Crypto markets move at breakneck speed. Have you ever wondered how some traders consistently skim profits from even the tiniest price fluctuations, day in and day out?

Welcome to the world of crypto scalping, a high-intensity trading approach where skilled traders leverage fast reflexes, advanced strategies, and sometimes even algorithmic bots to execute dozens or hundreds of trades each day.

This isn’t your basic “buy low, sell high” tutorial – it’s a deep dive into professional-level scalping tactics that can enhance your trading performance.

If you’re an experienced trader seeking to enhance your scalping strategies and boost your trading growth, read on. We will explore why scalping is well-suited for certain personalities, examine both discretionary and automated scalping methods, and uncover how top scalpers manage risk and leverage to maximize returns.

By the end, you’ll have a richer understanding of crypto scalping – and plenty of new ideas to test in the markets.

Why Scalping Suits Certain Traders

Scalping isn’t for everyone; it’s a rapid-fire, high-octane strategy that demands intense focus and discipline. However, for some traders, it’s the perfect fit. Why do certain individuals thrive as scalpers while others prefer slower-paced strategies?

Personality and Lifestyle

Consider your trading personality. Do you enjoy the adrenaline rush of making split-second decisions? Are you the type who prefers quick wins and dislikes waiting hours or days for a trade to unfold? If so, scalping suits your temperament.

Successful scalpers often liken their trading to a sprint or a series of quick boxing jabs – it’s all about short bursts of activity and immediate feedback. This approach can be ideal for traders who appreciate staying active and engaged, rather than passively holding positions.

In fact, many scalpers find long-term trading tedious; they thrive in a fast-paced environment where every minute can present a new opportunity.

Minimizing Exposure

Scalpers appreciate that they reduce their exposure to market risk. Executing trades quickly makes them less vulnerable to sudden adverse news events or overnight gaps. This aspect is appealing to risk-averse traders who still seek excitement.

Rather than enduring nerve-wracking fluctuations, a scalper typically ends each session in cash, sleeping soundly without any open positions. For those who value control and precision, scalping is ideal – every trade is a well-planned mission with a clear entry and exit, rather than an open-ended journey.

Leveraging Volatility

Crypto markets are notoriously volatile, which can scare off some investors but draws in scalpers like moths to a flame. Volatility results in more small price fluctuations to exploit. Each tiny tick up or down represents a potential profit when trading on the one-minute chart.

Traders who view volatility not as chaos but as opportunity will discover scalping to be a suitable strategy. It enables them to harness crypto’s wild price movements in a structured manner. If you can remain calm amidst rapid fluctuations, scalping allows you to turn volatility to your advantage.

In short, scalping suits traders who are decisive, enjoy action, and exhibit discipline under pressure. It rewards those who prepare thoroughly, execute without hesitation, and adhere to a plan amidst distractions. If this resonates with you, then the scalping strategies outlined ahead may be your path to enhancing your trading success.

The Scalper’s Mindset and Preparation

Before diving into specific tactics, it’s crucial to establish the right mindset and preparation – the foundation of any successful scalping operation. Scalping is often described as the trading world’s equivalent of a high-speed chess match. You need to think several moves ahead, but you must also act in the blink of an eye. How do professional scalpers prepare for this challenge?

Discipline and Emotional Control

At its core, a scalper must possess incredible discipline. Even a momentary lapse can be costly when making dozens of quick trades. Emotional swings – whether stemming from greed after a few wins or frustration following a loss – can result in impulsive trades that diverge from your strategy.

Elite scalpers train themselves to adhere to their game plan relentlessly. For example, if a trade does not meet your strict entry criteria, you simply skip it – no exceptions. If a trade goes against you, a disciplined scalper immediately cuts the loss, without hesitation or false hope.

In scalping, hesitation is the enemy. You might ask yourself: Can I manage taking five small losses in a row and still execute the sixth trade with confidence, as if nothing happened? If the answer is yes, you are mentally prepared for scalping.

Quick Decision-Making

Scalpers refine their decision-making process to be almost reflexive, which arises from thorough preparation and experience. Many traders develop a clear checklist or set of signals that, when aligned, trigger a trade. There’s no time for second-guessing when the market moves in seconds.

Some traders practice by replaying market sessions at an accelerated speed to train their reflexes, similar to a boxer training with rapid punches. The goal is to make the analysis process so ingrained that execution becomes second nature.

Technical Mastery

Scalping relies heavily on interpreting price action and indicators on very low timeframes, so successful scalpers often demonstrate mastery in technical analysis. They can read one-minute or tick charts as adeptly as others read hourly charts. Patterns that most may overlook – such as a subtle double bottom or a rapid volume spike – are clearly visible to a seasoned scalper.

Preparation involves studying these micro-patterns and understanding the context, such as recognizing when a small breakout is likely to fizzle due to an opposing higher timeframe trend.

Scalpers typically focus on a few preferred indicators or signals and learn them thoroughly. Whether it’s the alignment of a couple of fast-moving averages, the position relative to a VWAP (Volume Weighted Average Price), or a specific candlestick formation, they are intimately familiar with their triggers.

Learn more: VWAP in crypto trading

Equipment and Environment

If you’re going to trade at high speed, your tools and trading environment must support you. Serious scalpers regard their setup as a cockpit. This might include:

- High-speed internet and reliable hardware are essential: You cannot afford a platform freeze or a laggy connection while scalping. A split-second delay can turn a winning scalp into a losing one. Many investors opt for powerful computers and even backup internet connections.

- Multiple monitors or customized layouts: Scalpers often keep a close eye on various data points simultaneously – Level 2 order book, multiple timeframes of charts, and possibly a watchlist of assets. Having a multi-screen setup or an ultra-wide monitor enables you to observe everything without switching windows frantically.

- Hotkeys and advanced order types: To execute quickly, you can utilize keyboard shortcuts for entering and exiting orders. For instance, a key can instantly hit the bid or ask, or set a predefined stop-loss immediately upon entry. Advanced order types, such as OCO (one-cancels-other) orders, can automatically place a stop and take-profit target the moment you open a trade, ensuring you don’t waste time setting them manually.

Having the right mindset and preparation is akin to strapping on high-quality gear before a skydive. It doesn’t guarantee success, but it significantly enhances your odds and safety. With this solid foundation, let’s dive into the concrete manual scalping strategies that professional traders use to outsmart the crypto markets in the short term.

Advanced Manual Crypto Scalping Strategies

Manual (discretionary) scalping depends on a trader’s ability to analyze the market in real time and act swiftly. It’s you, the charts, and your instincts. Below are some advanced manual crypto scalping strategies that seasoned traders utilize:

Range Trading Scalps

Not every market is trending; often, crypto prices ping-pong within a range. Savvy scalpers thrive in these range-bound conditions. The strategy is straightforward: buy at the low end of the range and sell at the high end repeatedly, capturing small profits with each swing. However, maintaining this consistency requires finesse.

An experienced scalper first identifies a clear support and resistance zone where the price has been bouncing (for example, Bitcoin oscillating between $30,000 and $30,500 for the past hour). They might zoom into a 1-minute chart and watch for telltale signs of the price stalling at the extremes – such as several wicks rejecting off the support level or a cluster of sell orders appearing on the order book at resistance. Once they have high conviction that the range is holding, they execute: going long near support and exiting near the mid or top of the range, or vice versa for shorts.

Key tip

Utilize indicators such as the Relative Strength Index (RSI) or Stochastic Oscillator on ultra-low timeframes (1m or 3m) to assess mini overbought/oversold conditions within the range. If the price hits range support and the 1-minute RSI indicates oversold, it could serve as a signal to scalp a quick long. Conversely, an overbought signal near range resistance suggests a short scalp. Additionally, monitor volume: decreasing volume as the price approaches the range boundary often signals a reversal (buyers or sellers are exhausted).

Range scalping can lead to multiple small victories, but the risk lies in a sudden breakout from the range. To protect against that, always use a stop-loss just beyond the support or resistance. If the range breaks, you should exit immediately.

Successful range scalpers understand that many of their attempts may yield only a small profit or break even, but a few significant swings of the ping-pong can accumulate nicely by the end of the day.

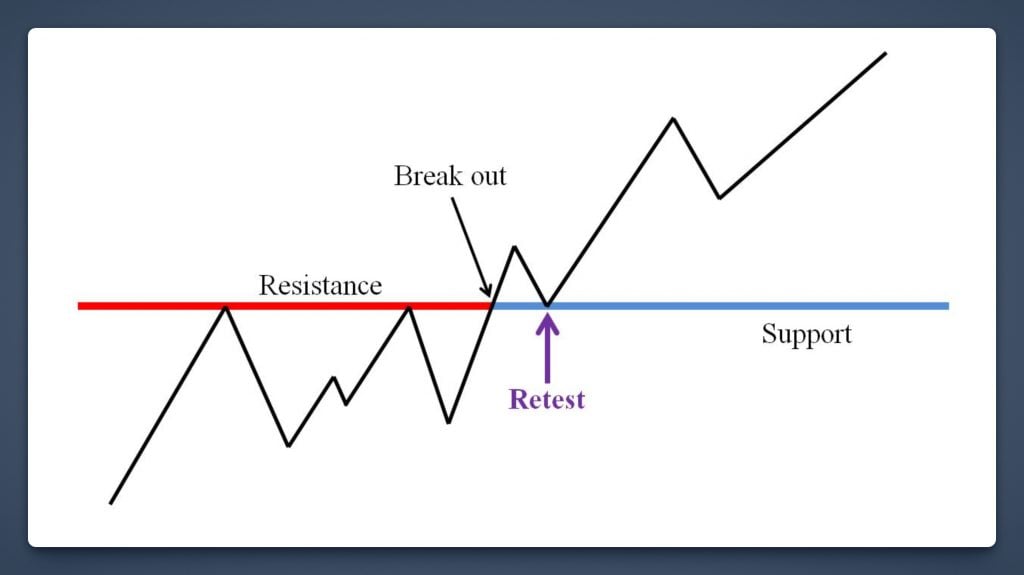

Breakout and Momentum Scalping

While range-bound markets are excellent for ping-ponging, there are other instances where you’ll witness an explosion of price action. Breakout scalping focuses on capitalizing on those sudden surges in volatility that happen when a price finally escapes a tight consolidation or breaks through a significant support or resistance level.

Here’s how a pro does it

Suppose Ethereum has been coiling under $2,000 for a while, and you suspect a big move once it pushes above. A breakout scalper will set alerts or maintain a laser focus on that level. The moment the price hits $2,001 with strong volume, they buy, riding the wave of buy orders that typically pour in.

In scalping, you don’t marry the trade; the scalper might aim to capture a quick 0.5% or 1% move if momentum is strong, then exit most of the position. Often, they’ll keep a tight trailing stop on a portion of the trade in case the breakout evolves into a larger trend run, but the core principle is to bank profits quickly on the initial spike.

Momentum scalping can also occur during news events or sudden shifts in sentiment. For instance, a surprise tweet or economic announcement may lead to a coin’s price surge. Skilled scalpers capitalize on extremely short-term patterns – such as a rapid sequence of green candles with high volume – and effectively ride the wave.

This approach is inherently risky, as such movements can reverse in an instant. Therefore, these traders employ lightning-fast stop orders for protection. A common technique is the break-and-retest strategy on seconds or tick charts: the price breaks through a level, then briefly retraces (the retest), and when it stabilizes, the scalper enters during that pause, aiming to capture the next leg of the move.

A crucial element is avoiding false breakouts. Not every price pop sustains. Seasoned scalpers look for confirmation, such as a significant volume spike, and may monitor the order book depth. If they observe that after breaking out, buy orders are still stacking up (or large sell walls have been aggressively consumed), they gain confidence that it’s a genuine move.

Conversely, if the breakout prints one big candle and then stalls, it may signal a trap for late buyers. An experienced scalper will either exit quickly or even flip short for a rapid counter-trade, anticipating that the price will snap back once the breakout momentum fades.

Breakout scalping is ideal for traders who can make split-second judgments and aren’t afraid to immediately cut and reverse their position if proven wrong. When executed correctly, it can yield some of the day’s biggest wins in just minutes, but it requires precision and the ability to read the crowd’s emotions on the chart.

Mean Reversion and Indicator-Based Scalping

Not all scalping focuses only on momentum; some strategies involve fading short-term extremes. Mean reversion scalping assumes that if price swings too far too quickly in one direction, it often snaps back (even if just slightly) toward the average. Essentially, it exploits the rubber-band effect of price.

One popular method employs Bollinger Bands or similar volatility channels on a very low timeframe chart. Bollinger Bands create an envelope based on standard deviations around a moving average. When the price pushes outside the bands, it signals an extreme condition.

An experienced scalper might monitor a 1-minute chart with Bollinger Bands, perhaps set to a period of 14 or 20 and 2 standard deviations. If they observe a sudden spike that touches the upper band and closes outside it, this indicates an overextension.

Combined with an overbought reading on an oscillator like RSI or a sudden drop in buy volume, a scalper could execute a quick counter-trend short, targeting a few ticks as the price reverts toward the middle band, which is the moving average.

The opposite applies for a downward spike representing oversold conditions, where a quick long scalp could be profitable.

Another indicator-based approach uses the Relative Strength Index (RSI) across multiple timeframes. For instance, if both the 1-minute RSI and 5-minute RSI indicate being deeply overbought (>80) following a sharp rally, a scalper might determine that a short-term pullback is imminent. They would then seek a micro setup to short (such as a small double-top or a bearish engulfing candle on the 15-second chart) and scalp a few points as the price mean-reverts and RSI declines.

This style demands a high level of precision, as you are trading against immediate momentum. It is most effective in choppy conditions or when a price swing clearly indicates an overreaction. The key is to secure profits quickly – often at the nearest minor support/resistance or moving average – since sometimes that “rubber band” only snaps back halfway before the original trend resumes. You don’t want to linger and turn a quick scalp into a counterproductive trade against the larger trend.

These manual strategies emphasize that there is no one-size-fits-all method for scalping – you might focus on one approach or use a combination based on market conditions. The common thread, however, is speed, precision, and strict risk management. Now, regarding speed, let’s examine how algorithmic approaches and bots elevate scalping to the next level.

Algorithmic Scalping Strategies and Crypto Bots

When human limits on reaction time and endurance become barriers, traders turn to algorithmic scalping.

In the crypto world, the use of bots and automated strategies has surged, enabling scalpers to operate 24/7 and execute trades far more quickly than any manual click.

Let’s explore how advanced traders leverage algorithms and crypto scalping bots for high-frequency gains.

Learn more: Algorithmic Crypto Trading

The Rise of Crypto Scalping Bots

Crypto never sleeps. As an experienced trader, you understand how exhausting round-the-clock markets can be. This is where scalping bots come into play.

A scalping bot is essentially a programmed set of rules that enters and exits trades on your behalf, based on predefined conditions. For example, you can code a bot to implement the range trading strategy we discussed: buy at support, sell at resistance, with all the conditions you’d normally check – but the bot does it automatically, even at 3 AM while you’re asleep.

Modern crypto trading platforms and APIs facilitate advanced bot strategies. While some traders create bots from scratch using languages like Python or C++ for optimal speed, others opt for configurable off-the-shelf trading bot platforms, which enable them to set scalping parameters without requiring extensive coding.

Regardless of the approach, the advantage is clear: a bot can scan multiple markets simultaneously, react in milliseconds to price changes, and execute a high volume of trades without fatigue.

Consider this scenario: You have a list of 20 altcoins that frequently engage in range trading during Asian market hours. You could deploy a bot to monitor all 20, executing quick mean-reversion scalps on each whenever the conditions are favorable. No human could effectively monitor 20 charts simultaneously in real time, but a computer can. This ability to scale breadth is one reason algorithmic scalping is so popular.

However, developing a reliable scalping bot requires thorough testing and calibration. You will likely run it on historical data (backtesting) and then in live markets with a small size (forward testing) to ensure it behaves as expected.

The parameters – such as what constitutes a valid entry, how tight the stops should be, profit targets, and so on – may need frequent tweaking as market conditions evolve. It’s a continuous process, almost like tuning a high-performance engine.

High-Frequency Trading Considerations

At the extreme end of algorithmic scalping lies the domain of high-frequency trading (HFT).

HFT firms invest heavily in ultra-low latency connections and often co-locate their servers in the same data centers as crypto exchanges to achieve execution speeds down to microseconds. While individual retail traders may not go to such lengths, it’s important to understand the influence of HFT in crypto markets. These algorithmic players utilize complex tactics (such as arbitrage and large-scale market making) to exploit minute inefficiencies.

You may not directly compete with HFT giants as a solo trader, but you can adopt some HFT-inspired tactics. For example, if you possess programming skills, you can operate your trading bot on a VPS (Virtual Private Server) located near the exchange’s servers, thereby reducing latency compared to a home computer setup.

Additionally, you can optimize your code for speed and ensure your bot employs immediate-or-cancel orders along with other micro-optimizations. When scalping for tiny profits, every fraction of a second and every fraction of a percent in fees is crucial.

One algorithmic technique available to skilled retail traders is event-driven scalping algorithms. These bots monitor for specific triggers, such as a sudden volume spike or a large trade order emerging in the order book, and respond instantly.

For example, you could program a bot to observe the order book for a large hidden order being revealed and to buy just ahead of that order, anticipating that it will drive the price up, then sell moments later into the mini rally it creates.

This approach is complex to execute correctly and can backfire if misinterpreted, but it’s an example of how automated strategies can replicate what a very sharp human scalper might do, only much faster.

Market Making and Arbitrage Bots

We touched on manual bid-ask spread scalping; algorithms excel at this. Market-making bots can simultaneously manage dozens of buy and sell orders, updating them as conditions change.

They dynamically adjust spreads based on volatility – for instance, widening the spread during volatile moments and tightening it during calm periods. These bots essentially print money in quiet markets by continuously buying slightly lower and selling slightly higher.

They can also be programmed to hedge positions. For example, if one of your orders gets filled and the price starts to move against you, the bot might immediately offset the risk by executing a market order on a correlated asset or in a futures market. This kind of complex logic is where bots excel over humans.

Arbitrage bots represent another algorithmic scalping strategy.

Crypto markets often exhibit price discrepancies between exchanges or between different trading pairs. Arbitrage bots detect these differences and execute a series of trades to secure low-risk profits. For instance, if Bitcoin is trading at $30,000 on Exchange A and $30,100 on Exchange B, an arbitrage bot will buy on A and simultaneously sell on B, capturing the difference minus fees.

Additionally, triangular arbitrages can occur within the same exchange (e.g., trading BTC/ETH, ETH/USDT, and BTC/USDT in a loop when their relative prices diverge). While many straightforward arbitrage opportunities have been eliminated as more bots enter the market, new ones continue to emerge, particularly in smaller or less efficient markets.

For the individual algo trader, focusing on one platform and doing something like a grid trading bot (a simple form of automated range scalping) might be more practical. A grid bot pre-defines a grid of buy and sell orders at set intervals, effectively implementing a range-bound scalp strategy hands-free. This can work well in sideways markets and is offered by many crypto trading tools today.

Many top scalpers use a hybrid approach: manually trading at critical moments while bots handle routine scalping. This human-machine mix captures the best of both worlds.

Risk Management for Scalp Traders

Whether manual or automated, risk management is the critical element of scalping. You might have the best strategy in the world, but if one or two trades fail, they can wipe out dozens of small wins. Experienced scalpers view risk management as sacrosanct – it’s genuinely their “secret sauce” for remaining profitable.

Tight Stop-Losses

In scalping, the mantra is to cut your losses quickly. This often means using very tight stop-loss orders on every trade. For instance, a scalper might risk just 0.2% or 0.5% on a trade. If aiming to make 0.5% to 1% on the winner, that could result in a 1:2 risk-reward ratio, which is acceptable if the win rate is high.

The key is that each loss is kept small in absolute terms. By limiting every loss, a series of a few bad trades won’t devastate the account. Some traders use mental stops with manual execution, but in the heat of scalping, it’s generally better to have an automatic stop order in place – slippage can occur, but at least you’re out near your predefined risk limit.

Position Sizing

Since stops are tight, position sizes can often be larger than in swing trading, as the dollar risk per trade is small. However, scalpers remain cautious not to exceed what the market liquidity can handle. It is important to assess the current volume of your trading pair. If your trade size is too significant relative to the typical volume per minute, you risk impacting the price or facing difficulties in exiting quickly.

Advanced scalpers frequently scale into positions, entering a few slices instead of one large order, allowing them to stay under the radar and achieve a better average price. However, when scaling in, they still consider the total position and ensure there is a stop for the entire amount.

Daily Loss Limits

Professional prop traders often have a daily loss limit – a maximum amount they’re willing (or allowed) to lose in a day before they stop trading.

Scalpers should adopt the same practice. For instance, you might establish a rule that if you’re down 3% of your account in a day (perhaps due to a bad streak or a single significant move against multiple positions), you call it quits for the day.

Because scalping is so fast-paced, it’s easy to fall into a tilt – a frustrated state where you start taking revenge trades to recover losses. A hard stop on your trading day prevents a bad day from becoming catastrophic. It’s like a circuit breaker for your account.

Adapting to Market Conditions

A subtle risk management point is recognizing when not to scalp. Not every moment is ideal for scalping. For instance, just before a major news announcement or during extremely illiquid weekend hours, even an experienced scalper might reduce their size or avoid trading altogether.

The risk of getting caught in a sudden gap or an unusual price spike is higher during such times. Knowing when to stay out is as important as knowing when to jump in.

Additionally, if the market’s character changes (for example, it shifts from a stable high-volume environment to low-volume choppiness), a good scalper might switch strategies or take a break for a while.

Leverage with Caution

Scalpers often use leverage to amplify those tiny moves into meaningful profits. Using 5x, 10x, even 50x leverage on crypto futures is not uncommon in scalping. But high leverage is a double-edged sword and demands even stricter risk controls.

A rule of thumb is: the more leverage you use, the smaller your margin for error. If you’re on 50x leverage, a 0.5% move against you means a 25% loss (ignoring fees). This is why only very confident, quick traders might venture that high, and typically only with automatic stops.

Many experienced scalpers actually prefer moderate leverage (like 5x or 10x) because it’s enough to juice returns without courting instant disaster. The key is to never use more leverage than necessary and always assume the worst-case scenario can happen.

Treat leveraged positions as if they’re fully in cash when sizing risk – for example, a $100,000 position on 10x leverage is $10,000 of your capital at risk; gauge your potential loss on that $100k position, not just the $10k margin. This mindset keeps respect for the market’s power.

Fees and Spreads

Scalpers cannot ignore trading costs. If your exchange charges a 0.1% fee per trade, a round trip (entry + exit) is 0.2%. If you’re scalping for a 0.5% profit, that’s nearly half gone to fees. Thus, many scalpers aim for platforms with lower fees or try to be market makers (using limit orders) to earn rebates.

Some advanced traders even negotiate fee discounts by achieving high monthly trading volumes. If you’re using a bot that trades a hundred times a day, you must factor fees into your strategy’s profitability – it can be the difference between a winning and a losing approach.

In summary, a scalper must become their own risk officer. Every trade has an exit plan if it goes wrong, and the overall day (or week) has a cap on potential losses. By enforcing these rules, you create a safety net for your ultra-fast trading activities, ensuring that no single mistake escalates into a disaster.

This allows you to play the scalping “game of numbers” calmly, knowing that as long as your edge is genuine and you adhere to your rules, the probabilities will work out in your favor over many trades.

Best Platforms and Tools for Crypto Scalping

Your skill and strategy are crucial, but the tools and platform you choose can greatly influence your scalping results. In a game where milliseconds and minor price differences count, selecting the right crypto trading tools and platforms is vital for a seasoned scalper.

Choosing the Best Crypto Scalping Platform

The “best” platform can vary depending on your needs, but top considerations include:

- Low Latency Execution: You need an exchange or trading platform that executes orders quickly and reliably. Platforms with frequent outages or slow interfaces are deal-breakers for scalping. Many traders prefer using desktop applications or direct API connections for speed over web interfaces.

- High Liquidity: Liquidity ensures your orders fill close to your expected price without significant slippage. Major exchanges, which handle high-volume pairs like BTC or ETH, are generally preferred. If you scalp smaller altcoins, focus on those with reasonable trading volume and tight bid-ask spreads.

- Favorable Fees: As noted, fees can quickly erode profits. The top platforms for scalping typically feature tiered fee structures where active traders receive discounts or even qualify for maker rebates. For this reason, futures exchanges often present lower fees than spot markets (though be cautious of funding rates if you hold futures positions for longer than a short duration).

- Advanced Order Types: A good scalping platform should provide more than just basic market and limit orders. Look for bracket orders (entry with attached stop and take-profit), trailing stops, and the ability to place iceberg orders (to conceal size), among others. These tools facilitate the quick execution of complex strategies.

- Stability and Support: You require a platform that stays stable during high volatility. If an exchange goes down whenever Bitcoin surges by 5% in a minute, it’s unsuitable for scalping, as that’s precisely when you need your platform to be operational. Additionally, consider the quality of customer support and whether the platform offers real-time status updates in case issues arise.

Some experienced traders even utilize multiple platforms: one may serve as the main execution venue for trades, while another is employed for charting and analysis.

For example, you might perform detailed analysis on a dedicated charting platform with advanced indicators, while executing trades on an exchange’s interface or API for speed. The goal is to create a setup that leverages each tool’s strengths.

For instance, you could display a chart on one screen using software that offers excellent drawing features and indicator libraries, while keeping your exchange’s order entry panel on another screen for quick access. Ensure to synchronize as much as possible (e.g., if you adjust a level on the chart, promptly update any corresponding order on the trading platform).

Crypto Trading Tools and Software

In addition to the trading platform itself, advanced scalpers often utilize extra tools:

- Order Flow Monitors: These tools visualize changes in the order book and display tape (time and sales) data in intuitive ways. Some crypto-specific tools feature heatmaps of liquidity (indicating where large orders are positioned in the book) and volume delta (the difference between aggressive buying and selling). This information can provide a scalper with an advantage in detecting very short-term shifts in supply and demand.

- Alert Systems: Setting custom alerts is crucial to ensure you don’t miss opportunities. Alerts that trigger a sound or text when the price reaches a certain level or an indicator condition is met can liberate you from constantly staring at the screen and facilitate semi-automation. For instance, an alert that notifies you when a 1-minute candle’s volume exceeds a threshold might indicate that a breakout is beginning.

- Scripting and API Tools: If you’re not creating a full bot but are looking for some automation, many platforms support scripting strategies (e.g., utilizing an exchange API or a platform’s scripting language). You can develop a semi-automated system that highlights or even partially executes trades when conditions are favorable. Even a simple script to automatically adjust your stop-loss to breakeven after the price moves X in your favor can be extremely useful.

- Analytical Journals: Maintaining a comprehensive record of your scalping trades and reviewing them is essential for improvement. Tools that monitor performance metrics (win rate, average win versus loss, hour of day performance, etc.) can highlight where you excel or struggle. Some sophisticated journals allow you to categorize trades by strategy (range, breakout, etc.), enabling you to identify which setups produce the best results.

- Simulation and Replay: Practice tools that allow you to replay historical market data are excellent for training and strategy development. Some platforms offer a replay mode that enables you to simulate trading on past data as if it were live, providing a fantastic opportunity to enhance your skills without risking capital.

Infrastructure Considerations: If you take scalping more seriously, you may want to invest in improved infrastructure:

- Some traders subscribe to premium data feeds that update more frequently or offer tick-by-tick data that free feeds might not provide.

- Operating a VPS close to the exchange’s servers can greatly reduce order transmission time.

- For those interested in algorithms, some exchanges provide sandbox environments to test API strategies. Additionally, third-party services can connect algorithms to exchanges with monitoring dashboards. If coding isn’t your strength, platforms offer visual strategy builders with drag-and-drop logic blocks. Use these carefully, as pre-built solutions may have hidden quirks.

In summary, treat your trading like a business: invest in the best tools and platforms that give you an edge. A reliable platform, quality data, and supportive technology can make a significant difference in your scalping performance.

Scaling Up Your Scalping Operation

One of the goals implied in the topic is to scale your trading – taking your scalping success and elevating it to new heights. How can you transition from earning a little side income with scalping to operating it like a high-powered trading venture? Here are some insights on scaling up:

Gradually Increase Trade Size

Scale your trades by slowly increasing position sizes as your account grows or your strategy confidence solidifies. Start with $5,000 positions, then move to $20,000, and so on. Be cautious – doubling the size can have a significant psychological impact. Many traders excel at small scalps but hesitate when trade sizes increase.

Focus on executing strategies as percentages or units rather than dollar P&L. Test each size increment- what works for a small account may not for larger orders, especially in smaller altcoins. If you observe diminishing returns when increasing size, consider diversifying trades across pairs or accepting lower percentage gains with larger sums.

Expand to More Markets

Another way to scale is horizontally – trade more assets. If you currently only scalp Bitcoin, consider adding other cryptocurrencies like Ethereum or some high-volume altcoins to your rotation. Each additional market provides a chance to apply your skills and multiply opportunities.

Of course, be cautious not to spread yourself too thin. Perhaps begin by introducing one additional market that behaves somewhat differently, and see if you can manage tracking both.

Over time, some scalpers maintain a roster of coins, jumping between whichever is performing best at the moment. This is where having a scanner or alerts proves helpful, so you know which chart deserves your attention at any given time.

Leverage and Funding

Leveraged crypto trading can increase your exposure without requiring more personal capital – but it’s risky if not paired with skill and discipline. Many professional scalpers actually use less leverage as their accounts grow, because they don’t need as much to achieve their profit goals; the account is sufficiently large to generate good returns on small moves.

However, if you have a profitable system and limited personal funds, one way to scale is through funded crypto trading programs and prop firms.

Platforms like HyroTrader are specifically designed to help traders scale. The model typically works as follows: you demonstrate your skills on a demo or evaluation account by achieving a profit target while managing risk. If you succeed, the firm provides you with a funded account (such as $50,000 or $100,000) to trade live.

You retain a significant portion of the profits, the firm takes a commission, and they cover any losses that exceed your agreed maximum drawdown (or they may terminate the account if you breach the risk limits).

For a skilled scalper, this can be an ideal scenario – you offer your talent and strategy, while they provide the capital. It’s essentially leverage without the need for borrowing – you’re not liable if things go awry, aside from potentially missing out on an opportunity. Many scalpers excel in these programs because it aligns with their trading strategy: short-term, disciplined, and focused on achieving profit targets without large losses.

HyroTrader, in particular, emphasizes that they allow scalping and even high-frequency strategies, which some traditional firms might restrict.

Advanced Strategy Diversification

Scaling up may also involve developing new scalping strategies to implement. You don’t want to put all your eggs in one basket, especially as your capital grows. For example, if your primary focus has been range scalping, consider also mastering a breakout strategy or a news-spike scalp. This way, if market behavior shifts, you have alternative methods to rely on.

For a scalper, diversification means having multiple playbooks to draw from. It could also involve incorporating slightly longer timeframes with your ultra-short trades – for instance, occasionally taking a 15-minute chart setup that you hold for an hour (still intraday, but slower than your usual few-minute trades). This approach can smooth out your equity curve; if one style hits a dry patch, another can pick up the slack.

As you grow, monitor your performance metrics closely and establish guidelines for when to scale further. For instance, you may choose to increase your trading size after achieving a specific return over a defined period, or to apply for a larger funded account once you’ve demonstrated your capabilities at the current level. Systematic scaling helps prevent impulsive jumps in risk – each progression is earned and justified by data.

Throughout this process, maintaining discipline remains essential. Larger amounts can tempt you to stray from what worked when circumstances were smaller. Adhere to the same risk management principles that brought you success.

If you managed a $1,000 account with respect and caution, apply the same approach to a $100,000 account. It’s still proportional risk; the market remains indifferent to the extra zeros in your balance, and so should your strategy.

Conclusion

Scalping in the crypto market is a fast-paced and demanding endeavor; however, for the right trader, it can be incredibly rewarding. We’ve explored a landscape of advanced scalping strategies, from quick-draw manual tactics to algorithmic wizardry, all highlighting the importance of discipline and risk management. By now, you should have a clearer understanding of what professional crypto scalping looks like in action.

The key takeaways?

First, know yourself: if you thrive in high-speed environments and possess the discipline to cut losses swiftly, scalping may be your ideal niche.

Second, mix and match techniques: you might blend range trading with breakout scalps or run a bot on the side while manually targeting key setups.

Third, always respect risk: small gains can disappear with one big mistake, so make risk management central to every strategy you implement.

Finally, consider the bigger picture – how will you scale your trading once you’ve proven your edge? This might involve gradually trading larger sizes or leveraging external capital and tools (as platforms like HyroTrader provide) to amplify your success.

No single “magic” strategy exists. The advanced tips we covered are like ingredients; it’s your job to mix them into a recipe that fits your style and market conditions. Crypto scalping combines art and science, rewarding creativity, practice, and adaptability. As an experienced trader, you must evolve with the market, refining your approach and learning from each trade to stay ahead of the competition.

Whether you’re deploying a lightning-fast bot at midnight or manually executing a flurry of trades during morning volatility, approach each session with a clear plan and a cool head. Over time, those seemingly small profits can compound into significant returns, especially as you scale up intelligently.