Imagine having a co-pilot who trades cryptocurrencies 24/7, never sleeping or second-guessing.

Automated crypto trading is exactly that: using crypto trading bots or algorithmic signals to execute strategies around the clock, capturing opportunities that human traders often miss. The crypto market never rests, and neither can you—unless you let bots, signals, or copy-trading technologies do the heavy lifting.

In this article, we’ll explore why automation matters, compare the main methods (from copy trading to DIY bots), and then look at how crypto prop firms and platforms like HyroTrader can help scale your strategies. Whether you’re a seasoned quant or a DIY trader, there’s plenty of advanced insight ahead to sharpen your edge.

Why Automate? The Case for Bots in Crypto

Crypto markets are known for their wild swings and non-stop action. On one hand, volatility can be lucrative; on the other, it demands unwavering attention. Humans, however, have limitations: you can’t stare at charts every minute, you need sleep, and emotions like fear or greed often cloud decisions. By encoding a strategy into a programmatic bot or service, you ensure trades happen exactly as planned, with the emotionless discipline of a machine.

For example, crypto trading bots could instantly act on pre-set signals across multiple exchanges, long after traders have left their screens. Think of a trading bot as the autopilot in a plane. You set the destination (your strategy rules and risk parameters), but the bot handles the flight. When the market climbs, it automatically “climbs” too. Are you more likely to stick to your plan or panic-sell during a flash crash? A well-designed bot will.

That said, automation isn’t magic. Cloning your strategy requires careful tuning. Market regimes shift, and a strategy that worked yesterday might sputter today. Bots can “overtrade” if not configured properly, turning a small edge into losses with too-frequent signals. We’ll dive into these challenges later, but first, let’s survey the main automated approaches traders use.

Approaches to Automated Crypto Trading

Traders talk about automation and often picture complex bots, but in reality, there are several flavors, each with pros and cons. Let’s compare the major methods:

Copy Trading Platforms

Copy trading lets you mirror another trader’s moves automatically. Hook your account to an experienced trader, and every buy/sell they make (often in proportion to your balance) is cloned in your account. This is appealing because it requires little effort and no coding—you learn from a pro’s strategy in real time.

However, it’s only as good as the leader. Copy trading is like getting into a car and letting someone else drive; if they make a wrong turn, you’re along for the ride. Check performance stats and track records, but remember: past profits don’t guarantee future gains. Many platforms also lack transparency (you might not know why a signal was given). Always diversify: follow a few traders, understand their style (scalping, swing trading, etc.), and never trust blindly. Would you trust someone else’s steering wheel? Approach copy trading as a learning tool, not a guaranteed shortcut.

Crypto Trading Signals

Signal services deliver buy/sell alerts based on analysis. You might join a Telegram channel or paid service where experts (or algorithms) send a message like: “Buy ETH at $3,000, target $3,200, stop $2,900.” You then execute these trades manually or via your own bot. Signals can provide clear, actionable guidance without building your own strategy logic.

The catch: signals often lag the market. By the time you act, some of the moves might be over. Signals can also be one-size-fits-all—what works for a whale managing millions might not fit your account. Beware of scams: some channels advertise juicy backtests that evaporate in live trading. In other words, using signals is like having a map but still needing to navigate traffic yourself. They can enhance your strategy, but relying on them blindly could defeat the purpose of automation.

Building Your Own Trading Bots

At the advanced end is coding your own bots. This means writing algorithms (in Python, JavaScript, etc.) that interact directly with exchange APIs. The advantage is full control. You decide exactly how to enter, exit, size, and manage trades. Your bot can implement any logic, from a moving-average crossover to a complex statistical model. It’s the “self-driving car” approach: you design the autopilot.

DIY bots can run at machine speed. You can scan multiple markets, arbitrage across exchanges, or hedge positions without blinking. However, the work is substantial. You need programming skills (or a bot-building platform) and a solid understanding of trading strategy design. Every script needs thorough backtesting and debugging. And when the markets go crazy, an unattended bot can lose money faster than a human trader.

If you enjoy data analysis and coding, creating your own crypto trading bots is powerful. Just remember to start small: backtest extensively, use paper trading, and add safeguards before giving your bot real money.

Crypto Prop Firms & Funded Accounts

Even a great bot hits a ceiling if you trade only with your personal funds. This is where crypto prop trading firms come in. These firms give traders access to much larger accounts (like $50K or $100K) after they pass an evaluation challenge. The trader keeps most of the profits, and the firm provides the capital. It’s like paying for a flight simulator ride with a crash refund guarantee—only the difference is it’s real money.

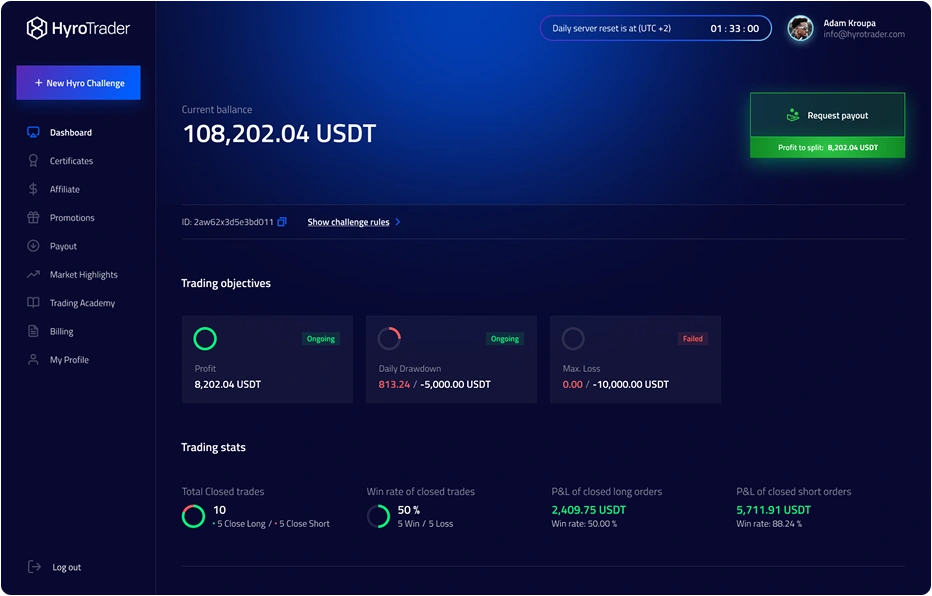

For example, a firm like HyroTrader might allow you to trade a $100K account once you demonstrate consistent profitability on a demo evaluation. Think: why grind small gains alone on $1K when you could perfect the same strategy on $100K? The firm imposes rules to manage risk: you might need to hit a profit target to win the account, and you must never breach a max drawdown or daily loss limit. These rules enforce discipline.

The benefits are clear: instant scale of capital, no need to risk all your savings, and a professional path to grow your strategy. The catch: profit splits (often 70–80% to you) and strict compliance. You’ll trade by the book (no revenge trading, no unexpected strategy changes) or you risk losing the funded account. But for systematic traders, funded accounts are a shortcut to multiplying returns. By plugging your crypto trading bots into a funded account, every winning trade is amplified by the bigger balance. Just remember the rule of thumb: protect that capital at all costs, and follow the firm’s rules as if your life depends on it (because it does, financially).

Deep Dive: Algorithmic Strategies in Crypto

Let’s drill into some popular algorithmic strategies (remember to align each to market conditions):

- Trend-Following Bots: These detect a sustained price direction and ride it. For example, a bot might use moving averages or breakout levels. When Bitcoin is shooting up day after day, a trend-follower would stay long. It’s like surfing: catch the wave early, ride it, and jump off before it crashes. Trend bots work great in strong bull or bear markets, but they can whipsaw in choppy, sideways markets.

- Mean Reversion Bots: These assume the price will revert to a mean. If an altcoin spikes 10% in an hour, the bot bets it will drop back down soon (and vice versa). Indicators like RSI or Bollinger Bands often trigger these. It’s akin to buying extra candies when the price dips because you think people will pay more soon. Mean reversion shines in range-bound conditions, but if the market trends hard, you might be buying or selling against the wind.

- Arbitrage Bots: In principle, arbitrage is risk-free profit: buy an asset cheaper on one exchange, sell on another at a higher price. In crypto, these gaps exist but vanish fast. A crypto arbitrage trading bot needs lightning speed and big capital. This strategy is like a squirrel snatching nuts while nobody notices—profitable but highly competitive. Unless you’re running co-located servers at exchange data centers, simple retail bots will only find small gaps.

- Grid Trading Bots: A grid bot places buy orders below and sell orders above the current price at regular intervals (creating a “grid”). If BTC is trading around $30K, the bot might buy every $500 drop and sell every $500 rise. This captures value in a range of markets. Think of dropping nets at different heights on a rising balloon: the nets keep catching more. The key risk: a breakout beyond the grid range can leave you one-sided. Set a clear range or drift limit.

- Scalping Bots: These perform many tiny trades for small gains. They exploit very short-term price moves. Scalpers might place limit orders on the order book’s edges repeatedly. This is akin to a hummingbird sipping nectar flower by flower: each sip is small, but total profit adds up. Scalping in crypto requires extremely low latency and a fee structure that allows many trades. It’s not for beginners, but some automated systems attempt it.

Each strategy is like a tool: useful in the right market and useless in the wrong one. Good algorithmic traders run multiple bots or switch strategies when conditions change. For instance, run a trend bot in a breakout environment and a grid bot in quiet periods. Diversifying algorithms can smooth out your equity curve.

Backtesting and Simulation

Before unleashing any strategy, backtest it thoroughly. However, beware of overfitting. If your backtest looks perfect (e.g., all trades profitable with magical timing), it’s likely too good to be true. Include realistic slippage and fees. Crypto markets can move abruptly; your backtest should assume that big orders will not always fill at ideal prices.

Use advanced validation: walk-forward testing (optimize on one data slice, then test on the next) and Monte Carlo simulation (randomize trade sequence or parameter choices) to gauge stability. Always use high-quality historical data—missing candles or wrong data can mislead an algorithm. Tools like Backtrader, Freqtrade, or QuantConnect can run these tests, but remember: they’re just software. Double-check crucial results manually. In short, treat backtests as directional guides, not gospel.

Risk Management for Automated Trading

Even a robot needs safety protocols. Key rules to code into your system include:

- Position Sizing: Never risk your entire account. A common rule is to risk only 1–2% of equity on any single trade. On a $10,000 account, that means risking $100–$200. In a $100K funded account, that might be $1,000–$2,000. This way, a few losses won’t blow you out.

- Stop-Loss and Take-Profit Orders: Hard stop-losses are crucial (or coded exit logic) to prevent runaway losses. Likewise, automated take-profits ensure you lock gains. For example, if you short BTC at $40K, predefine the stop at $42K and profit target at $38K in your bot.

- Overall Drawdown Limits: Many firms set a maximum drawdown (e.g. 10%). You should enforce similar rules personally: if your equity drops by a set percentage, pause trading and reassess.

- Diversification: Don’t put all funds into one coin or one strategy. Running a few uncorrelated bots (e.g. one targeting Bitcoin trends, another doing Ethereum arbitrage) can reduce risk. If one bot draws down, others might hold steady.

- Technical Safeguards: Limit your API key to trading only (no withdrawals). Use two-factor authentication. If possible, set up alerts to notify you if certain conditions are triggered (e.g., “bot exceeded risk limit” or “API connection lost”).

Risk management is the seatbelt and airbags of trading. It won’t make you rich, but it prevents catastrophic losses.

Execution: Infrastructure and Tools

Underneath every efficient bot is solid tech:

- Exchange APIs: All major crypto exchanges (Binance, Coinbase Pro, Kraken, Bybit, etc.) provide APIs for programmatic trading. Understand each API’s rate limits and quirks. Some bots use multiple exchanges for best price or arbitrage.

- Hosting Your Bot: Run your bot on a reliable server. Many use a VPS (Virtual Private Server) or cloud instance to ensure it never sleeps. Proximity to the exchange’s servers (i.e. low latency) can matter for high-speed strategies. Even an outage should be protected by backup servers or alerts.

- Trading Bot Software: You can code from scratch or use platforms. Open-source frameworks (like Gekko, Freqtrade) give flexibility if you’re comfortable coding. No-code services (Coinrule, 3Commas) can help non-programmers, though they may restrict strategy complexity. Weigh ease of use against customizability.

- Data and Indicators: Reliable market data (candlesticks, order book snapshots) is critical. Some advanced bots incorporate on-chain metrics (like exchange flows) or social sentiment scores. These can add an edge but also add complexity. Use them judiciously and always know what signals you’re trading on.

- Monitoring and Alerts: Automation isn’t “set and forget.” Implement logging to record every trade and decision your bot makes. Use alerts (email, SMS, chat) to flag issues: e.g., “API error,” “unusual drawdown,” or “strategy deployed.” This way you stay in the loop if something goes off-script.

A good setup minimizes downtime, maximizes speed, and keeps you informed.

Why HyroTrader Stands Out

HyroTrader is a relatively new crypto prop firm that has gained attention for being friendly to systematic traders. What sets it apart? In essence, it combines automated trading with funding. HyroTrader offers qualified traders funded crypto accounts (some reports mention up to $100,000 starting capital) and allows API trading. If you have a bot or automated strategy that proves itself on their demo, they let you run it live on their capital.

Traders praise HyroTrader’s structure: clear rules, supportive community, and modern tools. Unlike some firms that focus only on manual trading, HyroTrader explicitly supports algorithmic trading in crypto. You can plug your bots into their environment.

Imagine this: you spend weeks perfecting a scalper bot, and on your own $1K it made $100. On a $50K HyroTrader account, that translates to $5,000 (splitting profits with the firm, typically around 75-80% to you). The firm’s risk controls (max drawdown, profit targets) protect both sides, so trading remains disciplined.

The platform reportedly also offers features like multi-exchange access, strategy analytics, and community channels. It doesn’t promise a free lunch—if your bot loses too much, you risk losing the account, like anywhere else. But for savvy algorithmic crypto traders, HyroTrader provides an edge: much larger capital, embedded risk rules, and a programmatic-friendly system. By combining your algorithms with HyroTrader’s funding model, you can accelerate growth far beyond what you’d achieve solo.

Best Practices for Success

Even with the best tools, disciplined habits make the difference. Follow these best practices:

- Start Small and Scale: Even if you feel confident, begin with small position sizes or leverage. Observe how your bot performs live and increase size gradually. Think of it as nurturing a plant: you wouldn’t flood it with fertilizer on day one.

- Iterate and Improve: Don’t set a bot and forget it. Periodically review its performance logs: Are trades happening as expected? Where are the losses coming from? Adjust parameters or strategy logic based on real data. Markets evolve, and so should your code.

- Diversify Strategies: Run multiple bots or strategies that aren’t correlated. If Bitcoin spikes, maybe an altcoin mean-reversion bot can hedge losses. If one strategy stops working, others may keep profit flowing.

- Stay Educated: Crypto markets are dynamic. New technologies (DeFi tokens, L2 networks), regulations, and macro trends can shift behavior. Engage with trader communities, read research, and test new insights cautiously in your algorithms.

- Mental Discipline: Automation helps, but you still make decisions (selecting strategies, sizing, etc.). Resist overtrading in heat-of-the-moment. If a bot hits its stop-loss multiple times, don’t just override it emotionally. Follow your plan and risk limits.

- Document Everything: Keep records of your strategies, code versions, and results. This “journal” approach lets you learn from past successes and mistakes. If something breaks, you’ll know what changed.

By combining technical prowess with these smart habits, automated trading becomes a powerful ally rather than a black box.

Conclusion

Automated crypto trading is not a mysterious shortcut—it’s the disciplined application of strategy through code. When used responsibly, it turns thorough research and well-thought-out tactics into a tireless execution engine for the 24/7 crypto market. We’ve covered different paths to automation (copy trading, signals, DIY bots), the rising role of crypto prop firms with funded accounts, and how advanced algorithmic strategies work. Each method has its place, and the smartest traders often combine them.

Platforms like HyroTrader add another piece: letting your carefully tested bots run on much larger capital. With built-in risk rules, they help scale your edge. The key across all approaches is consistency and control: stick to your plan, manage risk relentlessly, and keep learning from real market feedback. Are you ready to get a “co-pilot” on your crypto journey?

In the end, the markets will always be there—volatile, exciting, and unforgiving. By harnessing automated crypto trading with wisdom and the right tools (and perhaps leveraging HyroTrader’s funded accounts), you give yourself a strong advantage. Take it step by step, maintain discipline, and you may find that your next big win comes not from luck, but from well-crafted code. Your future algorithmic trading success might just be one well-designed bot away.