually means you have to achieve a certain profit target (e.g., +10% on the account) without breaching risk rules like a maximum drawdown or daily loss limit. Swing traders might find the profit target achievable, but the rules can impose a bit of pressure.

For example, you might spot a great swing trade that you’re confident in, but you still must place a stop-loss (many firms mandate stop-losses on every trade) and ensure that even if the trade goes against you initially, it won’t hit the daily loss limit. Additionally, some firms historically had time limits (like “gain 10% in 30 days”), which can force traders to take suboptimal trades as the deadline approaches.

The good news is, as we will discuss, the better crypto prop firms have removed the time limit constraint, but you should double-check this. The key challenge is to treat the evaluation like a real account: follow your strategy, don’t rush trades to hit the target, and respect all the risk parameters. It requires discipline to stick to a swing trading plan under exam conditions, but that discipline is exactly what prop firms are looking for.

2. Drawdown Limits and Risk Management

Prop firms protect their capital by enforcing drawdown limits. Two common ones are a daily drawdown (e.g., you can’t lose more than 5% of the account in a single day) and an overall max drawdown (e.g., if you lose 10% from the initial balance or highest balance, the account is closed).

For a swing trader, this means you have to be strategic about trade sizing and stop placement, especially when holding trades for multiple days. A position that’s too large with a wide stop could violate a daily loss limit if it goes wrong.

For example, on a $100k account with a 5% daily drawdown, you shouldn’t risk more than $5k on any given day. If your strategy typically risks say 2% per trade, that’s $2k risk per trade max, which is fine. But if you were thinking of running multiple simultaneous swing trades, you must consider the combined risk if they all go south at once.

The challenge is adhering to these limits without stifling your trading style. It might require adjusting position sizes down a bit or staggering your entries. Some prop firms also require a minimum number of trading days during the evaluation (to ensure you’re not just lucky on one big trade).

For a swing trader who might do only a few trades a month, meeting a minimum of 5 or 10 trading days means you’ll want to take enough trades to satisfy that, or at least scale out of positions on different days to count as separate trading days. In summary, swing trading on prop capital is absolutely doable, but it imposes a risk framework, which, if anything, helps you become an even more disciplined trader.

3. Psychological Pressure of Trading OPM

Even for seasoned traders, there’s a psychological adjustment when trading “other people’s money” (OPM). Knowing that violating a rule could lose you the funded account might make you more cautious or, conversely, tempt you to swing for the fences to hit targets quickly. Both impulses need to be managed. The pressure of an evaluation or of maintaining a funded status can lead to deviation from your strategy.

For instance, cutting winners short to lock in profits and not risk losing the account, or moving stops impulsively. It’s important to remind yourself that the prop firm chose you (once you pass) because of your skills; they want you to stick to the proven methods that got you there. One way to handle the pressure is to mentally “own” the process: treat the prop account as if it’s your own hard-earned money, and trade it with the same care.

At the same time, leverage the fact that losses are not directly coming from your pocket to stay objective about trades – if a setup is invalidated, just exit, rather than hoping because you’re afraid to “lose” the chance. Many traders actually find their performance improves with a prop firm because the rules force good habits, but be prepared for an initial psychological hurdle as you adapt to having a bigger account and a few new constraints.

4. Adapting Strategy to the Firm’s Platform and Instruments

Not all prop firms are equal in terms of the trading platforms and instruments available. A challenge can be if a firm’s trading conditions aren’t identical to what you’re used to. For example, if you swing trade on Binance normally, and a prop firm uses a different exchange or a CFD platform, there might be slight differences in price feeds or available order types.

Latency or execution could differ, too. Most reputable crypto prop firms like HyroTrader mitigate this by using real exchange data and accounts, meaning you’ll be trading under conditions very close to what you’d get on a major exchange (we’ll touch on an example soon). It’s still wise to familiarize yourself with whatever platform the firm uses during a demo or trial phase.

As a swing trader, minor differences like a slightly higher spread won’t usually matter as much as they would to a scalper, but you should verify that the coins or pairs you want to trade are offered, and that you can place the types of orders you need (like stop-loss, take-profit, OCO orders, etc.). The challenge here is mostly upfront: choose a prop firm whose trading environment aligns with the crypto markets you trade, so you don’t have to adapt your strategy drastically. The closer the firm’s platform is to a real exchange, the smoother your transition will be.

In summary, the challenges of swing trading with a prop firm revolve around working within the rules and managing your mindset. None of these are deal-breakers for a serious trader – in fact, many swing traders find that once they adjust, they can trade almost exactly as they did on a personal account, but now with much more capital behind each trade. The next critical step is choosing the right prop firm that truly empowers swing trading rather than hindering it. Let’s discuss what to look for in a crypto prop firm as a swing trader, to make sure you get the benefits without unnecessary headaches.

What to Look for in a Crypto Prop Firm as a Swing Trader

Not all prop firms are created equal, especially when it comes to accommodating swing trading in crypto. When evaluating crypto prop trading firms as a swing trader, you should have a checklist of features and conditions that will set you up for success. Here are the key things to look for, and why each one matters for swing trading:

- No Time Limit on Evaluations: Time pressure can hinder swing trading. Look for firms that allow unlimited time to pass their evaluations, enabling you to wait for quality setups without rushing. This flexibility is key for effective swing trading.

- Overnight and Weekend Holding Allowed: Ensure the firm permits holding positions overnight and over weekends. This freedom is crucial, as swing trading often requires riding trends that extend beyond traditional market hours.

- Sufficient Starting Capital (Account Sizes): Choose firms with appropriate account sizes, typically starting at $10k or more. A solid scaling plan that increases your account size based on performance indicates a commitment to long-term growth.

- Generous Profit Split: Aim for firms offering a profit split of at least 70%, ideally up to 90%, as you prove your capabilities. A higher profit share means you retain more of your earnings from successful trades.

- Real Trading Conditions (Real Market Data): The firm should use real exchange data for pricing. This ensures your trading experience closely mirrors actual market conditions, which is vital for effective swing trading.

- High Leverage Available (with Sensible Limits): Look for firms that offer leverage between 1:10 and 1:100. High leverage provides flexibility in trading, allowing you to take advantage of multiple positions or varying risk/reward scenarios.

Keep these factors in mind as you research swing trading prop firms. The ideal scenario is to find a firm that checks all the boxes, so you can concentrate on trading and not worry about restrictive rules or mismatched conditions. Fortunately, there are new players in the industry that recognize the needs of crypto swing traders. One prime example is HyroTrader, which we’ll delve into next, as it embodies many of these ideal features.

HyroTrader: A Crypto Prop Firm Tailored for Swing Traders

One standout prop firm that has been making waves in the crypto trading community is HyroTrader. Designed from the ground up for cryptocurrency traders, HyroTrader offers a suite of features that align perfectly with what swing traders need. Let’s explore how HyroTrader addresses each of the key points we discussed, and why it’s an excellent choice if you’re looking to apply your swing trading strategy in a prop firm setting.

Large Starting Capital & Scaling Up to $1M

HyroTrader provides funding options that can kick-start your trading with serious capital. Traders can begin with account sizes as high as $100,000 right off the bat. For those who prove themselves, the firm doesn’t stop there – it offers a scaling plan to grow your account up to $1,000,000 over time. This scaling is typically achieved by incremental increases (e.g., 25% boosts every certain number of months of profitable trading).

What this means for a swing trader is that you have a clear path to eventually managing a seven-figure account. HyroTrader essentially says: show consistent results and we’ll continually up the ante for you. This commitment to scaling demonstrates a partnership approach – they want you to manage more capital as you succeed, which is the ultimate dream for a swing trader looking to maximize gains on long-term moves.

Generous Profit Split (70% to 90%)

HyroTrader’s profit-sharing model is very trader-friendly. Initially, you retain 70% of the profits you make, and as you continue to trade and grow the account, your profit split can increase up to 90% in your favor.

A 70/30 split is already solid (you keep the majority of gains), but 90/10 is almost like trading your own account in terms of reward retention. Few prop firms in any market offer 90% to the trader, and HyroTrader does this as an incentive for long-term performance.

For example, if you have a big swing trade that banks $20,000 in profit, starting out, you’d keep $14,000 (70%). As you move up the tiers and perhaps reach 80% or 90%, you’d keep $16k or $18k, respectively.

This high payout structure is especially important in volatile crypto markets – when you hit a home run trade, you want to keep as much of those profits as possible. HyroTrader ensures that over time, you’re rewarded for consistency with one of the best profit splits in the industry.

Instant Crypto Payouts (USDT/USDC)

Unlike some firms that make you wait until the end of the month or follow a schedule for profit withdrawals, HyroTrader enables instant payouts of your profits. As soon as you’ve got at least a minimal amount of profit (for instance, $100 or more), you can request a payout and receive it typically within 12-24 hours.

Payouts are processed in stablecoins like USDT or USDC, meaning you receive your money in a cryptocurrency that’s pegged to the dollar, which you can then easily trade or convert to cash as needed.

The advantage here is twofold: you have quick access to your earnings (no lengthy waiting periods), and using stablecoins makes the process fast and global (no bank wire delays). For a swing trader, this is fantastic because if, say, you close a big position on Wednesday and lock in profits, you don’t have to wait weeks to actually enjoy the fruits of that trade – you could withdraw the next day. HyroTrader’s on-demand payout policy shows they trust their funded traders and are operationally efficient.

There’s also a psychological benefit: knowing you can secure your gains promptly can encourage you to trade diligently and lock in profits when targets are hit, without worrying about administrative holdups.

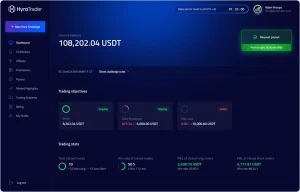

HyroTrader Dashboard

Real Exchange Data and Execution (ByBit/Binance Integration)

HyroTrader prides itself on using real exchange connectivity. Traders on the platform execute via real market data from major exchanges, notably ByBit’s trading environment and price feed, as well as data from Binance for certain features.

In practice, when you place a trade through HyroTrader, you’re interacting with live order books and real-time prices just as you would on an exchange. This results in transparent and reliable trading conditions: no artificial spikes, no price manipulation, and true market liquidity.

As a swing trader, you can trust that your technical analysis based on exchange charts will hold true on the prop account. For example, if Bitcoin’s price on Binance never went below $30,000, you won’t mysteriously get stopped out at $29,800 on the prop account – something that could happen with less scrupulous brokers offering CFDs.

HyroTrader’s approach eliminates that worry. We even advertise having no “trading wicks” (those sudden price blips some platforms produce) in our environment. Essentially, you’re trading real crypto markets through the HyroTrader prop firm’s interface, which is the ideal scenario.

This integration with real exchanges also means you can use advanced order types (stop-loss, take-profit, conditional orders) just as you normally would, and expect them to behave correctly. The fidelity to the real market is a huge plus for anyone doing multi-day trades, where accurate price data is critical for things like trailing stops or breakout entries.

Flexible Evaluation with No Time Limit:

HyroTrader offers swing traders an unparalleled opportunity with no time limit on achieving profit targets. This means you can take your time to reach the typical 10% target without the pressure of a ticking clock, allowing for better decision-making. Even once funded, there’s no requirement for monthly profits, just avoid breaching loss rules. This flexibility is ideal for swing traders who may prefer to wait for optimal market conditions.

High Leverage (Up to 100x):

Traders at HyroTrader can access leverage up to 1:100, enabling sizable positions even with smaller accounts. For a $100k account, this means potential control over $10 million in positions. You have the freedom to choose your leverage based on your risk profile, allowing for strategic adjustments as market conditions change. This contrasts with firms that limit leverage on swing accounts.

No Restrictions on Strategy – Trade Your Way:

HyroTrader imposes very few restrictions on trading styles, accommodating swing trading, day trading, and automated bots. As long as you follow basic risk management guidelines, you’re free to execute your strategies without arbitrary limitations. This is particularly beneficial for crypto traders who often face strict rules elsewhere.

Real-Time Risk Tracking & Analytics:

The modern trading dashboard at HyroTrader provides real-time updates on performance and risk metrics. You can monitor your available drawdown and unrealized profits instantly, ensuring you’re always aware of your risk status. Analytics on win rates and trade statistics allow for informed adjustments to your trading approach over time.

It’s clear that HyroTrader hits all the marks that a swing trader would desire in a prop firm: ample capital, relaxed time constraints, high profit retention, realistic trading conditions, and robust support. The firm effectively empowers you to do what you do best – analyze the crypto markets and trade the swings – while taking care of the funding and technical backbone. Many traders who have struggled with prop firms in the past (due to time limits or restrictive rules) are finding success with crypto-focused firms like HyroTrader precisely because the model is more flexible and aligned with real trading. By choosing a platform that embraces swing trading rather than discouraging it, you set yourself up for a much smoother path to scaling your trading profits.

Now that we’ve covered the platform and firm aspect, let’s turn our attention to some advanced tips on actually executing swing trades within a prop firm environment. Even with the right firm backing you, it’s ultimately your strategy and execution that will determine your success.

Advanced Tips for Swing Trading on a Funded Crypto Account

Having a funded account with a supportive prop firm like HyroTrader gives you a strong foundation, but to truly excel, you’ll want to adjust and refine your trading practices to fit this new context. Here are some advanced tips and insights for swing trading in a prop firm environment, so you can make the most of the opportunity:

1. Emphasize Risk Management and Respect the Rules

This might sound basic, but it’s absolutely critical in prop trading. Swing traders can sometimes get complacent with risk if they’re used to personal accounts without strict oversight.

In a funded account, you must internalize the prop firm’s risk rules as part of your own strategy. That means always use a stop-loss (HyroTrader, for instance, requires a stop on every trade within a few minutes of entry – a good practice anyway) and plan your trade size such that even if your stop is hit, you’re well within the daily loss limit.

A useful technique is the 1% rule: risk no more than 1% (or 2% at most) of the account on any single trade. On a $100k account, that’s risking $1k per trade; even a string of 5-10 losses won’t bust you. Since swing trading typically has a higher win percentage and reward-to-risk ratio than random trading, keeping risk per trade moderate ensures you can survive the occasional losing streak.

Be mindful of correlated trades. If you are long on multiple cryptocurrencies that tend to move together, such as BTC, ETH, and LTC, consider the combined risk. You might risk 0.5% on each, so that if the entire market drops and all your positions hit their stop losses, you only incur a total loss of about 1.5-2% instead of risking 3 separate trades at 1% each, which could add up to roughly 3%.

In a prop trading account, drawdowns are detrimental. It’s better to experience a steady climb rather than wild swings in your equity. Stick to your stop losses; don’t remove or widen them in hopes of avoiding a loss. If a trade idea becomes invalid, take the small loss and move on. Preserving capital, especially when managing someone else’s money, is crucial. By treating the prop firm’s rules as essential, you impose a healthy discipline on yourself that can enhance your overall trading performance. Many successful funded traders have noted that once they respected the drawdown limits as if they were natural law, they avoided catastrophic losses and their equity curve became much smoother.

2. Leverage the No-Time-Limit Advantage: Be Patient

One of the biggest edges you have as a swing trader in certain crypto prop firms (like HyroTrader) is the lack of a time limit to achieve your profit targets or to make profits once funded. Use this to your advantage by being extra selective with your trades. Patience is a swing trader’s virtue, and now you don’t have a deadline pushing you.

This means you can wait for only the best setups – those A+ trade scenarios that you’ve seen play out successfully many times in your trading career. Avoid the temptation to trade out of boredom or to “do something” just because you’re in an evaluation and feel you should be active.

Remember, in swing trading, oftentimes less is more. A few high-quality trades can hit your profit goals, whereas many mediocre trades just expose you to more risk. For example, if Bitcoin is stuck in a choppy, range-bound state for two weeks and your strategy doesn’t give any clear signal, it’s perfectly fine not to trade during that period. Once a strong trend or breakout emerges, that’s when you deploy your capital.

By being patient, you also reduce stress – you’re not constantly in the market or glued to the screen; you’re waiting calmly for your edge to appear. This approach not only helps you pass challenges more smoothly but also sets you up for longevity once you’re managing the funded account.

You might find you trade fewer times per month with the prop account than you did on your personal account, simply because you now have the luxury of time. That’s okay; if each trade is larger (due to more capital) and carefully chosen, your absolute profits can be higher with fewer trades. In summary, take your time – the market isn’t going anywhere. When the probability is in your favor, strike; when it’s not, protect your equity by staying on the sidelines.

3. Use Leverage Wisely – Don’t Overshoot on Overnight Positions

Having up to 100x leverage at your disposal doesn’t mean you should use it all, especially not for multi-day swings.

Swing trading often involves holding through volatile periods, possibly through news events or sudden market sentiment shifts. If you over-leverage, even a normal retracement could trigger a large drawdown or hit a stop that’s set too tightly due to the leverage.

A good rule of thumb is to size your positions as if you had no more than 5x or 10x leverage, even if more is available. For instance, on a $50k account, instead of thinking “I can take a $500k position with 10x or a $5M position with 100x,” focus on what portion of that account you’re willing to lose if wrong. If your stop is 5% away, a 10x leveraged full account trade would lose 50% – obviously too much.

You’d probably only take a fraction of the maximum size so that a stop-out loses 1-2% of the account. In practice, many successful swing traders on prop accounts use relatively low leverage for their core swing trades (maybe 3x, 5x, 10x) to keep trade risk manageable, and they save the high leverage bullets for very special situations (like a quick breakout trade with a super tight stop, where they might momentarily use 20x or more because the risk is still tiny in absolute terms).

Remember, your goal is steady growth, not a lottery win. Consistency beats occasional huge wins followed by huge losses. Using moderate leverage also helps you psychologically hold trades longer – if you’re 50x leveraged, a 2% adverse move is a 100% loss of the account (if no stop)!

You’d be so on edge that you might exit prematurely. But if you’re say 5x leveraged, a 2% against you is 10% of the account – not pleasant but within many firms’ drawdown limit; and if your stop is maybe 4% away (20% of account at 5x, which is too high risk actually – so you’d likely use even smaller size in that case), but you get the idea.

In swing trading, longevity and staying in the game for the big move are crucial. Right-sizing your leverage ensures you stay in control and don’t lose the account on one trade gone wrong.

4. Incorporate Both Technical and Fundamental Analysis

Crypto markets are influenced by a mix of technical patterns and fundamental news (like protocol upgrades, regulatory news, macroeconomic shifts affecting Bitcoin, etc.). As a swing trader on a prop account, you should refine your ability to anticipate or react to fundamental events that could boost or bust your trade.

For example, if you’re long on Ethereum for a swing trade because the chart looks bullish, be aware of any upcoming Ethereum network updates or major industry conferences that could affect sentiment. Likewise, keep an eye on the economic calendar – events like Federal Reserve meetings or inflation reports can indirectly impact crypto prices as the broader risk appetite shifts.

One advanced technique is to use on-chain analytics or sentiment analysis for fundamentals: these might not be things prop firms teach, but as an experienced trader, you can leverage tools like Glassnode (for on-chain data) or sentiment trackers on social media to gauge if a crypto asset is gaining bullish traction.

Perhaps you notice a spike in large holders (“whales”) accumulating Bitcoin over a week – that could reinforce your technically-driven decision to stay long for a swing. Conversely, if news breaks that a country is banning crypto trading, you might tighten your stops or take profit early on your swing trade to avoid a sharp downturn.

Prop firms don’t restrict news trading, especially HyroTrader, so you are free to hold or close positions around news as you see fit. The key is not to trade blindly. Combining TA and FA will give you higher conviction in your swings, which is important when you have to sometimes hold through scary dips on the way to your target.

Having a fundamental reason to stay in a trade (or to exit one) can make a big difference in profitability. In summary, treat your prop account like you’re running a small fund – do your due diligence on the assets you trade, not just the chart patterns. This holistic approach can increase your edge.

5. Take Advantage of Analytics and Learn from Each Trade

With a prop firm’s analytics (and your own record-keeping), make it a habit to review your trades periodically. Since swing trades are fewer in number, each one holds valuable lessons. For any given trade, ask yourself: Did it follow my plan? How well did I execute the entry and exit? Was my position size appropriate? Did I adhere to all rules (e.g., set my stop immediately, not add to a losing position, etc.)?

Use the metrics provided – for example, if the dashboard shows that your average losing trade is significantly larger than your average winner, that’s a problem to address (perhaps by cutting losses quicker or taking profits more systematically). Or if it shows your win rate is very high but you’re not making as much as you should, maybe you are taking profits too early on your winners – a common issue when adjusting to a profit-split scenario is being too eager to book any profit.

Keep an eye on your drawdown patterns, too. If you notice that you often dip close to the daily loss limit before bouncing back to profits, it means you’re riding the edge – consider scaling down a bit to give yourself more buffer. Prop trading will sharpen you if you embrace the feedback loop: trade, get data, tweak strategy, repeat.

Also, take advantage of any community or mentorship the firm offers. Discussing with other funded traders can reveal tips on, say, how to handle certain volatile periods or how to better manage the psychological aspect. Some prop firms have a leaderboard or share top traders’ stats (anonymously) – you can glean insight from those as well (like seeing that the most profitable traders maybe only trade 3-4 times a month, reinforcing the patience approach).

Continuous improvement is the name of the game. The market evolves, and so should you. Prop firms often update their conditions or add new products (e.g., HyroTrader might add a new exchange integration or new coin offerings); stay informed via their announcements so you can utilize any new advantages.

Conclusion

Swing trading in the crypto market offers some of the most exciting opportunities for traders, and prop firms have emerged as a powerful catalyst to help traders seize those opportunities on a much larger scale. For experienced swing traders, the fusion of their honed trading skills with a crypto prop firm’s funding and infrastructure can be a transformative step. You’re no longer limited by your account size; instead, you can ride the next big Bitcoin or Ethereum swing with tens of thousands of dollars at your command, amplifying your returns dramatically.

As we’ve explored, not all swing trading prop firms are the same. It’s crucial to choose a firm that aligns with the needs of a swing trader: no arbitrary time limits, sensible risk rules, generous profit-sharing, and a platform that mirrors real crypto market conditions.

In this regard, HyroTrader stands out as a premier choice. It checks all the boxes – from providing up to $100K (scalable to $1M) in trading capital to allowing unlimited time for you to hit profit targets, and from offering lightning-fast payouts in stablecoins to fostering a 24/7 crypto-centric trading environment. HyroTrader essentially empowers you to do what you do best, only bigger and better. It’s a prop firm that succeeds when you succeed, making it an ideal partner for a swing trader aiming for the next level.

In closing, the world of crypto prop trading is still relatively new and growing. Getting in now with a firm like HyroTrader can position you ahead of the curve, potentially giving you access to resources and capital that few others have in these markets.

It’s an opportunity to accelerate your trading career: where a 10% yearly return on your own capital might not change your life, a 10% monthly return on a prop firm’s six-figure account just might. You can turn your swing trading skills into a highly lucrative venture by carefully selecting the right prop firm and approaching the partnership with professionalism and dedication.

So, if you’re ready to swing trade crypto on a grander stage, consider taking that step – get evaluated, get funded, and let your trading talent shine with the backing of a top-tier crypto prop firm. Your future self, watching those profits roll in without having risked personal capital, will be glad you did.