As an experienced crypto trader, you thrive on volatility. You’ve ridden bull runs and weathered gut-wrenching crashes. But to truly harness the chaos of the crypto market, you need tools beyond basic longs and shorts. This is where crypto options trading comes in.

Options open up a world of possibilities – letting you profit from price swings in either direction, hedge against downturns, and even earn income in a flat market.

In this comprehensive guide, we dive into advanced crypto options strategies and actionable insights to elevate your trading. From betting on explosive moves with straddles to generating steady yield with covered calls, we’ll explore techniques for every market scenario.

You’ll learn how to manage risk in high-leverage trading environments and discover new frontiers like DeFi derivatives (on-chain options protocols) that are reshaping the landscape. We also examine how you can scale your approach through crypto prop trading, tapping into greater capital and professional-grade platforms.

By the end, you’ll have a roadmap to mastering crypto options trading, equipped with strategies to maximize returns and the discipline to manage the risks.

Why Crypto Options Matter for Advanced Traders

For experienced traders, crypto options offer an edge that standard spot or futures trading can’t match. Options let you craft positions that profit from almost any market scenario. You can hedge a large Bitcoin or Ethereum portfolio against crashes by buying put options – essentially paying a small premium for insurance on your holdings. You can generate income on idle assets by selling call options (collecting premiums in exchange for capping upside). And importantly, options provide built-in leverage: with a relatively small upfront cost, you control a much larger exposure to the market. This means a correctly timed option trade can yield outsized returns compared to an equivalent spot trade, all while defining your maximum risk (the premium paid) if the market moves against you.

Learn more: Crypto Futures

Equally crucial is the flexibility to express complex views on the market. If you expect a big move but aren’t sure of the direction, options let you bet on volatility itself rather than a specific price target – something impossible with regular trading. If you’re bullish long-term but wary of short-term turbulence, you can deploy strategies like collars (combining a long put and a short call) to protect downside while capping some upside beyond a target. This kind of nuanced positioning is a hallmark of professional trading.

Today, crypto options markets have grown more liquid and accessible; major exchanges like Deribit and OKX host active options order books for BTC and ETH, and even decentralized finance (DeFi) derivatives protocols now offer on-chain options for various tokens. For an advanced crypto trader, tapping into options means unlocking a new arsenal of tactics to manage risk and reward in a market that never sleeps.

Learn more: Crypto Derivatives

Advanced Strategies for Crypto Options Trading

With the basics of options under your belt, it’s time to deploy them in creative ways. Advanced crypto traders have an arsenal of strategies tailored to different market conditions and goals. The key is to pick the right strategy for your market outlook – whether you’re chasing big moves, anticipating calm waters, or looking to hedge risk while earning yield. Let’s explore some of the most effective crypto options trading strategies and how to use them. (Note: multi-leg strategies work best on highly liquid markets like BTC or ETH options; for smaller-cap coins, limited open interest can make complex positions harder to execute.)

Volatility Plays: Straddles and Strangles

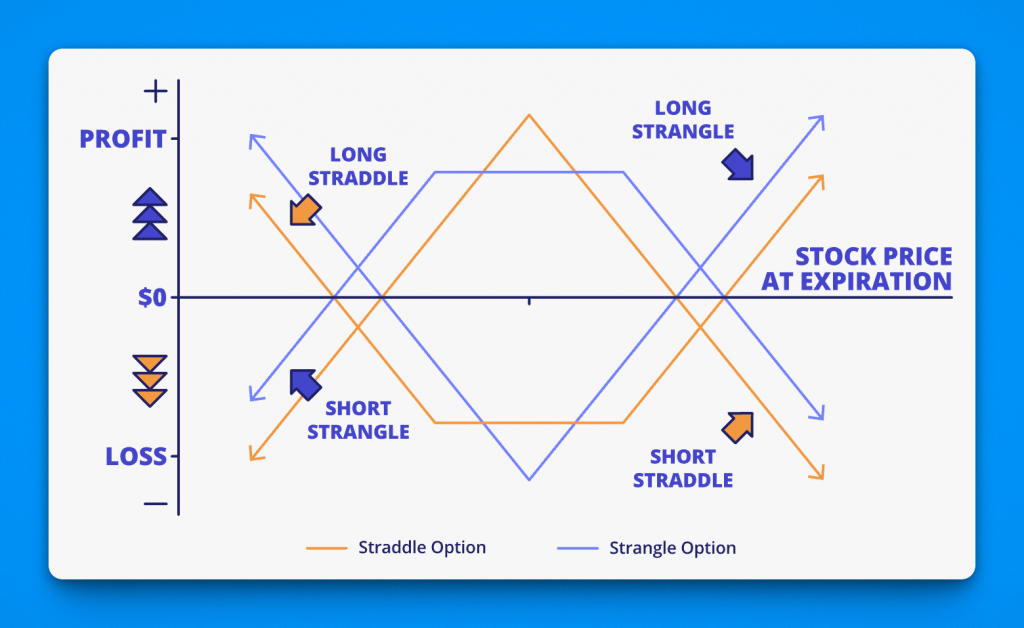

A long straddle involves buying a call and a put at the same strike price (usually at-the-money) with the same expiration date. You’re positioning for a significant price move in either direction: if the asset either moons or tanks enough, one of your options will pay off substantially. Your risk is limited to the combined premium you paid for both options. For the trade to be profitable, the price swing needs to be large enough to cover that total cost. Similarly, a long strangle means buying an out-of-the-money call and an out-of-the-money put (different strikes, same expiry).

This strategy has a lower upfront cost than a straddle because both options are OTM, but it requires an even bigger move in the underlying to yield profits (since the options start further from the money).

These volatility plays are ideal when you expect turbulence – say, before a major regulatory announcement or an upcoming blockchain upgrade – but aren’t sure which way the market will break. Essentially, you’re betting on volatility itself. If the market stays quiet instead, both options could expire worthless, and you’d lose the premiums (the cost of “buying insurance” for a move that never came).

Advanced traders use straddles and strangles when they believe the market underestimates how much the price could swing. If implied volatility is relatively low but you foresee a catalyst on the horizon, these strategies can be a potent way to capitalize on the coming storm.

Directional Moves with Vertical Spreads

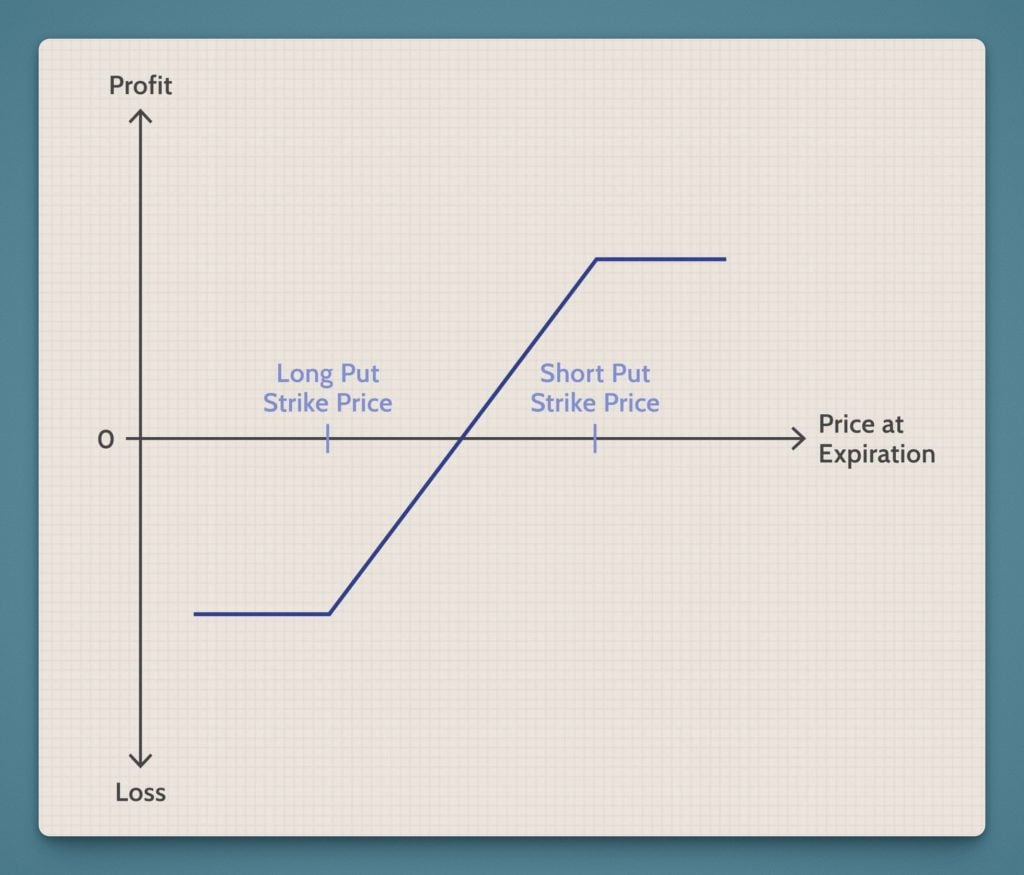

Vertical spreads are a straightforward way to take a directional stance while limiting risk. The idea is to buy one option and simultaneously sell another option of the same type (calls or puts) with a different strike price, both expiring on the same date. For instance, a popular bullish strategy, the bull call spread, involves buying a call at a lower strike and selling a call at a higher strike. The premium you collect from the sold call offsets part of the cost of the call you bought. You profit if the underlying price rises, but your upside is capped at the higher strike (since any gains beyond that are given up to the call you sold).

The benefit is a lower net cost than buying a naked call, and a clearly defined maximum loss (the net premium paid). Conversely, a bear put spread expresses a moderately bearish view: you buy a put at a higher strike and sell a put at a lower strike. If the price falls, the spread pays off up to the lower strike, and your risk is limited to the net premium you paid for the structure.

Vertical spreads are helpful when you have a target price range or a specific outlook in mind. Instead of paying hefty premiums for a single option, hoping for a home run, you’re structuring a more controlled bet. In a trending market where you expect, say, Bitcoin to rise but only to a certain level, a bull call spread can capture that move with much less cost than an outright call.

By selling an option against your long option, you’re effectively saying “I’m bullish, but only up to a point.” This not only lowers the breakeven point of the trade but also forces a disciplined exit (capped profit). Advanced traders appreciate that spreads help navigate crypto’s high volatility – they reduce the impact of exaggerated option premiums. In short, vertical spreads let you tilt bullish or bearish in a risk-conscious way, making them a staple in the advanced trader’s playbook.

Range-Bound Profits: Iron Condors and Butterflies

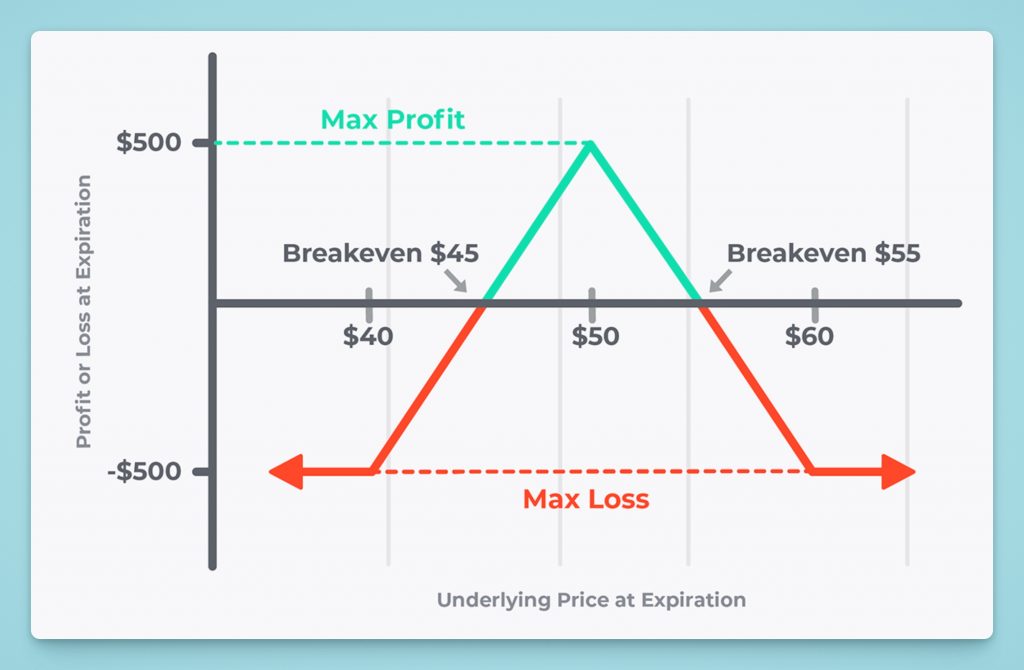

When you suspect the market will be quiet or confined to a range, income strategies like the iron condor shine. An iron condor involves four options that create a wide “spread out” position: you sell an out-of-the-money call and an out-of-the-money put (collecting premiums on both), and simultaneously buy a further OTM call and put for protection. This setup yields a net credit upfront.

If the underlying price stays between the two short option strike prices through expiration, all the options you sold expire worthless, and you pocket the premium (minus any small cost for the protective options you bought). Your maximum profit is the net premium collected. If the price moves sharply beyond your range, the long call or put that you bought limits your loss. In other words, any loss is capped at a known amount (the difference between the strikes minus the net premium received), so you’re not unprotected if a breakout occurs.

A similar strategy, the iron butterfly, takes a slightly tighter approach: you sell an at-the-money straddle (a call and put at the current price) and buy OTM wings for safety. This often brings in a larger premium, but the “safe” zone for the underlying price is narrower – you need the price to hover near the center strike at expiration to keep most of the profit. Both iron condors and iron butterflies are essentially ways to short volatility in a controlled fashion. They work best when you expect little price action.

Crypto markets, known for explosive moves, don’t stay calm for long, so timing is everything here. Advanced traders might deploy an iron condor during a period of consolidation – for example, if Bitcoin has been range-bound between $28k and $32k for weeks, one could sell a condor spanning that range. The key is monitoring the position; if an unexpected breakout looms (perhaps due to a sudden news event), you may need to adjust or close the trade to avoid turning a potential small loss into a bigger one. Used judiciously, these range-bound strategies can generate steady income in those rare lulls when crypto volatility takes a breather.

Hedging and Income: Collars and Covered Calls

Risk management can be built directly into an options strategy. A prime example is the protective collar. Say you’ve been holding a large Ethereum position that has appreciated significantly. You’re bullish long-term but concerned about short-term downside. With a collar, you buy a put option below the current price (providing downside insurance) while simultaneously selling a call option above the current price. The put guarantees you can sell your ETH at the put’s strike price even if the market crashes (capping your worst-case scenario).

Meanwhile, the call you sold means you might have to sell your ETH at the higher strike if the price rallies past that point, effectively capping your upside beyond that strike. The beauty of a collar is that the premium received from the call sale often covers the cost of the put, making this protection very cheap or even zero-cost. You’ve created a band: a floor to limit losses and a ceiling that you’re willing to accept on gains. Collars are great for guarding profits; advanced traders use them when they want to lock in a portfolio’s value through turbulent periods without outright selling their holdings.

On the income side, one of the most popular strategies is the covered call. If you hold an asset and expect only modest upside in the near term, you can generate extra return by selling call options against your position.

For example, suppose you own 1 BTC at $30k and doubt it will exceed $35k in the next month. You could sell a call option with a $35k strike. You immediately collect the option premium as income. If BTC stays below $35k through expiration, the call expires worthless – you keep your Bitcoin and the premium, effectively earning yield on your asset. If BTC does rise above $35k, the buyer of your call will exercise, and you’ll sell them your Bitcoin at $35k. You still keep the premium, but any price appreciation beyond $35k is what you “missed out” on by selling the call.

This outcome is fine if $35k was an acceptable sell price for you (in other words, you were willing to cash out at that level). Covered calls can be repeated periodically, turning your long-term holdings into a source of recurrent income. A cousin to this strategy is the cash-secured put: instead of holding the asset, you keep cash on hand and sell a put option at a strike where you’d be comfortable buying. If the price drops to that strike, you buy the asset (and use your reserved cash to do so) at an effective discount (thanks to the premium you received). If the price doesn’t drop that far, you simply keep the premium as profit. Both covered calls and selling puts are straightforward yet powerful tools for advanced traders to enhance returns or enter/exit positions at target prices – all while getting paid for the effort.

High-Leverage Trading with Crypto Options

Leverage is a double-edged sword, and with options, it comes in multiple forms.

First, options themselves are a leveraged instrument: a relatively small premium gives you control over a much larger notional value of the asset. For example, instead of putting up $30,000 to buy 1 BTC outright, you might pay a fraction of that amount for an option that grants you similar upside exposure. A 10% move in the underlying could translate to a 100% gain on a well-chosen option, exemplifying leverage.

Second, many platforms allow you to trade options on margin or use complex strategies that inherently carry leverage. Selling options (especially naked calls or puts) can create obligations far exceeding the premium earned, meaning a relatively small adverse price move could result in a large loss. In essence, high leverage is embedded in options trading, whether through the instrument itself or the way you finance the trade.

Advanced traders embrace leverage but treat it with respect. The goal is to use leverage to amplify well-thought-out ideas, not to gamble recklessly. This means always being aware of the worst-case scenario. Strategies like spreads, which we discussed, inherently limit leverage by capping losses; these are preferred when available. If you venture into selling options without protection, be sure you can cover the potential losses (or have a contingency plan, such as a stop-loss or hedging strategy, in place). It’s also wise to limit what portion of your account equity is exposed to leveraged bets. For instance, even if a platform allows you 50x or 100x leverage, you might only use a fraction of that in practice, so that a single trade gone wrong won’t vaporize your account.

When trading on a funded account or through a crypto prop trading program, you’ll also have enforced rules (like daily loss limits or max drawdowns) – use those to your advantage as a risk framework. Remember, crypto markets trade 24/7 and can make violent moves when you least expect them. Successful high-leverage trading boils down to meticulous risk management: always know how much you could lose, set alarms or stops for critical price levels, and be ready to act if things move against your position. In the right hands, leverage is a powerful tool; in the wrong hands, it’s a quick path to ruin.

Risk Management for Crypto Options Traders

No advanced strategy can save a reckless approach. Risk management is the bedrock of long-term success, especially in an arena as volatile as crypto options. While trading options opens up exciting profit opportunities, it also introduces many moving parts – multiple positions, time decay, changing volatility, and the temptation to leverage up. As an advanced trader, you must rigorously manage risk at every step to survive and thrive.

Key principles to keep your risk in check include:

- Limit your exposure per trade: Only allocate a small percentage of your capital to any single option position or strategy. This way, no single bet can wipe you out. Diversification of trades and strategies ensures that one bad trade (or a streak of them) doesn’t implode your whole account.

- Use spreads or defined-risk strategies: Wherever possible, use option structures that cap your downside. Strategies like spreads, collars, or covered calls inherently limit losses and prevent the open-ended risk you get with naked short options. If you do sell options naked, do it only on instruments you can adequately cover (e.g., selling a put only if you have the cash to buy the asset, or selling a call only if you hold the underlying or have other hedges). Defined-risk trades might have limited profit potential, but they ensure a bad market move isn’t catastrophic.

- Monitor volatility and the “Greeks”: Implied volatility is a crucial factor in option pricing – if it’s extremely high, recognize that options are expensive (and perhaps consider strategies that benefit from volatility decreasing, like selling premium). Keep an eye on your position Greeks: delta (directional exposure), theta (time decay), vega (volatility sensitivity), etc. These metrics tell you how your portfolio might behave if the market shifts. For example, if you’re short options, a surge in volatility (vega risk) could hurt you even if the underlying price hasn’t moved much. Understanding your Greeks helps in hedging effectively and avoiding unpleasant surprises.

- Plan your exits and adjustments: Before entering a trade, define your profit target and your pain point. If the trade goes in your favor, at what point will you take profits or roll your position into a new one? If it goes against you, how much are you willing to lose before you cut it? For instance, you might decide, “I’ll cut losses if this option’s price doubles from what I sold it for,” or “I’ll take profit when I’ve captured 70% of the maximum gain on this spread.” By setting these rules in advance, you remove emotion from the equation. Also consider the time factor – options lose value as they approach expiry (if out of the money), so be wary of holding losing positions into expiration, hoping for a last-minute miracle.

- Stay disciplined and emotion-free: Emotions can be as dangerous as market risk. Big wins or losses can tempt you into deviating from your strategy, either by getting overconfident or by revenge trading to earn back losses. Stick to your plan and your risk limits, no matter what the market throws at you that day. If you hit a daily or weekly loss limit, step away and regroup (prop firms enforce this, and it’s wise to enforce it on yourself too). Consistency is key; it’s better to miss a trade than to blow up your account. The best traders treat risk management not as an afterthought, but as a core part of every decision.

In essence, preserving capital is just as important as growing it. Crypto options trading offers high rewards, but it will punish complacency or careless risk-taking. By diligently managing your position sizes, exposures, and emotions, you ensure you’ll be around to capitalize on the next opportunity. Remember, trading is a marathon, not a sprint – and risk management is what keeps you in the race.

Exploring DeFi Derivatives and On-Chain Options

Not all crypto options trading happens on centralized exchanges. An emerging frontier is decentralized finance (DeFi) derivatives – on-chain options platforms powered by smart contracts. These protocols allow you to trade options directly from your crypto wallet without a traditional intermediary.

Platforms like Hegic, Opyn, Lyra, Dopex, and others have pioneered ways to create and trade options on Ethereum and Layer-2 networks. Instead of an order book, some use automated market makers and liquidity pools to match trades. For example, you can buy a put option through a DeFi protocol by simply interacting with a contract, or you could become the liquidity provider (essentially the “option writer”) in a pool to earn premiums. This on-chain approach offers a new world of possibilities: savvy traders might arbitrage price differences between DeFi options and centralized exchange options, or earn yield by supplying liquidity to an options AMM (automated market maker) that takes the other side of trades.

However, DeFi options come with their own caveats. Liquidity is often thinner than in established centralized venues, which can mean larger slippage and wider bid-ask spreads, especially for options on less popular tokens or far-out expiration dates. Pricing models used by DeFi protocols may be simpler or assume certain volatility inputs, which at times leads to mispriced options, presenting both opportunities and risks. If you have the analytical tools to spot when an on-chain option is overpriced or underpriced relative to its fair value, you can exploit that. But if not, you must be careful not to overpay due to illiquid markets.

Smart contract risk is another factor: bugs or hacks can and have happened in DeFi, so never put in more capital than you can afford to lose, even if the strategy itself is sound. On the flip side, the permissionless nature of DeFi means you have access to markets that might not exist elsewhere (imagine exotic options or coverage for tokens not supported by major exchanges). We’re also seeing innovation like options vaults – protocols where users deposit funds and the protocol automatically runs an options selling strategy (e.g. selling weekly calls to generate yield). These are essentially set-and-forget strategies powered by smart contracts, blending passive income with options trading.

For the advanced trader, exploring DeFi derivatives can be rewarding, but it requires homework. Each protocol might have different rules, fees, and risk factors. Start small to get a feel for how, say, a platform prices its options or how easily you can unwind a position. Over time, on-chain options may become as liquid and robust as their centralized counterparts. Until then, treat DeFi options as a supplement to your toolkit – a place to find niche opportunities or to deploy capital if you want to avoid centralized platforms. By keeping abreast of DeFi developments, you’ll be well-positioned to capitalize on the ongoing convergence of traditional trading strategies with cutting-edge decentralized technology.

Scaling Your Options Trading with Crypto Prop Firms

One of the challenges in advanced trading is scale – having enough capital to exploit your strategy fully. Crypto options, especially selling strategies or complex multi-leg trades, often require significant margin. If you have a proven track record but limited funds, crypto prop trading firms can bridge that gap. These firms evaluate traders (usually via a demo trading challenge) and fund those who meet the profit and risk criteria.

In return, the trader and the firm split the profits. For an options trader, a prop firm’s backing means you can access, say, a $100,000 account to deploy strategies that would be impractical on a $5,000 personal account. It’s effectively trading with someone else’s capital – the larger account size magnifies gains, while your personal risk is often just the fee you paid to take the evaluation challenge.

What should you look for in a crypto prop trading program, especially as an options specialist? Ideally, the firm offers:

- Real exchange trading – Your trades execute on actual crypto exchanges with deep liquidity (instead of a simulated environment). This ensures your options strategies get genuine market fills, and tactics like arbitraging or scalping aren’t hampered by fake pricing. Real exchange execution means tapping the same order books and volatility as any other pro trader in the market if you’re trading Bitcoin options or futures.

- High leverage – Sufficient buying power to make the most of the funded capital. For instance, using margin to open sizable options positions (within reason) to make your strategy’s returns meaningful. A good crypto prop firm gives you the room to leverage the account (with sensible limits) rather than confining you to minimal position sizes.

- Flexible challenges – An evaluation process that accommodates different trading styles. Maybe you specialize in slow, steady gains through options spreads, or perhaps you’re more of a high-risk/high-reward trader who waits for a big volatility play. Prop firms with one-size-fits-all challenges can inadvertently favor or penalize certain styles. Look for firms that offer reasonable profit targets, ample time to meet them, tolerable drawdown limits, or even multiple challenges (e.g., standard vs. aggressive) to suit your approach.

- Fast payouts – Getting your money quickly is paramount once you’re funded and start making profits. The best firms process profit withdrawals swiftly – some even offer weekly or on-demand payouts. Fast payouts prove the firm’s reliability and let you enjoy the fruits of your trading (or reinvest them) without lengthy waits. It’s your money – you should be able to access it promptly.

An example of a prop firm bringing these benefits to crypto options traders is HyroTrader.

HyroTrader integrates directly with major exchanges like ByBit, meaning all your trades execute on real order books with live market liquidity. This setup gives a genuine trading experience – you can use advanced strategies (multi-leg options, quick scalps around news events, etc.) without platform-imposed restrictions.

It provides high account leverage and buying power, allowing traders to engage in high-volume and high-value strategies (while still enforcing sensible risk limits to protect accounts). The evaluation challenges at HyroTrader are designed with flexibility in mind, giving you options in how you reach the profit target and manage drawdown, which suits a variety of trading methodologies. Importantly, when you do earn profits on a funded account, HyroTrader boasts fast profit splits and payouts, so you receive your earnings in short order.

Learn more: HyroTrader

In short, by partnering with a firm like this, an advanced trader can focus on what they do best – trading – while the firm provides capital, a robust platform, and a structured risk management framework. It’s an easy setup: the trader scales up their operation and the firm gains a share of the profits from a skilled player.

Conclusion

Crypto options trading represents the cutting edge of opportunity in the digital asset market. With the strategies and insights discussed above, an advanced trader can leverage volatility to their advantage, hedge against the unexpected, and generate returns in any market environment – be it bullish, bearish, or stagnant. The key takeaways are clear: be deliberate in choosing your options strategies, never skimp on risk management, and take advantage of the evolving tools around you (from on-chain platforms to funded trading programs) to enhance your edge.

You can turn crypto’s notorious volatility into a powerful ally by staying disciplined and adaptive. In a market that never sleeps, the prepared and knowledgeable trader is the one who will not only survive but consistently thrive.