Paper trading is an indispensable tool in the cryptocurrency space. Whether you are a newcomer eager to test the waters or an experienced trader aiming to refine your strategy, paper trading offers a risk-free environment to experiment and build confidence.

This article delves into the advanced insights of cryptocurrency paper trading and crypto demo trading accounts.

We will explore everything from foundational concepts to detailed strategies and tools, ultimately guiding you toward a seamless transition to real funded trading accounts.

Understanding Cryptocurrency Paper Trading

Cryptocurrency paper trading is the practice of simulating trades without putting actual money at risk. This method allows you to test various strategies in a live market environment, using virtual funds that mimic real-time conditions.

By engaging in paper trading, you have the freedom to experiment, learn from mistakes, and refine your techniques, all while safeguarding your capital.

Definition and Importance of Paper Trading

At its core, paper trading is an educational simulation. It provides a sandbox environment where traders can learn market dynamics, test hypothesis-driven strategies, and understand the nuances of technical analysis.

When you paper trade, you are essentially writing your own trading story without the financial risk. This makes it an ideal training ground for understanding market behavior.

Paper trading holds particular significance in the cryptocurrency market. Unlike traditional markets, crypto assets are highly volatile, and the market operates 24/7. This constant activity makes the learning curve steeper and sometimes unpredictable.

By engaging in cryptocurrency paper trading, you benefit from:

- Risk-Free Experimentation: You can trial strategies that might be too risky with real money.

- Market Familiarity: Experience live market conditions without the pressure of financial loss.

- Skill Development: Refine decision-making processes and technical analysis techniques over time.

Advantages and Limitations of Paper Trading

Paper trading offers a number of advantages. For one, it allows for continuous learning without the fear of loss. When you test your trades on a simulated platform, you gain valuable insights into your trading habits and decision-making processes.

Moreover, you can experiment with advanced order types and risk management techniques without worrying about slippage or unexpected market moves.

On the other hand, there are inherent limitations.

Paper trading often lacks the emotional intensity associated with real money trading. When actual funds are on the line, the pressure can influence your decisions, sometimes leading to different outcomes compared to a simulated environment. Additionally, some platforms might not fully replicate market liquidity and order execution speeds. However, modern platforms, especially those that use real-time data from leading exchanges, are closing this gap.

Navigating Crypto Demo Trading Accounts

Crypto demo trading accounts are designed to mimic live market conditions while allowing you to trade without financial risk. They serve as a bridge between theoretical learning and the practical application of strategies under real market dynamics. These accounts are an excellent starting point for anyone interested in cryptocurrency paper trading.

What are Crypto Demo Trading Accounts?

Crypto demo trading accounts are essentially virtual environments where traders can practice buying and selling cryptocurrencies without using actual funds. These accounts use live market data, allowing you to see the same price movements, order book dynamics, and volatility that you would experience when trading with real capital.

This risk-free environment helps you understand:

- Execution Mechanics: Learn how orders are filled, how slippage can occur, and the impact of order types.

- Platform Features: Familiarize yourself with tools such as advanced charting, technical indicators, and risk management functionalities.

- Market Behavior: Observe market reactions to news, trends, and global economic events without financial exposure.

Benefits of Using a Demo Account for Strategy Testing

The benefits of using a demo account extend beyond just eliminating financial risk. They allow you to test a variety of strategies, including scalping, swing trading, or even algorithmic trading, without the fear of losing capital.

Additionally, demo accounts let you refine your risk management techniques. For example, by setting stop-losses and adjusting leverage, you can see firsthand how these factors influence your trading outcomes.

Furthermore, crypto demo trading accounts give you an opportunity to measure your performance against live market conditions. Once you have a record of your simulated trades, you can evaluate your strategy’s effectiveness and adjust your approach accordingly. Many platforms now offer integrated analytics tools, enabling you to review key performance metrics such as win rates, average profit per trade, and maximum drawdowns.

For a hands-on experience with real-time market conditions in a controlled environment, you might consider exploring HyroTrader’s Crypto Demo Trading Account. This platform offers a comprehensive demo account where you can practice your strategies without any financial risk.

How to Get Started with a Crypto Demo Trading Account

Getting started with a crypto demo trading account is both straightforward and beneficial. Begin by selecting a reputable platform like HyroTrader that provides a demo environment mirroring live market conditions. Sign up and verify your account, then immerse yourself in the learning experience by:

- Exploring Platform Features: Take time to navigate through the trading interface, explore the charting tools, and learn about the various order types.

- Testing Different Strategies: Experiment with various trading strategies to determine which methods suit your style best. Whether you prefer technical analysis or fundamental insights, the demo account provides a safe space to hone your approach.

- Setting Realistic Goals: Use the demo environment to set profit targets and practice disciplined risk management. Treat every simulated trade as if real money were on the line.

Many traders find that the transition to live trading becomes much smoother once they become comfortable with the mechanics and develop a consistent strategy in a demo setting. To further boost your confidence, consider taking advantage of platforms like HyroTrader’s Start Trading page, where you can learn more about the pathway from demo to crypto funded accounts.

Advanced Strategies and Tools for Crypto Paper Trading

Once you are comfortable with the basics of paper trading and demo accounts, it is time to consider more advanced strategies. In this section, we delve into techniques and tools that can elevate your paper trading experience, helping you develop strategies that are robust enough for live market conditions.

Developing Your Trading Strategy in a Demo Environment

Developing a successful trading strategy requires constant refinement and adaptation. In a demo environment, you can experiment with various techniques such as technical chart patterns, momentum indicators, and even algorithmic approaches.

Begin by identifying your trading style: are you more comfortable with short-term scalping, or do you prefer swing trading? Establishing your preferences early on is key.

When designing your strategy, consider the following steps:

- Research and Analysis: Begin with an in-depth analysis of market trends and historical data. Use advanced charting tools to identify patterns and potential entry/exit points.

- Define Your Rules: Develop clear, unambiguous rules for entering and exiting trades. This should include setting stop-loss levels, profit targets, and risk-to-reward ratios.

- Backtesting: Use the demo environment to backtest your strategy against historical data. This step will help you understand potential performance without risking capital.

- Iterate and Improve: Trading is an ongoing process of refinement. Regularly review your performance, note areas of improvement, and adjust your strategy accordingly.

By following these steps, you build a foundation that can transition smoothly from demo trading to real-money trading. Remember, consistency and discipline are your best allies in any trading journey.

Utilizing Real-Time Market Data and Analytical Tools

In the realm of cryptocurrency trading, timely information is critical. Modern demo platforms often integrate real-time market data from leading exchanges such as Binance, ByBit, or OKX.

These data streams are invaluable for making informed decisions. Analytical tools such as advanced charting interfaces, technical indicators, and automated alerts help you gauge market sentiment and identify trends before they fully develop.

Consider tools that offer:

- Price Alerts: These notify you when an asset hits a predefined price level.

- Advanced Charting: Look for tools that allow for multiple indicators and customizable chart types.

- Historical Data Analysis: Access to comprehensive historical data enables you to backtest your strategies effectively.

Platforms like HyroTrader provide seamless access to a variety of trading interfaces. These platforms not only deliver live data but also equip you with the analytical tools required to stay ahead of the market curve.

Risk Management Practices in Paper Trading

Risk management is as crucial in a demo environment as it is when trading with real capital. Effective risk management involves setting realistic stop-loss orders, monitoring your exposure on each trade, and diversifying your trading strategies. One way to do this is by assigning a percentage of your demo portfolio to each trade and sticking to it.

Consider the following practices:

- Define Maximum Drawdowns: Establish a maximum percentage loss for any trading day to ensure you do not overextend in volatile markets.

- Use Stop-Loss Orders: Even in paper trading, practice setting stop-loss orders. This builds the discipline needed to manage risk effectively in real accounts.

- Position Sizing: Always calculate the appropriate position size based on your overall portfolio and the risk associated with each trade.

- Review and Adjust: After every trading session, review your trades, assess the outcomes, and adjust your strategies to improve risk management.

By integrating these practices, you enhance your understanding of risk management and develop habits that are essential for success when you transition to real trading. This disciplined approach not only minimizes losses but also helps maintain steady performance in the unpredictable crypto market.

Transitioning from Paper Trading to Funded Trading Accounts

After building competence and confidence through paper trading and demo accounts, the next logical step is transitioning to funded trading accounts.

This phase is both exhilarating and challenging, as it involves real financial stakes. However, you can make this transition seamlessly with the right strategies and mindset.

Evaluating Your Trading Performance

Before moving to live trading, it is critical to assess your performance in the demo environment. Evaluating your trading history enables you to identify your strengths, weaknesses, and areas where improvement is needed. Use metrics such as:

- Win Rate: The percentage of profitable trades versus total trades.

- Risk-to-Reward Ratio: Understanding how much you risk relative to the reward.

- Maximum Drawdown: The largest peak-to-trough decline in your demo portfolio.

- Consistency: The ability to maintain steady performance over time.

A thorough evaluation of these metrics not only validates your strategies but also builds your confidence for live trading. Once you have a solid track record, you can explore opportunities with a crypto prop trading firm. Platforms like HyroTrader’s Crypto Challenge allow you to prove your skills in a controlled yet realistic environment before transitioning to a funded account.

Overcoming the Emotional Challenges of Real Trading

Transitioning from paper trading to trading with real money introduces a psychological shift. The emotional impact of risking actual capital can be significant, and many traders find it challenging to manage the newfound pressure. It is essential to prepare yourself mentally by:

- Acknowledging Emotions: Recognize that fear and greed are natural parts of trading. The key is to control these emotions rather than let them dictate your decisions.

- Sticking to Your Plan: Rely on your pre-defined trading rules and avoid impulsive decisions.

- Taking Small Steps: Gradually increase your trading size as you build confidence, rather than jumping straight into high-stakes trades.

- Continuous Learning: Engage with communities, mentors, or trading groups to share experiences and receive support during the transition.

Developing a robust mental framework is just as important as having a sound trading strategy. The ability to remain calm under pressure will serve you well when the market behaves unpredictably.

Leveraging Prop Trading Firms like HyroTrader

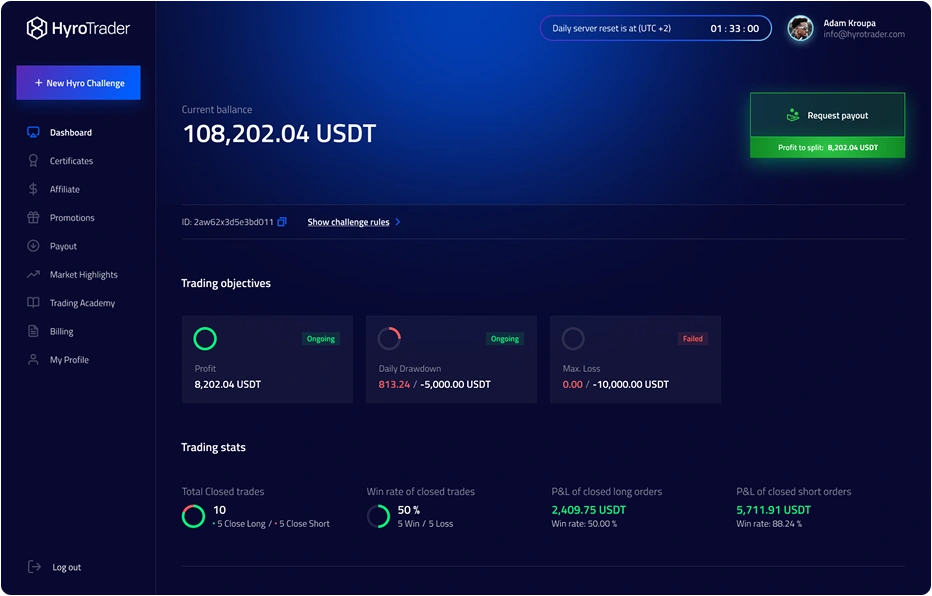

One of the most effective ways to transition from demo trading to live trading is by partnering with a reputable prop trading firm. Firms like HyroTrader offer a structured pathway that starts with a demo environment and, upon proving your abilities, provides access to funded accounts. With HyroTrader, you can benefit from:

- Substantial Trading Capital: Start with accounts funded up to $100,000, with opportunities for scaling as you meet performance benchmarks.

- Attractive Profit Splits: Retain between 70% and 90% of your profits while enjoying quick, on-demand payouts.

- Real-Time Market Access: Trade on platforms like ByBit and CLEO with data directly sourced from major exchanges such as Binance.

- Flexible Evaluation Process: HyroTrader’s challenge phases do not impose rigid time limits, allowing you to focus on disciplined trading rather than rushing to meet targets.

If you are ready to take your skills to the next level, consider exploring HyroTrader’s funding program. This opportunity not only validates your trading abilities but also provides the financial backing needed to expand your trading horizons.

Real-World Case Studies and Success Stories

Real-world examples provide invaluable insights into the practical application of paper trading strategies and their eventual success in live trading.

Let us examine a couple of interviews that illustrate how traders can effectively transition from demo accounts to funded trading environments and start earning.

Expert Tips and Best Practices for Crypto Paper Trading

To maximize the benefits of crypto paper trading and demo accounts, consider incorporating these expert tips and best practices into your daily routine. These guidelines are drawn from seasoned traders who have successfully navigated the transition from simulation to live trading.

Key Tips for Effective Paper Trading

- Document Every Trade: Keep a detailed journal of every trade you make in your demo account. Record your entry and exit points, the rationale behind each decision, and the outcome. Over time, this record will serve as a valuable tool for refining your strategy.

- Set Realistic Expectations: Treat your paper trading environment with the same seriousness as live trading. Set profit targets, adhere to your risk management rules, and simulate realistic market conditions.

- Focus on Consistency: Instead of chasing large gains, focus on achieving consistent, incremental improvements in your performance.

- Utilize Advanced Tools: Take advantage of analytical tools and real-time data to refine your strategies. Platforms that offer comprehensive charting, historical data analysis, and live alerts can provide a significant edge.

- Simulate Emotions: Although no real money is at stake, practice managing your emotional responses. Develop strategies to remain calm during periods of high volatility, as this discipline will be crucial when transitioning to live trading.

Common Pitfalls to Avoid

- Overtrading: One of the most common mistakes is executing too many trades in a short period. Overtrading can lead to burnout and often results in lower overall performance.

- Ignoring Risk Management: Failing to set stop-loss orders or neglecting proper position sizing can turn a promising strategy into a costly lesson.

- Relying Solely on Technical Indicators: While technical analysis is a critical component of trading, it should be combined with a comprehensive understanding of market fundamentals.

- Neglecting Review: Without regular performance reviews and adjustments, even the best strategies can become outdated or misaligned with current market conditions.

Continuing Education and Community Engagement

The cryptocurrency market is in a state of constant evolution. Staying ahead requires continuous learning and engagement with the trading community. Here are some ways to ensure you remain at the forefront:

- Participate in Webinars and Workshops: Look for industry events and online webinars that focus on advanced trading techniques and market analysis.

- Engage with Trading Forums: Joining communities and discussion groups can provide fresh perspectives and insights into evolving market trends.

- Follow Market News: Keeping abreast of global economic events and crypto-specific news helps contextualize your trades and adjust your strategies accordingly.

- Mentorship: If possible, connect with experienced traders who can provide guidance and feedback on your trading approach. HyroTrader offers an experienced trader Discord community for you.

A prop trading firm can serve as an excellent platform for those who wish to validate their skills further and eventually move into funded trading. Explore opportunities with firms like HyroTrader and use their robust support systems and evaluation processes.

Conclusion

The journey through cryptocurrency paper trading and demo trading accounts is a critical phase for anyone serious about entering the crypto markets. By embracing a disciplined approach to paper trading, you not only hone your technical skills but also build the confidence and resilience needed to face real market challenges.

Whether you are testing new strategies, refining risk management techniques, or preparing to transition to a funded trading account, the practice of paper trading remains an invaluable component of your trading education.

In this article, we have explored the fundamentals and advanced techniques of cryptocurrency paper trading. We discussed the importance of demo trading accounts, offered insights into developing effective strategies, and examined how to manage risk and emotions.

For traders ready to take the next step, consider leveraging platforms like HyroTrader’s Crypto Demo Trading Account. This risk-free environment allows you to test your strategies before transitioning to a funded account, where you can benefit from significant capital allocations, attractive profit splits, and real-time market access.

By integrating the lessons learned from paper trading into your daily practice, you position yourself for long-term success. Remember that the evolution from simulation to live trading is not instantaneous. It requires patience, discipline, and a commitment to continuous improvement. Embrace the process, stay engaged with the community, and let your trading journey unfold confidently and precisely.