Crypto markets move at a relentless pace, and even seasoned traders can feel like they’re riding a rollercoaster. Are your swing trading strategies keeping up? As an experienced crypto trader, you’ve likely nailed the basics – now it’s time to refine your approach and squeeze more profit out of those medium-term price swings. Swing trading in cryptocurrency isn’t about luck or casual “HODLing”; it’s a strategic art of capturing the market’s natural ebb and flow over days or weeks.

In this comprehensive guide, we’ll dive deep into advanced swing trading tactics tailored for the crypto market. From mastering trend-riding techniques to timing breakouts and managing overnight risk, you’ll discover actionable tips that can elevate your trading game. We’ll also dispel common myths that might be holding you back and explore how leveraging the right tools (and even the right trading platform) can give you an extra edge.

If you’ve ever wondered how top crypto swing traders consistently catch big moves without babysitting their screens 24/7, you’re in the right place. Let’s break down the nuanced strategies and insights that can help turn a good swing trader into a great one – all while navigating the unique challenges and freedoms of the crypto market.

The Unique Dynamics of Crypto Swing Trading

Swing trading crypto is a different beast compared to swing trading stocks or forex. For one, the crypto market never sleeps – it’s active 24/7, which means a strong move can happen at 3 AM just as easily as 3 PM. There’s no closing bell to pause the action, and that around-the-clock volatility is both a blessing and a curse. The good news is you’re not limited by session hours, so a great setup can be traded whenever it appears.

The challenge?

You need to manage positions through overnight stretches and weekends, staying prepared for sudden news or “whale” trades that can spike or sink prices while you’re offline.

Another dynamic is the sheer volatility in crypto. A coin might swing 10% or 20% in a single day – paradise for a nimble swing trader who can catch that move, but brutal if you’re on the wrong side without a plan. These rapid swings mean bigger profit potential on each trade, yet they also demand respect for risk. Traditional swing trading principles still apply, but they must be tuned to crypto’s rhythm. For example, technical patterns like breakouts and reversals tend to play out faster and more dramatically in crypto, and false signals (like fake breakouts) can be common in thinly traded altcoins.

Seasoned traders also know that crypto markets have unique cycles – Bitcoin’s trend can lift or sink the entire market, and sentiment can shift on a dime with regulatory news or a viral tweet. As a crypto swing trader, you have to factor in these broader influences more than you might in other markets.

The bottom line is that crypto offers tremendous swing trading opportunities, but to capitalize on them consistently, you’ll need to adapt your strategy to handle non-stop trading hours, high volatility, and the ever-evolving market sentiment. With that context in mind, let’s explore specific strategies to thrive in this environment.

Key Swing Trading Strategies for Crypto

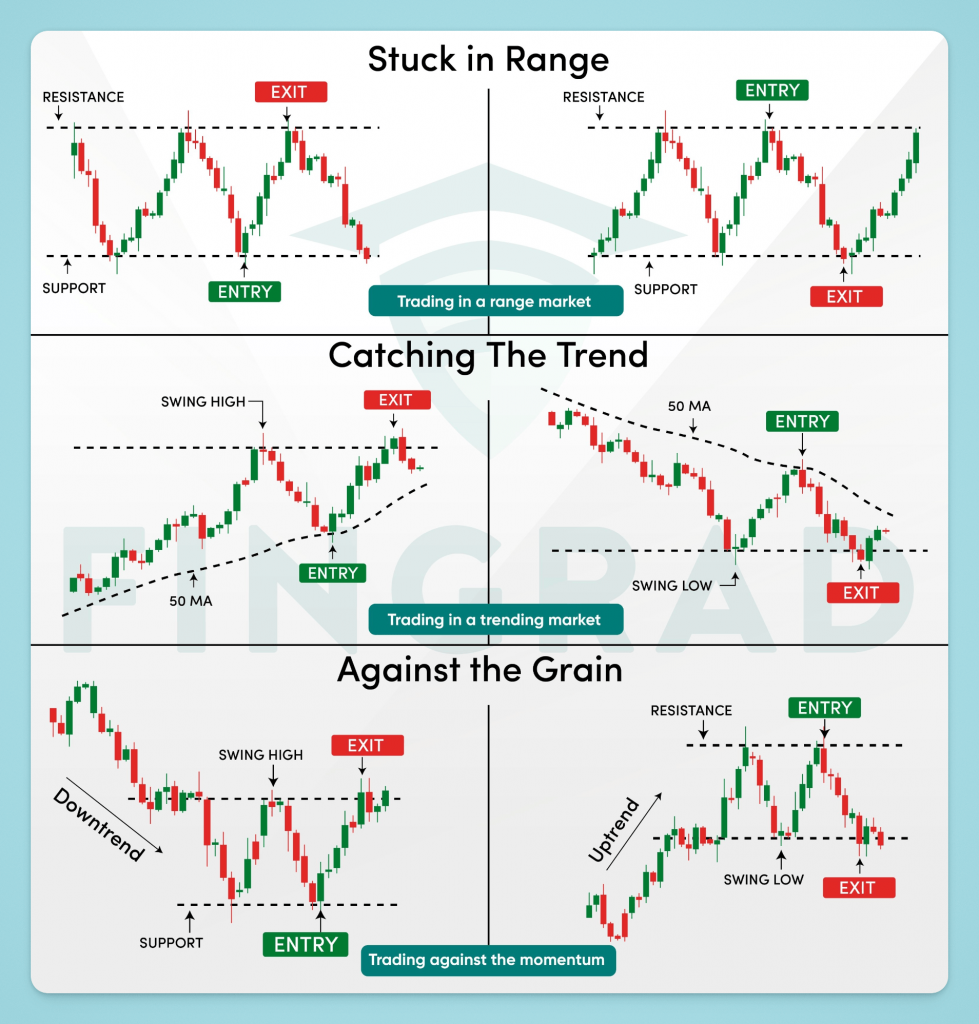

Every swing trader has their go-to setups, but in crypto, it pays to diversify your strategy toolkit. Below, we break down several battle-tested swing trading strategies adapted for the crypto arena. You might find that some trades call for trend following, while others favor a counter-trend approach – the key is to apply the right method for the market condition at hand. Let’s examine a few core strategies and how to execute them effectively in cryptocurrency markets.

Riding the Trend

One of the most reliable ways to swing trade crypto is to go with the flow of the market – in other words, trend following. When a cryptocurrency is in a clear uptrend (higher highs and higher lows on the chart), a swing trader’s job is to hop on that trend and ride it until the momentum fades. Think of it like surfing: you want to catch the wave early and then glide along with it, rather than trying to swim against it. In practical terms, this might mean identifying an uptrend using a moving average crossover (for example, the 50-day moving average crossing above the 200-day) or simply observing price structure (breaking above key resistance and then using that level as new support).

Once you’ve confirmed an uptrend, look for pullbacks as entry opportunities. Instead of chasing a coin after it’s already jumped 20% in a week, wait for a controlled dip (a brief counter-move against the trend). For instance, if Ethereum has been climbing steadily, you might wait for a 2-3 day pullback to a support zone or a trendline before buying. This way, you’re getting closer to a relative low within the uptrend, which offers a better risk-to-reward ratio. Your stop-loss can be placed just under the recent swing low (in an uptrend) – if the trend is truly intact, price shouldn’t break that level. On the flip side, in a downtrend, a trend-following swing trader would look to short the rips (entering on relief rallies) with a stop just above a recent swing high.

The key with trend riding is not to get greedy or fearful too soon. Let the trend itself tell you when to exit. You might use a trailing stop-loss that moves up as the price moves up, or watch for signs of reversal like a lower high forming after a series of higher highs. Experienced swing traders often take partial profits at predefined levels (say, after a coin moves X% in their favor) but keep a portion of the position running to capture any extended move. By aligning your trades with the prevailing trend, you increase the probability of success – it’s like having the wind at your back. Just remember that no trend lasts forever; stay vigilant for those reversal signals so you can lock in gains when the tide starts to turn.

Range Trading (Buying Support, Selling Resistance)

Crypto isn’t always trending up or down – often it gets caught in sideways ranges where price ping-pongs between a clear support level and a resistance level. Rather than avoiding these flat periods, savvy swing traders can profit by trading the range. The idea is simple: buy near the range’s support (the “floor” price that buyers repeatedly defend) and sell near the range’s resistance (the “ceiling” where sellers consistently step in). If the range is well-defined, these swing trades can be repeated multiple times as the price oscillates within the “box.”

For example, suppose Bitcoin has been fluctuating roughly between $25,000 and $30,000 for several weeks. A range trader would wait patiently for BTC to dip toward $25K support, then enter a long position as close to that level as possible (with a stop-loss a bit below $25K in case the support fails). As the price swings up, they’d aim to take profit in the high $20Ks or near $30K resistance. Conversely, if the price approaches the top of the range and shows signs of stalling, an experienced trader might even consider a short position near $30K with a stop just above that resistance, targeting a move back down toward the midpoint or lower end of the range.

Successful range trading requires a disciplined approach. Don’t get greedy and assume the range will last forever – always be prepared for a breakout or breakdown. One common tactic is to take profits slightly before the exact support or resistance level, since crypto prices can turn around just before hitting the obvious levels (due to other traders anticipating the same range). It also helps to watch volume and momentum indicators: if you see volume drying up as price nears resistance, it suggests the move is weakening (a good time to sell or short). If momentum indicators like RSI show oversold conditions at support, it adds confidence to a buy entry there.

Of course, if a genuine breakout occurs – say Bitcoin blasts above $30K on high volume – a range trader switches gears (more on breakout trading next). Your stop-loss will protect you from heavy losses if the range breaks while you’re in a trade. In summary, range-bound markets can be a swing trader’s playground. By staying nimble and respecting those support/resistance boundaries, you can harvest repeated small-to-moderate gains until the market finally decides on a direction.

Breakout and Retracement Entries

Markets spend a lot of time in ranges, but eventually they break out. A breakout occurs when the price pushes beyond a significant support or resistance level (or out of a chart pattern) with momentum. For swing traders, breakouts can be golden opportunities – catching a new trend right as it ignites. There are two main ways to play breakouts: jumping in as the breakout happens, or waiting for the retracement (pullback) afterward for a safer entry.

Breakout entries: This is the more aggressive approach. You monitor a key level – say an altcoin that’s been capped under $100 for weeks – and when it finally surges above $100, you buy immediately, anticipating a swift move higher as others pile in. In crypto, true breakouts often come with big volume spikes and rapid price action (think of those 15% daily green candles when a coin escapes a long consolidation).

The upside of entering the breakout is that you don’t risk missing the train; strong breakouts sometimes run hard without looking back. The downside is the risk of a false breakout – price pokes above resistance, lures in traders, then reverses sharply (also known as a “fakeout”). To guard against that, it’s wise to confirm the breakout if possible (for example, wait for a 4-hour or daily candle to close above the level, or see that volume is significantly above average). Also, use a stop-loss just below the broken level or the breakout point – if price falls back into the old range, that’s your cue that the breakout failed.

Retracement entries: Often, after a breakout, the price will pull back slightly to test the old resistance as new support – this is the classic “buy the pullback” strategy. If you missed the initial surge or prefer not to chase, set an alert or limit order around that breakout level. In our altcoin example, if $100 was the breakout point and the coin runs to $120, you might catch a retrace back toward $105-$100. Entering on that dip can give you a better entry price and confirmation that $100 is now holding as support. It’s a bit like getting a second chance to hop on the moving train, with slightly less risk because you’re closer to a support level. The trade-off is you might miss some moves if the pullback never comes (sometimes breakouts just keep roaring).

Whichever method you choose, successful breakout trading requires decisiveness and planning. Identify your breakout candidates in advance by drawing trendlines or marking key price levels on your charts. Keep a watchlist of coins approaching major support/resistance or forming patterns like triangles or flags. When the moment arrives, execute your plan: enter, set your stop, and have a target in mind (many traders project the size of the prior range or pattern to estimate how far the breakout could run). Breakouts can lead to some of the most profitable swing trades, as they often mark the start of a new trend. By either striking while the iron is hot or waiting for the first pullback, you can position yourself to ride that new momentum out of the gate.

Multiple Time Frame Alignment

One hallmark of experienced swing traders is the use of multiple time frames to improve trade selection and timing. The idea is to align your trade with the bigger picture trend, while fine-tuning your entry on a smaller chart. For example, you might use the daily chart or 4-hour chart to identify the general trend and key levels, then zoom into the 1-hour chart to pinpoint an optimal entry once conditions look right. By doing this, you avoid the pitfall of taking a trade that looks good on a 1-hour chart but is actually fighting against a strong trend visible on the daily.

Here’s how multi-timeframe analysis might work in practice: Suppose on the daily chart you see that Cardano (ADA) has been in a steady uptrend, but over the last week it’s pulled back to the 50-day moving average – a potential support in the context of the uptrend. Rather than blindly buying the dip, you drop down to the 4-hour chart to inspect the pullback. There, you notice that the selling pressure is waning – maybe the 4H candles are showing long wicks on the downside (indicating buyers stepping in), or an oscillator like RSI is climbing out of an oversold level. You even spot a small basing pattern or a double bottom on the 4H timeframe. These clues on the lower timeframe tell you the daily pullback might be ending.

So you execute a long entry on the 4H chart’s confirmation (say, a break above a minor resistance on that timeframe), confident that the trade is aligned with the larger daily uptrend. Your stop can go below the recent low on the 4H chart (just beyond the bottom of the pullback), which is a logical invalidation point if the trade idea is wrong.

The reverse works for downtrends: use the higher timeframe to confirm the asset is in decline, then use a lower timeframe bounce or consolidation as an entry to short. The benefit of multiple time frame alignment is that it filters out a lot of noise and bad signals. If you only trade when both your macro view and micro timing agree, you’ll likely increase your win rate. It also instills patience – sometimes you’ll sit on the sidelines waiting for that alignment, rather than forcing a trade based on one time frame alone.

A word of caution: stick to a couple of timeframes and don’t overcomplicate it. For swing trading, something like a daily/4H combo or 4H/1H combo works well. If you start examining five different time frames, you may find conflicting information everywhere. The goal is to see the forest (higher timeframe trend) and the trees (entry setup) together. When they line up, you’ve got a high-quality swing trade setup on your hands.

Advanced Risk Management & Leverage

No matter how great your strategy setup looks, risk management ultimately separates profitable traders from blown accounts. Crypto’s volatility makes it even more important to manage risk tightly on swing trades.

A smart approach begins with position sizing: decide how much of your account you’re willing to risk on a given trade (experienced traders often risk no more than 1-2% per trade). This way, even if a trade goes wrong, it’s a small dent, not a devastating hit.

Calculate your position size based on your stop-loss distance. For instance, if you’re buying Litecoin at $80 with a stop at $72 (8 dollars risk per coin) and you’re risking $400 of your capital on the trade, you’d take 50 LTC as your position (because 50 * $8 = $400). This discipline ensures that big swings won’t wipe you out – you’ve predefined your maximum loss.

Speaking of stop-losses, placing them correctly is an art. You want your stop to be at a logical level that invalidates your trade idea, not just a random tight number that could get hit by normal noise.

In the Litecoin example, setting the stop at $72 might correspond to a point just below a key support or the last swing low. That way, if the price drops that far, it likely means the upswing you anticipated isn’t materializing. Be mindful that crypto can have sudden wicks – brief spikes down or up, especially on leverage exchanges.

Some traders give their stops a bit of “breathing room” or use a wider stop with smaller position size to avoid getting wicked out, but don’t give so much room that you end up risking too much. Always strike a balance between not getting shaken out by minor volatility and not holding on until a small loss becomes a huge one.

Leverage is a double-edged sword in crypto swing trading. Platforms like futures exchanges or prop firms (e.g., those offering 10:1 up to 100:1 leverage) let you control a bigger position with less capital. This can amplify your profits and your losses. The rule of thumb is: just because high leverage is available doesn’t mean you should max it out. Use only as much leverage as needed to size your position properly within your risk limits.

For example, if your account is $5,000 and you want to take a $10,000 position on a swing trade, 2x leverage is plenty – you don’t need 10x or 20x for that. High leverage (20x, 50x, 100x) is usually unnecessary for swing trading because the moves you target (say 10-20% swings) are large enough to yield great returns with modest leverage. In fact, using extreme leverage on a multi-day trade is asking for trouble; even a normal retracement can liquidate your position if your leverage is too high and you haven’t left enough cushion.

Another aspect of risk management is holding trades overnight or over multiple days. Unlike day trading, swing trading assumes you will hold positions for extended periods. Make sure your platform or broker allows this, because some trading accounts (especially certain prop firms or funding programs) might restrict overnight holding.

Best crypto prop firms like HyroTrader are built with swing trading in mind – they let you hold positions overnight and even through the weekend, so you won’t be forced to exit a good trade prematurely. This freedom is crucial; nothing is worse than having to close a winning position on Friday night because of a rule, only to watch the market make a big move in your favor over the weekend.

While holding a trade for days, be aware of event risks. Major news (exchange hacks, regulatory announcements, macroeconomic events) can erupt anytime and cause gaps or sharp moves. Mitigate this by staying informed – set price alerts for key levels, and consider reducing position size ahead of big known events (like a Federal Reserve meeting or a network upgrade for a cryptocurrency). Some swing traders also hedge their bets: for example, if you’re long several altcoins, you might hold a small short position in Bitcoin or an index as insurance, so if a market-wide drop occurs, your hedge softens the blow.

In summary, treat risk management as part of your strategy, not an afterthought. Plan your exits (stop-loss and take-profit) as diligently as your entries. Use leverage sparingly and intentionally. By protecting your downside, you preserve capital to trade another day, which means you’ll be around to catch the next great swing trade that comes along.

Tools and Platforms to Enhance Swing Trading

Having the right tools can make executing your swing strategy smoother and more efficient.

Advanced charting software is a must – most crypto swing traders rely on platforms like TradingView or similar to conduct technical analysis. These allow you to draw trendlines, set alert notifications at key price levels, and apply any indicator you fancy (from RSI and MACD to Fibonacci retracement levels). Setting alerts is particularly helpful; rather than staring at charts around the clock, you can get a notification when price hits a level that might trigger your next action (for example, “alert me if Ethereum breaks above $2000” or “if Bitcoin dips to the 50-day moving average”).

Some traders also use screeners or scanners to find coins that meet certain criteria (say, “show me cryptos that are up 5%+ today on high volume” or “coins where the 20-day moving average just crossed above the 50-day”). These tools can surface new swing trade candidates that you might not be watching already.

If you’re technically inclined, trading bots or algorithmic tools can assist with swing trading, not to set-and-forget, but to help automate parts of your strategy. For instance, you might program a bot to execute your entry and stop-loss exactly when a certain technical condition is met, eliminating hesitation or human error in fast-moving markets.

There are off-the-shelf crypto trading bots where you can input strategy rules (platforms like 3Commas, Cryptohopper, etc.), but whether you use them or not, it’s valuable to understand that they exist. Even without full automation, using features like OCO (one-cancels-other) orders – where you set a take-profit and stop-loss at the same time – can be a lifesaver. This way, once you enter a trade, you’ve already defined your exit conditions, and you don’t have to constantly manage the position unless something changes.

Equally important is the trading platform or broker you choose to execute your swing trades. Ideally, you want a platform that offers: a wide range of cryptocurrencies (so you’re not limited in what you can trade), real-time market data, reliable order execution, and reasonable fees. For swing trading, also consider if the platform supports features like margin trading (if you plan to use leverage) and if it has robust order types (stop orders, trailing stops, etc.).

If you find your personal capital is a limiting factor, you might explore crypto proprietary trading firms or funded trader programs to scale up. (We covered what swing traders should look for in a prop firm in our crypto prop trading firms guide – for example, having no time limits on evaluations and allowing overnight holds is essential.) One such platform, HyroTrader, has been tailored for crypto traders who want this kind of flexibility.

HyroTrader provides access to substantial trading capital and puts an emphasis on trader freedom: you can hold positions overnight and on weekends, trade multiple cryptos on real exchange data feeds, and never worry about arbitrary daily loss cut-offs or time-based rules that interfere with your strategy. Plus, when you do book profits, you can get paid out in crypto quickly (HyroTrader offers instant payouts in USDT/USDC stablecoins, rather than making you wait weeks).

The benefit of using a platform aligned with swing trading needs is that it lets you focus on strategy execution, not on fighting platform restrictions. Whether you stick with a traditional exchange or opt for an innovative prop firm like HyroTrader, ensure your trading platform is an ally to your strategy. It should provide the tools, capital, and flexibility you need to implement your swing trades effectively, so you can concentrate on reading the market and making smart decisions.

Common Misconceptions & Mistakes

Even seasoned traders can fall for certain myths or slip into bad habits. Let’s clear up a few common misconceptions and mistakes in crypto swing trading:

“Swing trading crypto is easy money.”

It’s true that swing trading can be lucrative, but it’s far from easy. Some assume that because you’re not glued to the screen like a day trader, profits will just roll in. In reality, swing trading requires careful analysis, patience, and risk control. Every trade still has risk – there’s nothing “easy” about letting thousands of dollars ride on a multi-day market move. Successful swing traders treat it as a professional endeavor, not a casual gamble.

“I don’t need stop-losses; I’ll just exit manually.”

Relying on manual exits is a mistake, especially in a 24/7 market. You might think you’ll wake up or be online to cut a losing trade, but what if a sudden crash happens at 4 AM? Having a stop-loss in place is insurance against catastrophic loss. Setting stops at logical levels is not a sign of weakness – it’s a hallmark of a disciplined trader. Don’t let the misconception that “crypto always bounces back” fool you into holding a coin that’s plummeting beyond your pain threshold.

“Overleveraging for quick gains.”

New traders often believe that using maximum leverage will make them rich faster. In truth, overleveraging is one of the fastest ways to destroy your account. A 10% move against you at 10x leverage means a 100% loss (all your capital on that trade gone). Experienced swing traders know that moderate leverage (or even no leverage) with proper position sizing yields far better long-term results. The goal is steady growth, not a lottery win followed by a likely wipeout.

Trying to nail absolute tops and bottoms.

It’s tempting to aim for the perfect entry at the very bottom or to hold until the absolute peak. But obsessing over perfection can backfire – you might miss good trades waiting for an ideal entry that never comes, or you might round-trip a winning trade into a loss, hoping for a few extra percent. “Buy low, sell high” doesn’t mean “buy the lowest tick and sell the highest tick.” Leave a little on the table and focus on consistently capturing reliable portions of trends.

Ignoring market context and news.

A common mistake is to look at charts in a vacuum. Swing trading doesn’t mean you can ignore fundamentals or news events. Crypto is sensitive to headlines – exchange hacks, legal regulations, macroeconomic shifts, you name it. If you’re unaware, you could be blindsided. For example, a technically beautiful setup might still fail if a negative news bomb drops on the crypto sector that day. Stay informed: set up a news feed or alerts for major developments related to the coins you trade.

By recognizing and addressing these misconceptions, you put yourself in the top tier of traders who learn from others’ mistakes. Swing trading success comes from doing many small things right consistently, and avoiding the big pitfalls that can knock you off course.

Conclusion

Crypto swing trading is both a science and an art. As we’ve explored, enhancing your strategy involves more than just picking entries and exits – it means understanding the unique market landscape, managing risk like a pro, leveraging tools and platforms like HyroTrader to your advantage, and keeping your head in the game when emotions run high. The reward for this hard work? The ability to consistently extract profits from those wild crypto price swings that leave less-prepared traders scratching their heads.

Remember, every experienced trader you admire was once figuring out these same lessons. By applying the advanced strategies and insights we’ve discussed, you’re stacking the odds in your favor. Map out the trends and ranges, plan your trades and trade your plan, and don’t let little mistakes snowball into big ones.

With the right approach – and a trading platform that empowers rather than restricts you – you’ll find that swing trading offers a flexible, exciting path to grow your crypto wealth.