Ever wondered why some crypto futures traders thrive while others blow up their accounts on a single big move? In the high-stakes world of cryptocurrency futures, success isn’t just about making bold bets, it’s about strategic trading and strict risk management. Crypto futures markets operate 24/7 with extreme volatility and leverage up to 100x, offering immense profit potential alongside equally significant risks. For experienced traders, the key to longevity is mastering advanced trading strategies while keeping a tight grip on risk.

This comprehensive guide dives deep into advanced crypto futures trading strategies, from trend following and scalping to arbitrage and options hedging, and lays out robust crypto risk management frameworks tailored for high-leverage crypto trading. We’ll also explore how partnering with a crypto trading prop firm (like HyroTrader) can amplify your trading through access to capital, instant payouts, real-time execution, and trader-friendly rules.

By combining savvy strategy with disciplined risk control (and leveraging prop firm resources), you can navigate the crypto futures arena with confidence, turning market volatility into opportunity while safeguarding your capital.

Advanced Crypto Futures Trading Strategies

Crypto futures offer numerous ways to profit beyond simple long or short positions. Seasoned traders often deploy multiple techniques to adapt to market conditions. Below are some advanced strategies that can give you an edge in the futures arena:

Trend Following and Momentum Trading

One core strategy in crypto futures is trend following, “riding the wave” of a strong market move. Instead of fighting the tape, trend-following traders identify and join established trends, whether it’s a multi-week bull run on Bitcoin or a sharp downtrend on an altcoin.

Techniques like moving average crossovers or breakouts from key price levels help signal when a trend is underway. For example, a trader might go long on a perpetual contract (a type of crypto futures with no expiry) when the price breaks above a resistance level and moving averages start sloping upward, indicating bullish momentum.

Trend followers aim to “let winners run” and cut losers quickly. This means holding a winning position for as long as the trend persists, often trailing a stop-loss behind to lock in profits in case the trend reverses. Crypto’s notorious volatility actually benefits this approach; a strong trend can lead to outsized gains if you stay on the right side of it.

Of course, discipline is required: not every price blip is the start of a trend. Experienced traders use tools like the Average Directional Index (ADX) or simply price action analysis to filter out false signals. When done correctly, trend following in crypto futures can feel like surfing a wave, exhilarating and profitable, as long as you maintain balance and know when to jump off before it crashes.

Scalping in High-Speed Markets

On the opposite end of the spectrum from trend trading is scalping, a fast-paced strategy focused on very short-term moves. Scalpers aim to capture many small profits (for example, a fraction of a percent) repeatedly throughout the day. In crypto futures, where price swings can be rapid even in a one-minute chart, scalping opportunities are plentiful. A scalper might enter and exit trades within seconds to minutes, exploiting tiny price fluctuations or inefficiencies in the order book. The goal is not to hit home runs, but to rack up a steady stream of minor gains that accumulate.

Learn more: Crypto Scalping

Successful scalping requires razor-sharp focus, lightning-fast execution, and an environment that supports high-frequency trading. Many scalpers use futures trading tools like depth-of-market (DOM) displays and custom algorithms to jump in front of short-term trends. It’s also crucial to choose platforms with low fees and good liquidity; high fees can eat most of a scalper’s profits, and poor liquidity means slippage on each quick trade.

Crypto exchanges like ByBit or Binance (which feed into prop firm platforms like HyroTrader’s) are popular for their deep liquidity on perpetual contracts, making scalping feasible.

Risk management is what keeps a scalper in the game long-term. With leverage, a single large loss can wipe out dozens of small wins. That’s why scalpers enforce strict stop-losses and position limits on every trade. For instance, a scalper might risk only 0.5% of their account on any given position. If the trade goes south beyond a tight threshold, they exit immediately.

Some trading environments place restrictions on rapid trading, but a crypto-focused prop firm such as HyroTrader welcomes scalping as long as you stay within risk limits. The benefit of a prop firm’s backing is that you can scale up the size of your scalp trades using the firm’s capital, amplifying those small gains into meaningful profits, all while the firm’s rules (like daily drawdown limits) ensure you don’t spiral into a big loss.

Arbitrage Opportunities

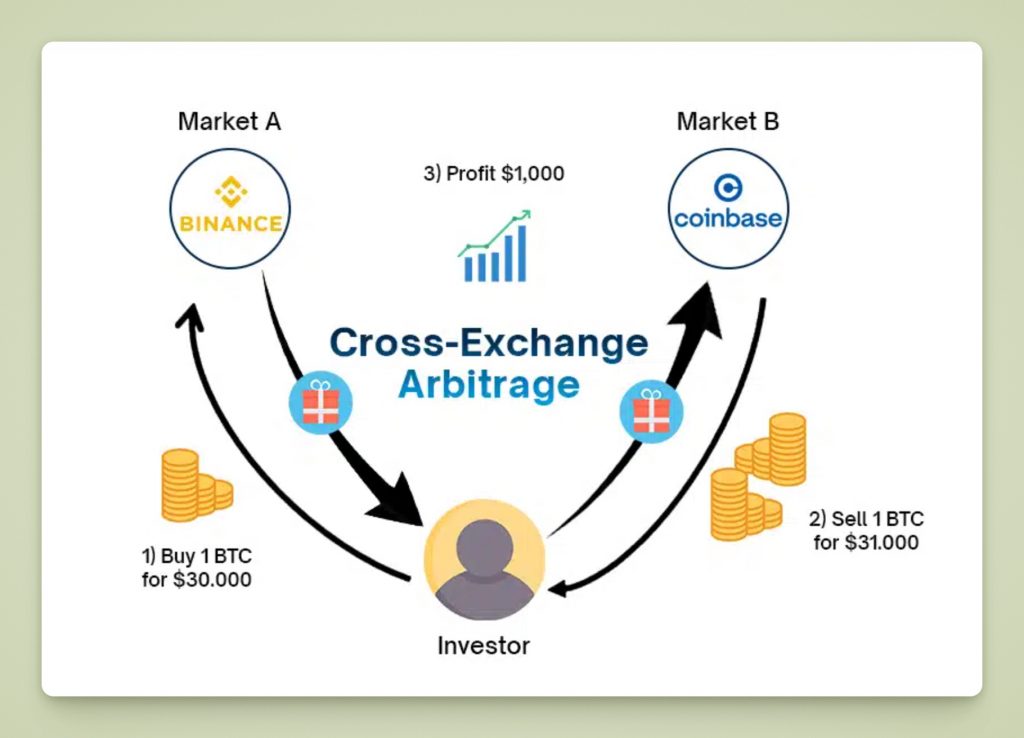

Crypto markets are fragmented across dozens of exchanges, which means prices for the same asset can sometimes differ between platforms. Arbitrage is an advanced strategy that takes advantage of these price discrepancies for risk-free or low-risk profits. In futures trading, one common approach is cross-exchange arbitrage: for example, if Bitcoin perpetual futures are trading at $30,100 on Exchange A and $30,200 on Exchange B, a trader could simultaneously sell the contract on B and buy on A to lock in a $100 profit (per Bitcoin) once the prices converge. Speed is essential, these gaps often close in seconds as arbitragers jump in.

Learn more: Crypto arbitrage trading

Another variant is cash-and-carry arbitrage, which involves spot-futures pricing differences. Say a quarterly Bitcoin futures contract is priced higher than the current spot price (as often happens in bullish periods). An arbitrager can short the futures (sell high) while buying the equivalent amount of Bitcoin on the spot market (buy lower).

By the contract’s expiry, the prices typically converge; the trader closes both positions and pockets the spread minus fees. With perpetual contracts (which don’t expire), a similar idea is to exploit the funding rate: if the funding payments are favoring short positions (meaning longs pay shorts), a trader could short the perpetual future and hold an equivalent long position in the underlying asset to earn the funding fee with minimal net market risk.

There are also arbitrage opportunities in more complex forms: triangular arbitrage within a single exchange (using three trading pairs to cycle through and come out with more of the original asset), or between decentralized finance (DeFi) platforms where prices can desynchronize. These require sophisticated bot usage to execute fast. In all arbitrage strategies, execution risk is the main challenge; delays, fees, or slippage can eat into profits.

High leverage is typically not needed for arbitrage because the aim is to exploit near risk-free differences; however, using a prop firm’s larger capital can increase absolute returns. A firm like HyroTrader gives traders access to substantial funds so that even small percentage gains from arbitrage become significant dollar profits. Just remember: even arbitrage isn’t truly risk-free if you can’t execute quickly or if one leg of the trade fails, so having backup plans and ultra-fast connections (which prop firm infrastructure can provide) is vital.

Options Overlay and Hedging Strategies

Advanced crypto traders often combine futures with options to fine-tune their risk and return. This “options overlay” approach means using options contracts (calls and puts) alongside futures positions to hedge against adverse moves or to enhance profits.

For instance, imagine you’re long on a Bitcoin futures contract (thinking the price will go up). You could buy a Bitcoin put option as an insurance policy in case the price crashes; if the market tanks, the gains from the put option help offset losses on your futures position. This strategy, essentially a protective put, caps your downside while keeping upside open.

Conversely, if you have a profitable long futures position but expect the market to stall, you might sell a call option against it (creating a covered call-like strategy). The call option’s premium provides extra income, and if the price indeed stays flat or dips, you keep the premium on top of your futures profits. (If the price keeps rising beyond the call’s strike, your upside is limited, but that was a trade-off you accepted for the guaranteed premium.)

Options overlays can also help in volatile, high-leverage situations by smoothing out P&L swings. Say you’re running a short-term scalping strategy on ETH futures but worry about a sudden breakout against your position; you could buy a cheap out-of-the-money option as a hedge for that day. If the unlikely event happens, the option payout covers the hit on your scalp.

Strategies like straddles or strangles (holding options that pay off on big moves in either direction) can be used around major news events while you maintain minimal futures exposure, so you’re positioned for volatility without risking a huge directional bet on futures.

Employing an options overlay requires advanced knowledge of the options market and adds complexity to your trading. However, it’s a powerful way to manage risk proactively.

A prop firm can be advantageous here as well, by providing the capital, they enable you to allocate some funds to options hedges without eating too much into your core trading capital. Some prop firms even allow trading crypto options or have relationships with exchanges that list options, giving you more tools in your arsenal.

While HyroTrader’s primary offering is crypto futures accounts, a skilled trader can manually incorporate options from their personal account to hedge prop account positions if needed. The bottom line: options overlays, when used judiciously, act like a safety net or profit booster, enabling high-leverage futures traders to take bold positions with a bit more peace of mind.

Mean Reversion and Range Trading

Not all markets trend strongly; crypto prices often chop in ranges or revert to a mean. Mean reversion strategies capitalize on the tendency of prices to swing back toward an average after an extreme move. An experienced futures trader might identify that Ethereum has been oscillating between say $1,800 and $2,000 for weeks. Each time it nears the upper band, the trader sells (or shorts a futures contract), expecting the price to fall back toward the middle of the range; when it nears the lower band, they buy (go long), anticipating a bounce.

Indicators like Bollinger Bands or RSI (Relative Strength Index) can help flag overbought or oversold conditions in a range-bound market. For example, if Bitcoin’s price tags the upper Bollinger Band and RSI flashes very high, a mean reversion trader might short the BTC perpetual contract with a target of a few percent lower once the excitement fades. Because this style bets against the crowd at extremes, it can be lucrative during sideways markets when trend followers struggle.

However, caution is key: a market that appears range-bound can suddenly break into a new trend (a breakout). That’s the nightmare scenario for a mean reversion trader who might be fading a rally that doesn’t stop. Stop-loss discipline is absolutely essential; you must cut the trade if the breakout is real, to avoid heavy losses.

Using moderate leverage or smaller position sizes helps, too, since mean reversion often yields smaller profit per trade (you’re aiming for modest pullbacks, not massive moves). Some prop firms’ risk rules, like maximum drawdown limits, naturally encourage mean reversion traders to be selective and not overstay their welcome in a runaway market. In essence, range trading is like a rubber band snapping back; it works nicely until the band stretches too far and snaps, so always have a safety exit planned.

Algorithmic and Quantitative Strategies

Some of the most advanced crypto futures strategies are algorithmic, executed by bots or scripts that can trade 24/7 without human fatigue. Quantitative trading methods like statistical arbitrage (“stat arb”) and market-making fall into this category. These approaches rely on mathematical models and automation rather than discretionary chart reading.

In statistical arbitrage, a trader might program a system to find price divergences between related trading pairs or between a crypto asset and its derivative. For example, if historical data shows a strong correlation between two cryptocurrencies (say, ETH and ETC) but suddenly their prices diverge, a stat arb algorithm might short the outperforming one and long the underperforming one on futures, betting that their spread will converge back to normal.

If done correctly, profit is made when the gap closes, regardless of overall market direction. The challenge is ensuring the “relationship” holds; if fundamentals shift and the correlation breaks down completely, the trade can go awry. Hence, stat arb traders constantly update their models and employ strict stop-outs if the spread moves too far.

Market-making is another quant strategy where the trader (often a bot) places both buy and sell limit orders around the current price, aiming to earn the bid-ask spread consistently. In crypto futures, market makers provide liquidity and profit from the tiny differences in price for incoming orders. This can generate a high volume of small wins, not unlike scalping, but automated. It requires sophisticated systems to manage inventory (ensuring you don’t accumulate a huge net position accidentally) and to adjust quotes in milliseconds as the market moves.

Competing with high-frequency trading firms can be tough, but on lesser-traded altcoin futures, an individual with a good algorithm can still earn decent returns by being the go-to liquidity provider.

For independent traders, developing and running algos means dealing with APIs, servers, and constant monitoring, not to mention a strong understanding of quantitative methods. Prop firms can assist here by offering reliable trading infrastructure and sometimes even APIs to plug your algorithms into their capital. HyroTrader, for example, connects traders to real crypto exchanges (like ByBit) with robust data feeds, which is crucial for any algorithmic strategy. They don’t restrict strategies like automated trading, as long as risk parameters are respected.

This means if you have the quant skills, you can leverage a prop firm’s capital and tech to let your crypto trading bot loose on the markets. It’s a scenario where your algorithm does the heavy lifting, and the firm’s resources help maximize the results.

Risk Management in High-Leverage Crypto Trading

If strategy is your offense, risk management is your defense, and you’ll need a strong defense to survive and thrive in high-leverage crypto trading. In a market where double-digit percentage swings can happen in hours, having a sound risk management plan is not optional; it’s absolutely critical. Let’s break down key risk management principles and how you can apply them in crypto futures:

Position Sizing and Leverage Control

In crypto futures, leverage is a double-edged sword. High leverage (20x, 50x, even 100x) magnifies profits but losses equally. The first rule of risk management is to choose your position size such that even a worst-case loss is something your account can survive.

A common guideline among professionals is to risk only a small percentage of your account on any single trade, often 1-2% for active traders, and perhaps even less in extremely volatile markets. This means calculating your position size based on the distance to your stop-loss.

For example, if you’re willing to risk 1% of your capital and your trade idea would be invalidated with a 0.5% move against you, you could use about 2x leverage on that position (since a 0.5% move * 2 = 1% account loss). If the required stop distance is larger, you dial down the leverage or trade size accordingly.

The beauty of crypto futures is that you have the flexibility to fine-tune position sizes and leverage. Just because an exchange offers 100x leverage doesn’t mean you should use it fully. Experienced traders often use high leverage primarily to reduce the capital tied up in a trade (for example, using 10x leverage so that only 10% of the position’s value is posted as margin), but they still manage the actual dollar risk carefully.

It’s critical to account for liquidation risk: if your position is too large relative to your margin, even a 1% adverse move could liquidate (force-close) your trade at a loss beyond your stop if slippage occurs. To avoid this, never push your margin to the brink; maintain a buffer. Many traders keep using leverage moderately (say, 5x or 10x effective leverage) except in the most confident setups.

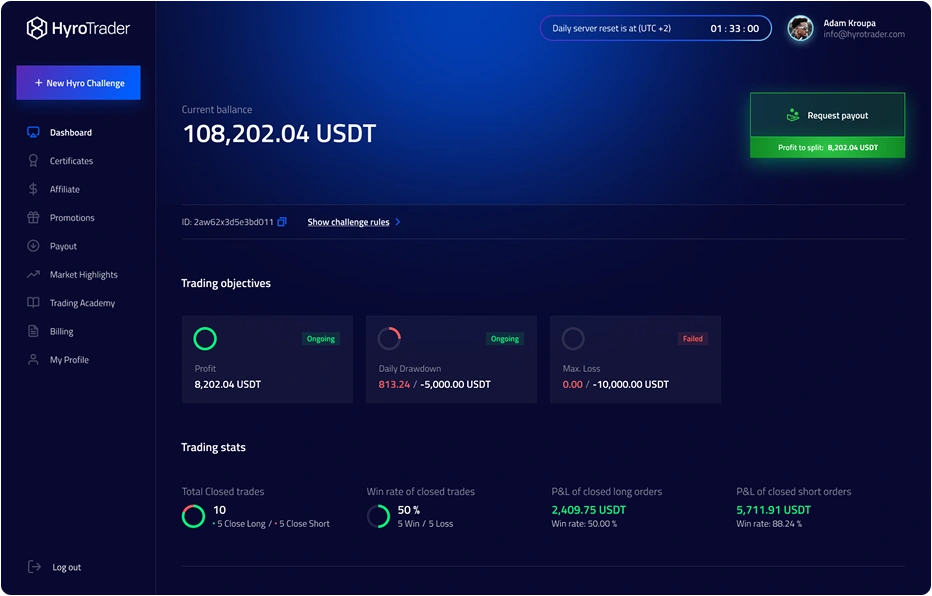

Position sizing isn’t just about limiting downside; it also smooths your equity curve so that no single trade (or small cluster of trades) can ruin you. If you hit a losing streak, which will happen, a sensible sizing strategy ensures you live to fight another day. Prop trading firms enforce this in their rules: for instance, HyroTrader caps maximum daily drawdown (e.g., 5%) and overall drawdown (e.g., 10% of the account) on funded accounts.

As a trader, you should impose similar rules on yourself. If you risk 1% per trade, you’d have to be disastrously wrong many times in a row to breach a 10% loss, a string of bad luck that’s statistically rare if you have even a mildly edge-leaning strategy. By controlling position size and leverage from the outset, you set the stage so that even if the market throws a curveball, it won’t knock you out of the game.

Stop-Loss Orders and Protecting Your Capital

If there’s one non-negotiable tool in high-leverage trading, it’s the stop-loss order. A stop-loss is a preset order to automatically close your position if the price hits a certain level against you. This is your safety net, the brake to your speeding car. Without stops, a fast market move can turn a small mistake into a catastrophic loss, especially when leverage is involved. Crypto markets can move so fast that manually exiting is often too slow or clouded by emotion, so you want that automatic kill-switch in place.

When setting stops, it’s important to place them at logical levels (like beyond a technical support/resistance or invalidation point for your trade thesis), not just an arbitrary tight distance that’s likely to get hit by normal noise. Give the trade some breathing room, but always calculate: if that stop hits, how much will I lose? It should align with your risk-per-trade threshold (from the position sizing rule above). For example, if you short BTC at $30,000 with a stop at $30,300, that’s a 1% move against you. With 5x leverage on that trade, a stop-out would cost about 5% of the position value if that’s more than you planned to risk, either reduce leverage or tighten the stop (assuming that still makes sense with the chart structure).

A good practice is to enter your stop-loss order immediately as you enter a trade. This way, you’re protected even if you get distracted or if a sudden flash crash occurs. In fact, prop firms often mandate this for their traders. HyroTrader, for instance, requires traders to place a stop-loss on every position (within a few minutes of opening it) and even suggests not risking more than 3% of the account on any single trade. These rules reinforce discipline; they basically force you to pre-define your worst-case loss, which is exactly what any prudent trader should do on their own.

On the flip side, consider also defining take-profit levels or using trailing stops to lock in gains. A take-profit order will automatically close your trade at a target level in your favor, which can be useful if you’re not actively watching or if you have a specific profit goal. Trailing stops move your stop-loss up (or down, for short trades) as the trade goes in your favor, preserving some profit if the trend reverses. This is particularly handy in crypto futures when you catch a big move but don’t know exactly when it will end, the trailing stop lets you ride as far as possible and then secures profits when momentum finally shifts.

Learn more: How to take profit in crypto

In essence, stop-losses (and their profit-taking counterparts) enforce the golden rule: never let a single trade lose more than you can afford. It’s better to take a small, planned loss and reset, than to hope a bad trade “comes back” while it snowballs out of control. Pride can’t get in the way here, the most successful traders are not those who never take losses, but those who never take devastating losses.

Managing Volatility and Drawdowns

Crypto’s volatility is a double-edged sword: it creates opportunity but also means things can go wrong quickly. Managing drawdowns (the decline from a peak in your equity) is about keeping those inevitable losing periods small and controlled. Part of this is position sizing and stops (as discussed), but it also involves adjusting your tactics when conditions get rough.

For example, if you find yourself in a drawdown (say you’ve lost 5% or 10% of your account in a week), a prudent move is to reduce your trading size temporarily. Scaling down after losses helps prevent a vicious cycle where you try to “win it all back” and instead compound the damage with too-large positions.

Another aspect is diversifying your strategies or trades, if possible. If all your trades are highly correlated, for instance, you’re long on multiple altcoin futures that tend to move in tandem, then a market dip could hit them all at once and deepen your drawdown.

Some advanced traders counter this by hedging or mixing uncorrelated plays: maybe pairing a long position in one coin with a short position in another if the situation warrants, or holding a small options position that pays off in a crash. The idea is not to put all your eggs in one basket, especially not a highly volatile basket.

Keep an eye on volatility indicators too. Measures like the Bitcoin Volatility Index or even simply the width of Bollinger Bands can tell you when the market is particularly hot. In high volatility regimes, you might tighten up risk (smaller positions, wider stops, quicker profit-taking) because price swings are larger. In quieter times, you might carefully allow trades more room.

Also, pay attention to funding rates on perpetual futures; extremely high positive funding (traders paying a lot to be long) can be a red flag that bullish leverage is overheated, and a sharp reversal could be coming (and vice versa for negative funding rates). Savvy risk management means anticipating how the market environment might shift and being ready to pull back risk when storm clouds gather.

Every trader will face drawdowns; the goal is to survive them. Set personal drawdown limits that trigger a “time-out” for you, for example, if you hit a 10% drawdown, you stop trading for a day or two to reassess and cool off. This mimics what prop firms do by pausing accounts that hit their loss limits. It’s not punishment; it’s to protect you from yourself when you’re most vulnerable to making rash decisions. By respecting volatility and managing drawdowns proactively, you ensure that a bad week or month remains a temporary setback, not the end of your trading career.

Discipline, Psychology, and Consistency

Even with great strategy and tools, a trader’s worst enemy can be themselves. Emotional decision-making, fear, greed, revenge trading after a loss, can wreck even a solid trading system. This is why discipline and psychological control are pillars of risk management. Experienced crypto futures traders develop routines and rules to control their emotions. For example, you might have a rule to take a 15-minute break after any significant loss to clear your head, or a rule that you won’t add to a losing position (no “doubling down” in hope of a rebound).

Consistency in following your plan is key. It’s tempting to deviate when the adrenaline is pumping, maybe you skip a stop loss just this once because you’re sure the market will come back, or you risk 20% of your account on one trade because it feels like a “sure thing.” These lapses are exactly what ends careers. Sticking to your risk parameters, trade after trade, day after day, is what makes them effective. Over time, this consistency leads to a smoother equity curve and helps your confidence because you know you’re not betting the farm on whims.

One helpful practice is keeping a trading journal or log. Note down not just your trades but why you took them, how you felt, and whether you followed your rules. This helps identify patterns (maybe you lose most when trading past midnight in a tired state, for example). With crypto’s 24/7 lure, it’s easy to burn out or make impulsive trades at odd hours; a journal can highlight those pitfalls so you can adjust.

Finally, align yourself with a risk management culture. If you’re trading with a prop firm like HyroTrader, embrace their risk rules as supportive guidelines rather than limitations. Those daily loss limits, required stops, etc., are there to protect capital (the firm’s and yours) and to nudge you toward best practices. Professional trading is a marathon, not a sprint. By cultivating discipline and a resilient mindset, you ensure that you can keep playing the game tomorrow, which means you’ll be around to capitalize when the really great opportunities come.

How Prop Trading Firms Enhance Crypto Futures Trading

At this point, we’ve covered how a skilled trader approaches crypto futures, employing savvy strategies and rigorous risk management. Now, where does a prop trading firm like HyroTrader come into play? In essence, prop firms can act as a force multiplier for a trader’s skill. They provide additional capital, resources, and structure that can elevate your trading to the next level, provided you know how to use those advantages. Let’s examine several key benefits that prop trading firms offer to crypto futures traders:

Access to Capital and High Leverage

The most obvious benefit a prop firm provides is funding. Instead of being limited by your personal capital, you can trade a larger account funded by the firm. For example, HyroTrader offers account sizes starting from tens of thousands up to $200,000 or more. This means you can deploy your strategies on a bigger scale, capturing larger absolute profits from the same percentage gains. If your strategy historically yields 5% per month on average, doing that on a $100,000 account yields $5,000 instead of $500 on a $10,000 account. The difference is huge, and it’s life-changing for many traders who have the skill but not a big bankroll.

High leverage is already a feature of crypto futures, but a prop firm’s capital allows you to use leverage more strategically. You might not even need to max out exchange leverage when the account size itself is large. For instance, rather than using 50x leverage on a $2,000 position of your own money (effectively controlling $100,000), you could use 5x or 10x on a $100,000 funded account to take the same $100k position with more cushion and lower stress. You’re achieving the same market exposure but with less risk of a margin call because the account has more equity behind it.

Additionally, prop firms like HyroTrader often allow generous leverage limits on their accounts (since crypto is inherently high-leverage-friendly). HyroTrader, for example, allows up to 1:100 leverage. The key is that with the firm’s funding, you have flexibility: you can dial the leverage up or down to match your risk comfort, knowing you have substantial capital at hand. The firm effectively underwrites your potential (and limits your downside with rules). For traders who can manage risk well, access to large capital plus available leverage is the rocket fuel for scaling up returns.

Instant Payouts and Profit Splits

Another compelling advantage of a prop trading firm is how profits are handled. When trading on your own, you might need to keep most of your capital in your exchange account to continue trading, and withdrawing profits can sometimes be slow or limited by the exchange. Prop firms typically operate on a profit-split model: you keep a large percentage of the profits you earn (70% to 90%) and the firm takes the rest as a performance fee. With a firm like HyroTrader, the profit splits often start around 70% to the trader, and can scale up to 80% or 90% as you prove consistency and grow your account.

Equally important is the payout process itself. HyroTrader, for instance, advertises instant or very fast payouts, often processing withdrawal requests within hours, paid in stablecoins like USDT or USDC. This is a big deal for traders: it means when you have a solid winning month or a great trade, you can actually realize those gains quickly, turning digital profits into money in your bank (or wallet). Rapid payouts also help reinforce good habits; you’re encouraged to lock in profits regularly, rather than let them sit and tempt you into overtrading.

The prop firm essentially handles the backend of moving money, so you can focus on trading. You don’t have to worry about converting large amounts of crypto to cash yourself or the security of holding large balances on an exchange long-term; the firm takes on that operational overhead.

Just remember, the profit split means you are giving up a slice of your winnings, but in exchange, you’re trading with the firm’s money (and their risk). For most successful prop traders, it’s a very fair tradeoff: they’d rather have, say, 80% of a big number than 100% of a small number. Instant payouts ensure that as you earn, you get paid, which keeps motivation high and ties back to real-world results.

Real-Time Market Execution and Trading Tools

When you trade through a prop firm, you still need a robust trading platform, and good prop firms ensure you have it. In crypto futures, milliseconds can matter, and reliable execution is crucial. HyroTrader integrates with leading exchanges (such as ByBit) or provides a trading interface that directly pipes into real exchange order books. When you place a trade, you get real-time market data and actual execution on a major exchange, not some simulated environment that might behave differently. There’s no dealing-desk interference; your orders hit the market like any other trader’s.

Best crypto prop firms also give you access to advanced futures trading tools. For example, HyroTrader’s platform leverages Binance’s price feed through its CLEO interface. It offers advanced charting, the ability to set multiple take-profit and stop-loss orders (bracket orders), and detailed performance stats. These tools help you analyze and execute your strategies more effectively.

Some prop firms might even provide additional analytics or risk dashboards so you can monitor your progress toward profit targets or see your drawdown in real time. This kind of transparency and tech support is a huge plus, especially if you’re running complex strategies or multiple positions.

Another aspect is reliability and support. If you’re trading significant size on a funded account, you want to know the infrastructure won’t glitch out in a fast market. Prop firms typically invest in stable connections and servers. And should any technical issues arise, a firm like HyroTrader has 24/7 customer support and a community (like Discord channels) where you can quickly get help or discuss with fellow traders.

Essentially, you’re not trading alone in the wild; you have a safety net of technology and human support behind you. This allows you to focus on making good trading decisions, knowing that the mechanics of execution and data are being handled professionally.

Trader-Friendly Rules and Supportive Environment

Prop firms succeed when their traders succeed, so reputable firms set rules that encourage good trading rather than hinder it. A great example is the absence of restrictive rules around strategies. HyroTrader, for instance, doesn’t prohibit tactics like scalping or news trading (which some traditional prop firms might restrict).

You’re free to trade crypto futures 24/7, including weekends and holidays, which is essential because crypto markets never sleep. The firm’s interest is in you making money within managed risk, not in micromanaging how you trade.

That said, prop firms do have risk rules, and these are actually beneficial to the trader when viewed correctly. Daily loss limits, maximum drawdown limits, and required stop-loss usage are guardrails keeping you from catastrophic mistakes. Instead of viewing them as shackles, experienced traders recognize that such rules enforce the discipline we’ve been discussing all along. It’s like having a built-in risk manager who makes sure you call it quits for the day if you’re off track, living to trade tomorrow.

HyroTrader also offers a scaling plan: if you perform well over a few months, they can increase your account size, giving you access to even more capital. This incentivizes steady, controlled growth rather than swing-for-the-fences behavior. Plus, firms often refund your evaluation fees once you’re fully onboard and making profits, a nice perk that essentially says, “we invest in you if you prove yourself.”

Finally, consider the intangible support: being part of a prop trading community. With HyroTrader, you get access to other serious traders (via online communities or forums), educational resources (they even have a trading academy), and sometimes mentorship.

Trading can be a lonely endeavor, but with a prop firm, you have peers and sometimes coaches to bounce ideas off or to keep you accountable. All these factors create a more supportive environment for a trader compared to going it completely solo. It’s not that the firm will hold your hand; you’re expected to be self-sufficient, but knowing you have a structure around you often brings out the best performance.

Conclusion

Crypto futures trading is a high-octane arena where knowledge, strategy, and discipline make all the difference. As an experienced trader, you have an array of advanced strategies at your disposal, from riding long-term trends or executing lightning-fast scalps to locking in arbitrage plays and hedging with options. Yet, without strong risk management, even the best strategy can implode in the face of crypto’s volatility. That’s why risk control measures like prudent position sizing, stop-losses, and psychological discipline are the unsung heroes behind every consistent trader’s success.

By integrating these strategies and risk principles, you set yourself up to capture gains and keep them. And with the backing of a prop trading firm like HyroTrader, you can amplify your edge. The firm’s capital, quick payouts, solid infrastructure, and trader-centric rules act as a springboard, allowing you to trade bigger and smarter while safeguarding against the worst-case scenarios. Think of it as having a turbocharged engine under the hood and a roll cage to protect you on the track.

In summary, mastering crypto futures is about balancing aggression with caution. Embrace the cutting-edge strategies that the crypto market enables, but always respect the risk. Use all the tools, technical insight, risk frameworks, and prop firm support to navigate the market’s twists and turns. Do this, and you’ll be in the best position to thrive in the exciting world of high-leverage crypto trading.