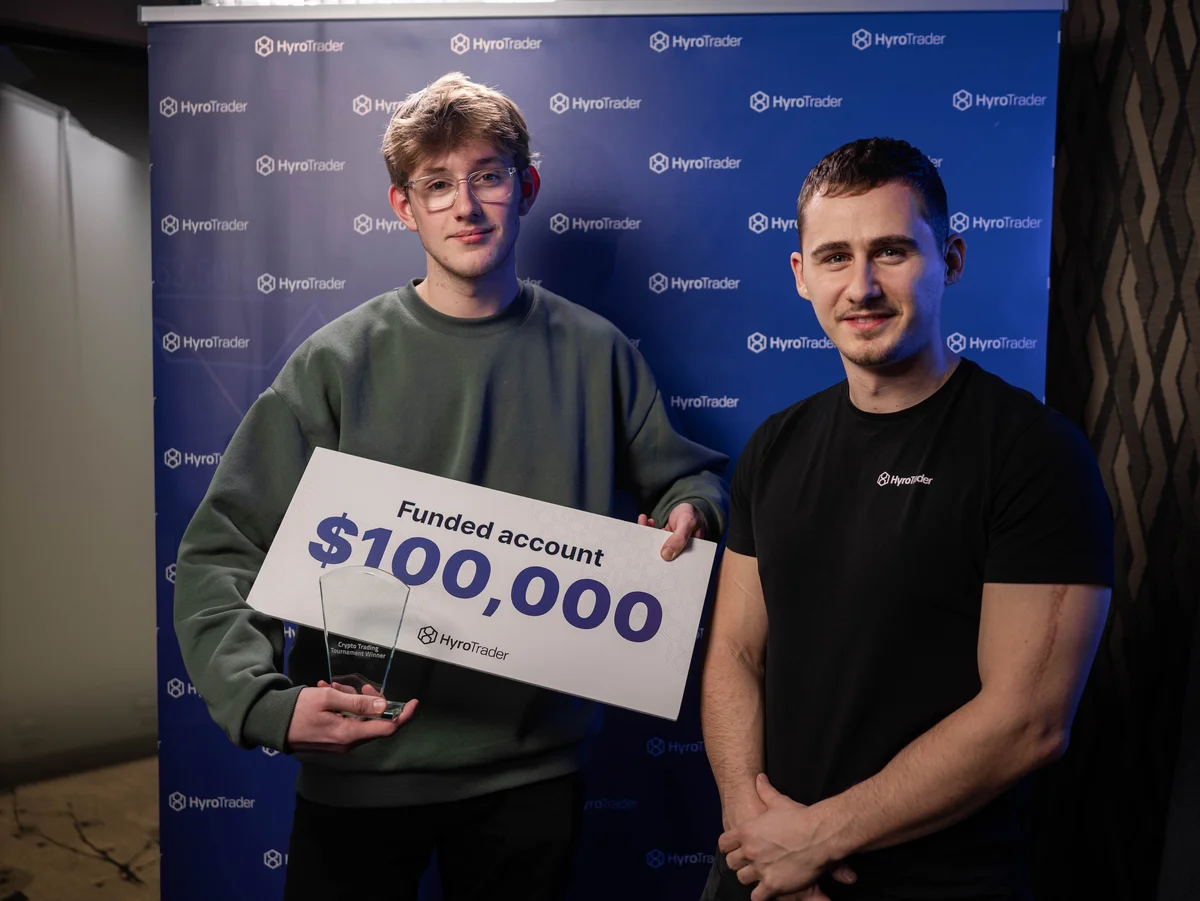

Crypto Trading Tournament

Compete online from the comfort of your home against top traders. Climb the leaderboard with the highest PnL and win your share of a $235K evaluation prize pool. Prove your skills and become the next HyroTrader champion.

Prove You Are the Best Trader

Traders will compete using Bybit demo accounts. The goal of the competition is to achieve the highest PnL within 7 days of trading. Participants can focus on scalping, day trading, or swing trading strategies.

Only USDT perpetual contracts are allowed during the tournament. Join the online tournament and build your reputation as one of the best crypto traders!

ByBit

ByBit

HyroTrader Tournament

Rewards preview

HyroTrader Tournament Instructions

Join the tournament, connect your account, and start trading.

Trade USDT Perpetuals and aim to achieve the highest PNL.

Become the winner of the tournament and win prizes worth up to $235K in evaluations.

HyroTrader Tournament Conditions

The HyroTrader Tournament is simple, there are no complicated conditions orrules. Your sole objective is to achieve the highest PNL among all participating traders.

Tournament Rules

Stop-loss orders are essential for limiting potential losses by automatically executing trades at predefined price levels, and traders must use a stop-loss on every position. Additionally, traders should not risk more than 3% of their initial account balance per position, ensuring that a triggered stop-loss does not exceed this limit. Traders have 1 minute from entering a trade to set the stop-loss. To ensure the stop-loss is correctly recorded by our monitoring system, it must be set as either a Stop Loss or a Trailing Stop Loss on Bybit (conditional orders or other types will not be considered valid stop losses).

Daily drawdown is calculated as the difference between the highest and lowest values of your account during the day, considering all unrealized profits and losses. You are allowed a daily drawdown limit of 5% of your initial account balance. This means that your account’s value should not drop more than 5% below its highest point for the day. The daily server reset occurs at UTC.

The account’s equity (unrealised losses and profits) must not fall below 90% of the initial account amount.

Traders may only risk up to 25% of their initial challenge balance. This means the total margin allocated to your open positions cannot exceed 25% of your starting balance. Example: For a $10,000 account, your maximum margin exposure is $2,500. Exceeding this limit may result in penalties.

What is the Cumulative Open Position Value rule? The combined value of all open positions must not exceed twice the account’s initial balance (2X). Example: For a $10,000 account, the total value of all open trades cannot exceed $20,000. Violating this rule could result in penalties or account termination.