Ever strapped rockets to a rollercoaster? That’s what leveraged crypto trading can feel like. For experienced traders, using borrowed capital to amplify positions can skyrocket profits – or trigger dizzying crashes.

In this deep dive, we’ll arm you with advanced crypto leverage strategies, execution tactics, and stringent risk management techniques to tame volatility and chase higher gains without blowing up your account.

We’ll even look at how tools like HyroTrader – a crypto prop trading firm – fit into a pro’s playbook.

Buckle up; this is not your “margin trading 101.”

Understanding Advanced Leverage Dynamics

Before you amplify trades, let’s reassess leverage itself. In crypto, you can often access insane multipliers (10x, 50x, even 100x on futures). But what does that mean in practice?

Leverage is a double-edged sword: it magnifies gains and losses. For example, a 10% move on Bitcoin yields 100% profit on a 10x-long position – but flip it, and you wipe out the entire stake.

So why use it at all? The answer lies in strategy and situational awareness.

Leverage goes beyond just a number. In crypto markets, you can trade spot with borrowing (margin trading) or derivatives (futures, options), where leverage is implicit. On derivatives, funding rates kick in: if you’re long on a perpetual swap and longs pay shorts, holding costs accumulate over time, effectively a tax on leveraged long positions during bull runs (and vice versa).

Advanced traders track these funding rates as part of their strategy – for instance, simultaneously taking opposite positions in two markets to capture funding rate arbitrage.

Learn more: Crypto derivatives

Cross vs. Isolated Leverage: Many platforms offer cross-margin (all your account equity backs the position) or isolated-margin (each position’s risk is limited to its own margin). Imagine walking a tightrope while carrying everything in your bag (cross-margin): one wrong step (big loss on any trade) and the whole bag could fall. An isolated margin is like leaving extra weight off; each rope has its own load.

Experienced traders often mix both: using isolated leverage for high-conviction trades (so one big loss won’t kill everything) and cross leverage for diversified exposure where some positions’ profits can automatically cover others.

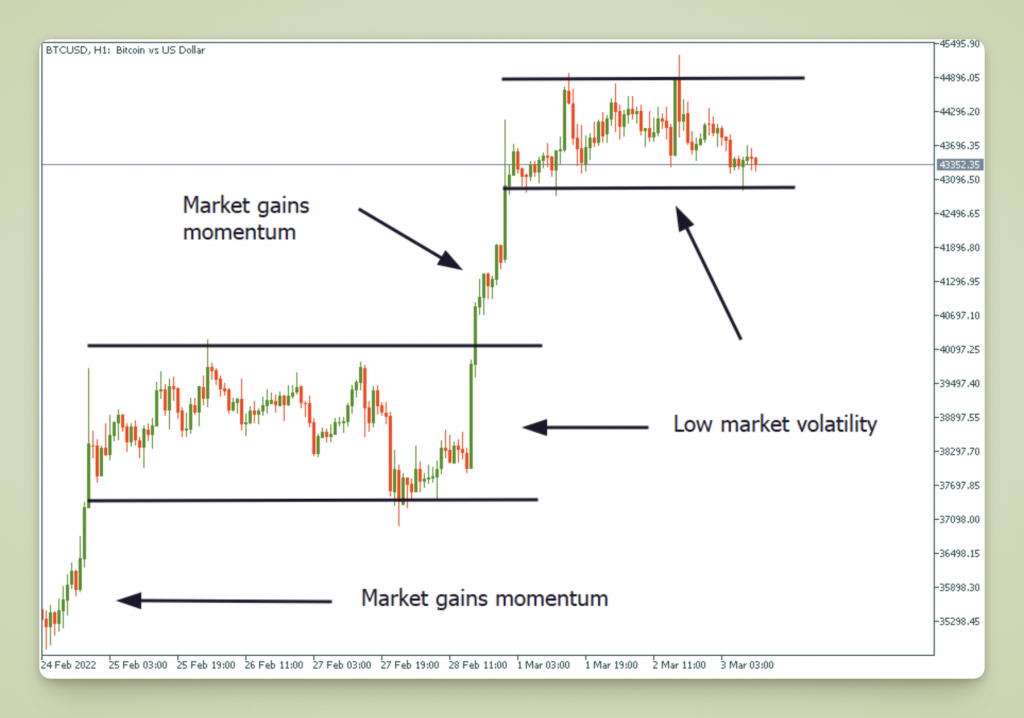

Despite the hype around 100x, advanced traders know: optimal leverage depends on volatility and edge, not greed. In calm markets, more leverage can be managed; in wild swings, even 3x can be dangerous.

Meta question: How many times have you seen a chart explode out of nowhere? Precisely. This is why understanding market regimes is key. If Bitcoin is gyrating ±10% daily, hanging on with 50x is like cliff-diving without checking the water depth. Advanced traders constantly adjust leverage based on market depth, volatility, and time horizon.

Advanced Crypto Leverage Strategies

How do pros actually use all that leverage? It’s not about always maxing out. Here are some high-level tactics:

Pyramiding (Scaling In)

Instead of risking full size at entry, add to winning positions. It’s like building a pyramid: start small, and only climb higher if the base holds. For example, if a breakout looks strong, you might enter with 2x leverage and add another 3x after confirmation, then maybe top off at 5x. This way, if the trade reverses early, the loss is contained, and if it runs, your returns compound.

Laddering Out (Scaling Out)

Lock in profits gradually. Imagine a trader who wins big, then lets greed push them off the cliff. Instead, many use trailing stops or partial exits. For instance, take 25% profit at +10%, another 25% at +20%, and let the rest run with a stop under a technical level. This approach reduces risk of giving back gains when markets reverse.

Hedging Pair Trades

In crypto, many assets correlate. If you’re long an altcoin with leverage, hedge by shorting the broader market (or BTC) a bit, or vice versa. For example, if you see high bullish momentum on DeFi coins but fear a Bitcoin correction, you might take a small short on BTC futures while going long on the DeFi index. A winning hedge doesn’t cancel profit but cushions drawdowns. It’s like wearing a seatbelt in a sports car – you still race, but a safety net’s there.

Trend Riding with Trailing Techniques

Position management is key in trending markets. Advanced traders often use trailing stops to lock in gains on big moves. For example, in a 10x long on Ethereum, instead of a fixed stop, they might use a volatility-based trailing stop (say, below the 20-period ATR or a moving average) so that as price ascends, the stop follows. This way, they surf the trend, catching large portions of the wave before it crests.

Volatility Breakout Strategies

Crypto is volatile by nature. Seasoned traders exploit this by using leverage during breakout setups. For instance, using Bollinger Bands or ATR breakouts: if an asset breaks out of a tight range on high volume, a trader might enter with leverage, betting that volatility will explode. But crucially, they must set tight risk controls in case of false breakouts.

Leveraged Diversification

Instead of putting all leverage on one coin, spread across uncorrelated crypto assets or trading strategies. Imagine being blindfolded on that rollercoaster – you trust the machine. But if you’re not sure, strap a parachute too. A trader might use moderate leverage on a basket of strong altcoins rather than maxing out on a single volatile token. It’s hedging within leverage use.

Each of these tactics is an advanced crypto leverage strategy on its own, but combining them is where art meets science. It’s about orchestrating small wins and limiting damage, not chasing that one life-changing trade.

Risk Management in Crypto Trading

Talk about leverage without risk management, and you’re just a gambler. In crypto’s wild west, surviving to trade another day means ruthlessly protecting capital. Think of risk management as your safety harness.

Size It Right

Avoid jeopardizing your home for a fleeting opportunity. Traditional advice in leverage trading suggests risking only 1–2% of your capital per trade, with a maximum of 5% for high-confidence setups. If your total capital is $100,000, then a leveraged trade should risk no more than $2,000-$5,000. While this amount may seem insignificant, it shields you from the risk of a single disastrous trade. With high leverage, even a 1% risk translates into a slim margin, so remember: effective position sizing is crucial.

Stop-Loss and Take-Profit Orders

Mandatory. Experienced traders frequently implement hard stop-loss orders right after entering a leveraged position. Even with a fundamentally sound strategy, unforeseen market fluctuations (such as a whale sell-off or a glitch) can occur.

Always consider the worst-case scenario and establish an exit in advance. Many professionals adopt a tiered strategy: setting a fixed stop for total security and a trailing stop for the remaining position. The general guideline is to ensure that no single stop loss exceeds 2-3% of your equity on any trade.

Know Your Liquidation Price

In leveraged trading, the liquidation level represents a critical threshold. Experienced traders determine this level in advance. For instance, using 10x leverage on BTC means that a slight decline of around 10% can lead to liquidation (even less if accounting for fees). Think of it like a fuel gauge: if your position gets close to liquidation, consider lowering your leverage or increasing your margin if you’re feeling certain about the trade. Always know the exact point of your margin call before entering a significant trade.

Diversification and Correlation Controls

It’s easy to think, “I have funds; why not open several positions?”

However, if all investments go in the same direction, this is just pointless diversification. For instance, being long on both BTC and ETH with 20x leverage is nearly equivalent to doubling down on a single bet, as ETH typically follows BTC’s movements. Instead, consider balancing your risk: hedge with stablecoins or inverse ETFs, or combine crypto with other uncorrelated assets if possible. Even when using leverage, a bit of diversification can help avoid drastic losses in your portfolio.

Understand Funding Rates and Rollover Costs

Holding leveraged futures or perpetuals can result in funding fees that quietly diminish returns. For example, if longs pay 0.1% every 8 hours, a 10x long position incurs a 1% loss of notional with each funding period. This accumulates over time, decreasing your advantage. Savvy traders incorporate these costs into their strategies. One approach is to change direction or pause trading if the funding becomes unfavorable (i.e., if you need to pay interest), rather than solely concentrating on price movements.

Stress-Testing with “What-If” Scenarios

Before deployment, imagine extreme scenarios. What if the coin drops 20% overnight due to a regulatory ban? What if the exchange has a flash crash? Some traders even use “paper trade” or backtest with historical volatility spikes to see how their position sizing holds up. It’s like training for a storm: better to find flaws in calm seas than sink in a tempest.

Psychological Discipline

Risk management transcends mere numbers; it embodies a mindset. In the cryptocurrency market, fluctuations can trigger strong feelings of fear and greed like few others can. Establish clear rules and adhere to them. Avoid pursuing losses through revenge trading, as this often leads to greater costs. Evaluate each trade critically: Is it a calculated risk or a reaction driven by emotions? If your day is going poorly, it may be wise to take a break. Even seasoned traders experience significant drawdowns; maintaining discipline helps them persevere.

Effective risk management requires more than simply applying a stop-loss; it’s about adopting a lifestyle. In times of increased volatility, your protective measures should become more stringent, not more relaxed. Keep in mind: the house doesn’t risk jeopardizing its casino. Similarly, treat your trading account with the same care; be relentless in mitigating risks while allowing gains to develop through solid strategies.

Execution Techniques in Volatile Markets

Even the best strategy fails if execution is sloppy. Crypto order books can be thin, and prices can leapfrog. Here’s how to execute like a pro:

Choose the Right Order Types

Market orders executed in a volatile market can result in poor prices. To mitigate this, seasoned traders typically opt for limit orders, even when pursuing a trade. Establish aggressive limit orders slightly beyond significant levels (such as support/resistance or Fibonacci lines) to capture the movement while minimizing slippage. When it comes to stop-losses, always rely on exchange stop or trailing-stop orders instead of reacting impulsively. Pro tip: utilize “reduce-only” stops on certain platforms to prevent unintentional reverse positions.

Time and Size Your Trades (TWAP and Iceberg Orders)

Large orders attract market attention. When you need to take a substantial leveraged position, think about breaking it into smaller parts. Using Time-Weighted Average Price (TWAP) orders or manually spacing your trades can help prevent altering the market price. It’s akin to softly joining a conversation instead of announcing your arrival loudly. Certain sophisticated platforms provide “iceberg” orders, which only disclose a part of the total size. These are particularly useful if they are available for crypto futures.

Volume and Liquidity Awareness

Before entering a trade with 50x leverage, it’s wise to check the depth chart. If your desired position size exceeds the upper layers, you might encounter slippage or partial fills. Real-time liquidity heatmap tools can be invaluable. During periods of low volume (like late-night trading), consider reducing your trade size or waiting for busier market sessions. Many experienced traders focus on major market openings (e.g., 00:00 UTC for crypto) when liquidity is at its highest.

Use Technical Indicators Judiciously

During high volatility, lagging indicators such as RSI and MACD tend to be slow. Nevertheless, some professionals use them carefully. For instance, a strong uptrend may drive the RSI into overbought territory, but in the crypto market, the term “overbought” can persist. Instead, it’s better to utilize quicker tools like Bollinger Bands or VWAP breaks for entering trades. VWAP, which stands for volume-weighted average price, can serve as a magnet; breaking through VWAP on substantial volume frequently indicates a significant move.

In summary, combine indicators with price action: the chart’s shape, including candlestick patterns and support/resistance levels, often outweighs any oscillator in times of panic.

Follow the Herd… Selectively

Rhetorical question: If everyone is flocking to the hottest crypto “meme coin,” should you jump in or hold back?

Herd behavior can create momentum that leverage can exploit, but it may also lead to harsh reversals. A prudent strategy involves monitoring volume surges and social sentiment. Occasionally, a coin investment surge (confirmed by on-chain data or order flow) can help you seize a leveraged increase. Other times, it signals the need to refrain from buying or to short the coin. This approach demands both experience and composure to counteract FOMO.

High-Frequency Signals and News Filters

Speed is essential. Some traders rely on algorithmic alerts, such as sudden whale trades or API-based breakers, to respond to outlier events. Others monitor a trading view tab, watching for futures funding fluctuations or unusual options activity. When a major exchange crashes or a distressing tweet emerges, the initial reaction may be panic; however, within a moment, a decision must be made.

As the saying goes: Be fearful when others are greedy, and greedy when others are fearful. During periods of volatility, the initial instinct is incorrect 90% of the time. Utilize a reliable news feed or alerts, like price or funding thresholds, to avoid impulsive decisions.

Backtest and Adjust on the Fly

After hours, analyze major trades. If a leveraged execution experienced significant slippage, inquire about the cause and adjust your strategy for next time (consider smaller orders or different timing). Professional traders act as their own analysts. With time, you’ll recognize patterns; for example, ETH might spike on macro news, yet remain stable during Bitcoin’s weekend dip. Adapt and grow.

Remember: effective execution can distinguish between a leverage strategy that appears strong on paper and one that ultimately fails in practice. In the volatile crypto world, treat each order as a mini-battle plan. Be systematic, not impulsive.

Tools and Platforms for Enhanced Leverage Trading

With advanced techniques in hand, you need the right tools to deploy them. Crypto markets offer both mainstream exchanges and specialized platforms – pick your arsenal.

Exchanges with Advanced Features

Top-tier exchanges such as Binance Futures, Bybit, and OKX offer exceptional leverage options (50x, 100x, and occasionally more on specific pairs). They also feature detailed order types, advanced charting options, and API access. To minimize slippage, opt for exchanges with strong liquidity. Many professional traders maintain multiple accounts across various exchanges to select the best liquidity and features for each trade.

Algo Trading and Bots

Professional traders often automate repetitive tasks. Bots can be programmed to trail a moving average or execute trading strategies when specific market conditions arise (such as volatility or volume).

For instance, an automated crypto trading bot could short Bitcoin at 5x leverage following an early morning sell-off that breaches a key support level. While bots can dramatically fail if market conditions shift suddenly, their execution speed surpasses any human ability. Always ensure that kill switches and maximum loss limits are integrated for bots; autopilots can crash if left unchecked.

Charting and Analysis Tools

In addition to what exchanges provide, tools like TradingView enable custom scripts and alerts. You might create an alert that states: “Notify me to go long 10x on ETH if BTC closes above the upper Bollinger Band with a volume spike in the 5-minute frame.”.

Merging on-chain data (like movements from whale wallets) with technical analysis can give you an advantage. These platforms allow you to backtest your strategies against numerous historical data points to determine if your leverage approach could have weathered past market downturns.

Crypto Prop Trading Firms (e.g., HyroTrader)

Often overlooked by newcomers, best crypto prop trading firms offer traders the necessary capital and infrastructure.

A case in point is HyroTrader, a crypto-centric prop firm that provides qualified traders with funded accounts on major exchanges. This is pertinent because it seamlessly integrates with leverage trading. HyroTrader and similar services enable you to trade with substantial professional leverage (up to 1:100) using real market data (thanks to their API connections with Binance and Bybit). You demonstrate adeptness by hitting predetermined targets (for example, 10–15% profit), and they distribute the earnings.

Significantly, HyroTrader allows unlimited evaluation time to pass its challenge, offers instant crypto payouts (in USDT/USDC) upon achieving profit milestones, and provides generous profit splits (starting at 70% for the trader and scaling up to 90%).

For an advanced trader, this means experiencing the excitement of high leverage with someone else’s capital, combined with genuine exchange execution (no simulated prices) and minimal waiting for funding. Essentially, HyroTrader serves as a trial ground: if you possess a solid leveraged strategy, you can concentrate on executing it and managing risk without depleting your own capital.

Real-Time Data and Connectivity

Platforms like HyroTrader underscore the significance of direct market feeds. Even when using an exchange, acquire data from credible aggregators or stream depth charts. Some experienced traders operate their own full nodes or utilize direct API feeds to gain a millisecond advantage in order execution—in volatile surges, speed translates to cost savings.

Additionally, monitor cross-exchange crypto arbitrage tools if you’re trading similar assets across multiple platforms; sometimes, price discrepancies can enable low-risk leveraged arbitrage opportunities.

Community and Education Platforms

Don’t underestimate the value of network effects. Various chat groups for professional traders (paid or free) offer a platform for sharing insights about potential market movements or atypical order flow. However, remember that while someone may declare “Bull run now!” in a group, it’s your strategy and risk management that ultimately carry out the trades. Utilize collective wisdom to enhance your strategy, rather than substituting it.

You can merge technology’s capabilities with your strategies by leveraging these tools. Consider them as sophisticated navigation instruments on a ship; they don’t steer but assist you in navigating through challenges.

Conclusion

Leveraging crypto trading resembles riding a dragon: it can elevate you to great heights or devastate your resources. The key is not to shy away from the dragon, but to master the art of riding it with skill and discipline. Experienced traders turn the odds in their favor by using advanced techniques (like scaling positions, hedging, and capturing volatility), managing risk effectively (through strict sizing, stop-losses, and emotional regulation), and executing trades intelligently (with strategic order tactics, reliable tools, and even funding from proprietary firms).

It’s crucial to ensure that every strategy is tested against the tumultuous movements in crypto markets. Profit stems from patience, practice, and careful decision-making. Ultimately, the distinguishing factor between professionals and amateurs is not the amount of leverage utilized, but the wisdom in how it is applied. Trade wisely, prioritize safety, and let compound profits be your true reward.