Have you ever noticed how the same cryptocurrency can trade at slightly different prices on two exchanges simultaneously?

This isn’t a glitch; it’s an opportunity. Crypto arbitrage trading focuses on capitalizing on these price gaps for profit. Essentially, it involves buying a coin on one platform where the price is lower and quickly selling it on another platform where the price is higher.

Sounds like a risk-free money machine, right? Well, almost. While the concept is straightforward, executing it in real markets is a bit more complex.

In this guide, we’ll explore crypto arbitrage trading for beginners – but with a twist.

We assume you’re not completely new to crypto trading. You know your way around an exchange and understand basic trading terms, so we won’t bore you with Crypto 101.

Instead, we’ll focus on advanced insights and practical tips to help you profit from arbitrage. We’ll cover why these arbitrage opportunities exist (even in this relatively mature market), the different types of arbitrage strategies you can try, a step-by-step guide on how to engage in crypto arbitrage trading yourself, and the tools (like bots and platforms) that can give you an edge.

We’ll also address the less glamorous side – the risks and challenges – and share best practices to maximize your chances of success.

By the end of this article, you’ll have a solid roadmap for arbitrage crypto trading that can turn those tiny price discrepancies into real gains.

Ready to find out if you can still beat the market with arbitrage? Let’s jump in.

Why Crypto Arbitrage Opportunities Still Exist

Cryptocurrency markets have evolved significantly, yet they remain somewhat inefficient. Even in this mature market, despite the presence of hundreds of exchanges and millions of traders, price discrepancies continue to exist. Why hasn’t arbitrage been completely eliminated by now?

Several factors allow crypto arbitrage opportunities to continue existing and to remain significant today.

Price Inefficiencies in a 24/7 Global Market

Unlike traditional stock markets, crypto trading never sleeps. It’s a 24/7 global circus of buying and selling. With thousands of coins and tokens being traded on exchanges worldwide, it’s virtually impossible for prices to remain in lockstep. Different exchanges have unique user bases and liquidity levels. For instance, Exchange A might experience a surge of buyers for a token, driving its price up, while Exchange B (with fewer active traders on that token) still has it priced lower.

These price inefficiencies are what arbitrage traders capitalize on. The fact that crypto markets operate nonstop across various time zones means that no single exchange can quickly correct a price imbalance. If Bitcoin suddenly jumps 5% in price on a U.S. exchange at 3 AM in London, an Asian exchange might lag a few minutes (or more) behind in adjusting its price, creating a brief window for profit.

Moreover, cryptocurrencies often trade in pairs with different base currencies (USD, EUR, BTC, ETH, various stablecoins, etc.). A coin might be priced at $ 100 in BTC on one platform and in USDT on another where it’s traded against a stablecoin.

The conversion rates or demand for those base currencies can differ, causing temporary price gaps until traders notice and balance things out. In moments of imbalance, arbitrageurs can step in to capture the difference.

Market Maturation vs. Ongoing Gaps

It’s true that as the crypto market matures, the obvious arbitrage gaps have become smaller and shorter-lived. A few years ago, it wasn’t uncommon to see Bitcoin trading at prices 5-10% higher on one exchange compared to another for hours (remember the famous “Kimchi Premium” in South Korea, where local BTC prices were dramatically higher?).

Today, with more sophisticated traders and bots in the game, large disparities typically get resolved quickly. However, “quickly” still isn’t instant. Human and technological limitations mean there’s often a brief moment when you can act.

Additionally, new opportunities continue to arise. New tokens may list on one exchange before others, resulting in wildly different prices until other markets adjust. Regional differences in demand, due to local regulations or payment methods, can cause one exchange’s order books to diverge from the global average.

And let’s not forget varying liquidity: a coin with thin trading volume might spike on one platform but not on another, resulting in a price difference that an arbitrageur can exploit before it closes.

In short, while the crypto markets are more efficient than ever, they are not perfectly efficient. The constant introduction of new assets, the fragmented nature of exchanges (both centralized and decentralized), and 24/7 volatility ensure that crypto arbitrage remains a viable strategy.

The catch is that to profit, you need to be faster, smarter, and more prepared than the competition, which is exactly what we will assist you with in this guide.

Types of Crypto Arbitrage Strategies

Not all arbitrage is created equal. There are several types of crypto arbitrage trading, each with its unique approach and complexity. As a beginner in arbitrage (but a savvy trader otherwise), it’s helpful to understand the different arbitrage strategies you might consider. Here are the main categories:

Cross-Exchange Arbitrage (Between Exchanges)

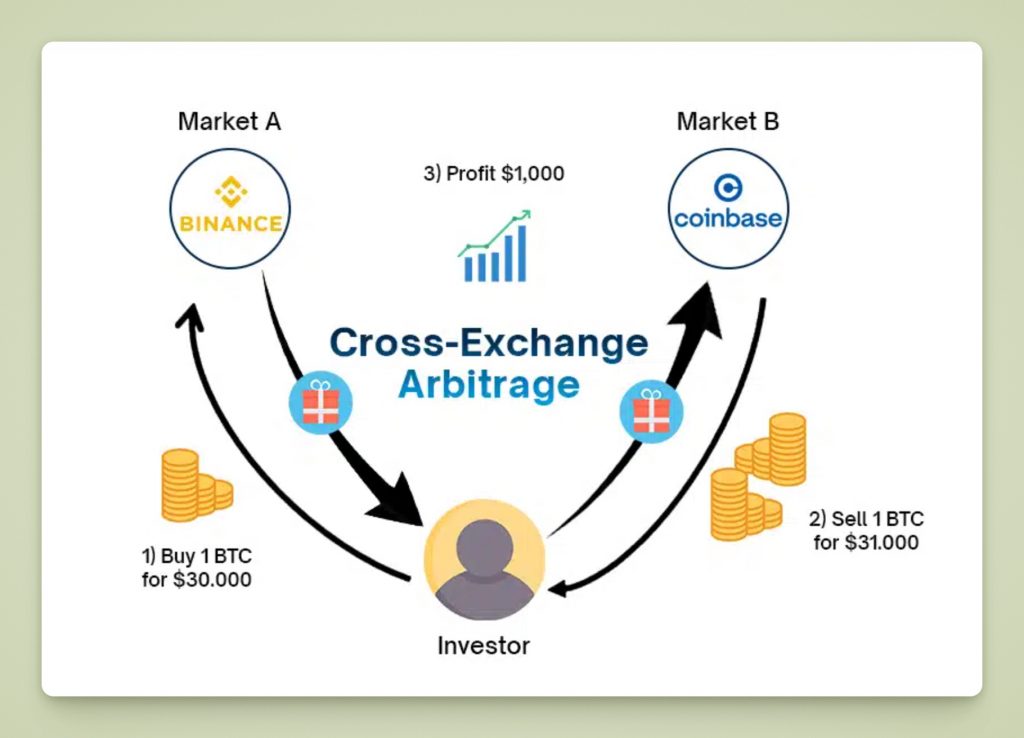

When most people think of arbitrage, this is what they imagine: buying on Exchange X and selling on Exchange Y to profit from a price difference. Cross-exchange arbitrage (also known as inter-exchange arbitrage or spatial arbitrage) is the simplest form.

For instance, if Ethereum is trading for $1,800 on Exchange A and $1,820 on Exchange B, an arbitrageur could purchase ETH on A at the lower price and simultaneously sell the same amount of ETH on B at the higher price, pocketing the spread (approximately $20 per ETH, minus fees).

The key to cross-exchange arbitrage is speed and execution. Price gaps can close within minutes or even seconds as traders catch on. Often, successful arbitrageurs using this strategy maintain funded accounts on multiple exchanges so they don’t waste time transferring coins during the trade.

You might buy ETH on the cheaper exchange using dollars or stablecoins available there, while simultaneously selling an equal amount of ETH that you already hold on the more expensive exchange. This way, you avoid waiting for blockchain transfers during the arbitrage, which could jeopardize the opportunity.

After executing, you’ll gain extra profit in one exchange (in the quote currency) and hold less of the asset in the other exchange. Later, you can transfer funds to balance your positions. We’ll discuss that process step by step shortly.

Cross-exchange arbitrage is conceptually straightforward, but you must consider trading fees, withdrawal fees, and network transfer times. A 1% price difference may seem like easy money, but if you incur a 0.2% trading fee on each exchange along with a hefty withdrawal fee, your profit could disappear or even turn into a loss.

Advanced arbitrage traders often look for exchanges with low fees and utilize high-volume accounts to secure fee discounts. Some even negotiate directly with exchanges for market-maker fee arrangements when they arbitrage frequently.

As a beginner, concentrate on small spreads that are genuinely profitable after accounting for all costs, and always do the math before executing.

Triangular Arbitrage (Three-Way Trades on One Exchange)

Triangular arbitrage involves three trades with three different assets and often doesn’t require moving funds between exchanges, as it typically occurs on a single exchange.

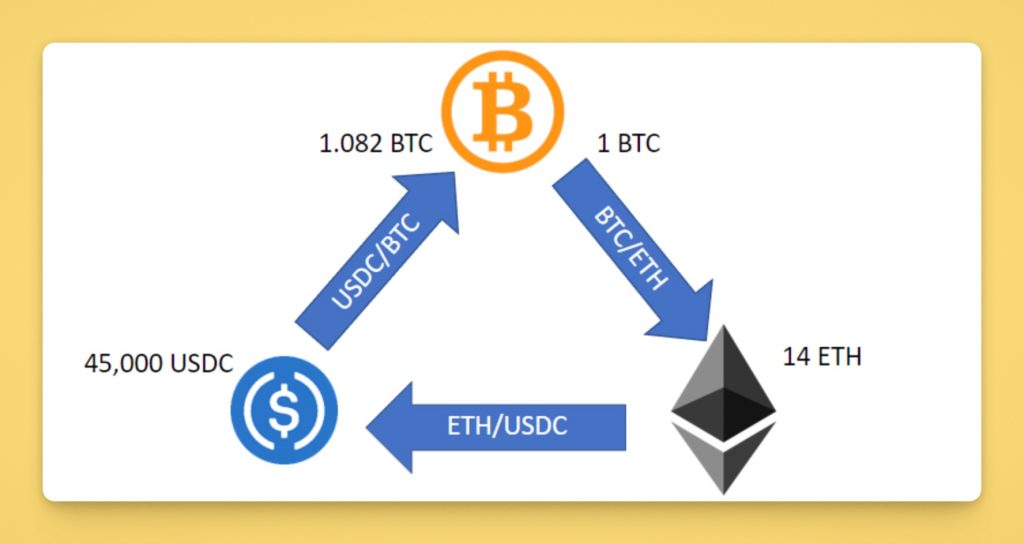

How does this work? The idea is to exploit price differences among three currency pairs involving three currencies (let’s designate them A, B, and C). It may sound confusing, but an example clarifies:

Imagine that on Exchange Z, you notice the following prices:

- Pair A/B (e.g., ETH/BTC) has a certain exchange rate.

- Pair B/C (e.g., BTC/USDT) has a rate.

- Pair A/C (e.g., ETH/USDT) has a rate.

In an efficient market, the price of ETH/USDT should equal the price of ETH/BTC multiplied by the price of BTC/USDT (that’s the law of one price in action). If it doesn’t, there’s a triangular arbitrage opportunity.

For instance, if 1 ETH is worth 0.06 BTC on the ETH/BTC market and 1 BTC is valued at 20,000 USDT on the BTC/USDT market, you would expect 1 ETH to be 0.06 * 20,000 = 1,200 USDT on the ETH/USDT market. However, if ETH/USDT is trading at 1,210 USDT, you have a chance for arbitrage:

- Trade 1: Sell USDT to buy BTC (buy BTC/USDT).

- Trade 2: Use the BTC to buy ETH (buy ETH/BTC).

- Trade 3: Sell the ETH for USDT (sell ETH/USDT).

By the end, you might have more USDT than you started with, capturing the price mismatch as profit. In practice, you would program these three trades to execute quickly in sequence. If done correctly, triangular arbitrage yields a nearly risk-free profit entirely within one exchange’s ecosystem, so you don’t need to worry about inter-exchange transfers or network fees.

However, triangular arbitrage is considerably more complex to identify and execute manually. The price differences are often minute fractions of a percent and can vanish in seconds. This strategy is primarily the domain of bots and quants – algorithms can continuously scan markets for mispricing and execute the three legs of the trade more quickly than any human.

As a beginner, you can experiment with triangular arbitrage using small amounts and perhaps exchange APIs, but be aware that competition is fierce. The advantage is that you’re not paying withdrawal fees or dealing with multiple platforms, but trading fees apply to each of the three trades. If each trade costs 0.1%, that results in a 0.3% round trip, meaning the opportunity must exceed that to be worthwhile.

Triangular arbitrage demonstrates that even on a single exchange, arbitrage opportunities in crypto trading can exist among different trading pairs.

DeFi Arbitrage (Decentralized Exchange Opportunities)

Decentralized exchanges (DEXs) and liquidity pools have opened a whole new world of arbitrage in recent years. DeFi arbitrage typically involves exploiting price differences between decentralized exchanges (such as Uniswap, SushiSwap, PancakeSwap, etc.) and centralized exchanges (CEXs), or between two DEXs on the same or different blockchain networks.

Prices on decentralized exchanges (DEXs) are determined by automated market makers (AMMs) that balance token ratios in liquidity pools. If one pool becomes unbalanced (for example, a significant swap pushes the price of a token up or down in that pool), it may create a disparity relative to other markets.

For instance, suppose on a DEX the ETH/DAI pool is quoting 1 ETH = 2005 DAI, but on a centralized exchange the price is 1 ETH = 2020 DAI. An arbitrageur can buy ETH at a lower price on the DEX (paying 2005 DAI per ETH) and then sell that ETH on the centralized exchange for 2020 DAI, netting 15 DAI per ETH (less any fees).

The act of buying ETH on the DEX will increase its price there, and selling on the centralized exchange will decrease its price, eventually closing the gap – but you profited before that equilibrium was restored.

DeFi arbitrage often involves interacting with blockchain smart contracts and incurring transaction fees (gas fees). If you are operating on Ethereum, gas costs can significantly reduce profits, which is why these opportunities are frequently pursued by bots that can calculate whether the profit margin is greater than the gas fee at that moment.

In fact, flash bots and MEV (Miner Extractable Value) bots are continually searching for DEX arbitrages and even offer miners (or validators) a premium to prioritize their transactions (this practice is referred to as priority gas auctions or frontrunning in a benign sense).

For beginners, DeFi arbitrage represents advanced territory, but it’s beneficial to be aware of its existence. If you choose to explore this area, start on lower-fee chains (like Binance Smart Chain, Polygon, etc.) where transaction costs won’t erode your gains.

Also, exercise caution: engaging with smart contracts involves risks (such as bugs and hacks), and DEX prices can fluctuate rapidly. Nevertheless, DeFi arbitrage is a key reason crypto arbitrage continues to thrive – the price disconnects between DeFi and CeFi can offer profitable opportunities if you act swiftly and intelligently.

Cross-Market Arbitrage (Spot vs. Futures)

Another type of arbitrage in crypto involves exploiting price differences across various markets for the same asset. A common example is the disparity between the spot price (the current market price of the actual asset) and the futures price (the price of a derivative contract that settles at a future date). In traditional markets, this is referred to as “cash-and-carry” arbitrage, which is also highly relevant to crypto.

Imagine Bitcoin is trading at $30,000 on the spot market, while a futures contract expiring in one month is trading at $30,300. The futures price is higher – possibly due to market bullishness – but by the time it expires, it will have to converge with the spot price (or the spot price will rise to meet it).

An arbitrageur can capitalize on this by shorting the futures contract at $30,300 (betting it will decline) while buying actual Bitcoin on the spot market at $30,000. What’s the net effect? At the futures contract expiration, if Bitcoin’s spot price converges with the futures price, the arbitrageur’s positions balance out, allowing them to profit from the $300 difference (minus costs).

This strategy effectively locks in a $300 risk-free profit per BTC since any loss on one side is offset by a gain on the other. This approach is known as futures basis arbitrage.

A similar concept exists with perpetual swap contracts (which don’t expire but have funding rates). If the funding rate is positive, meaning that longs pay shorts periodically because the perp price is above the spot, an arbitrageur can short the perpetual swap while holding an equivalent long position in the spot market.

They will collect the funding payments and remain market-neutral since the spot holding offsets the short in the event of a price movement. If funding is high, this strategy can be very profitable with low risk. However, funding rates can change quickly, and there are fees to consider on both sides.

Cross-market arbitrage often requires significant capital and a solid understanding of derivatives. There are also platform-specific nuances (such as the need to maintain margin for futures, etc.).

Nevertheless, it stands as an important avenue for arbitrage and demonstrates that arbitrage trading isn’t solely about exchange A versus exchange B; it can also involve market type A versus market type B.

Advanced traders frequently incorporate these strategies into their arsenal, particularly during periods when futures prices significantly diverge from spot prices (like around major news or hype cycles).

How to Do Crypto Arbitrage Trading (Step-by-Step)

By now, you understand the basic concepts and various forms of crypto arbitrage. So, how do you actually implement this in practice? Let’s walk through a simplified step-by-step plan for a basic cross-exchange arbitrage trade. This will provide you with a template that you can adapt to different situations. Even if you plan to use bots or more complex methods later, it’s valuable to manually go through the process at least once with a small amount to understand how it works.

Prepare several exchange accounts and funds

Successful arbitrage requires quick action, so set up accounts on all relevant exchanges in advance. Complete KYC verification early to avoid delays when opportunities arise. Fund accounts with enough balance for both sides of a potential trade.

Keep quote currency (like USDT or USD) on exchanges where you’ll buy, and the asset (or base currency) on those where you’ll sell. For instance, hold $5,000 in Exchange A and 0.2 BTC in Exchange B for Bitcoin arbitrage, allowing you to buy 0.2 BTC on A and sell it on B.

Use stablecoins or fiat, you’re comfortable keeping on exchanges, and implement security measures (2FA, withdrawal whitelist) to safeguard your funds.

Identify price discrepancies and plan trades

This is essential for crypto arbitrage trading – spotting opportunities. You can monitor order books and prices on multiple exchanges, but it’s challenging to track everything. Many arbitrageurs use price tracking tools or bots to get alerts when a percentage difference arises.

For beginners, checking a price aggregator like CoinMarketCap can help, which shows prices across exchanges. For example, if Litecoin (LTC) is $95 on Exchange X and $ 97 on Exchange Y (a 2.1% difference), calculate whether this covers trading fees (~0.2% each) and withdrawal fees.

If it does, formulate your plan: decide how much LTC to arbitrage based on your balance on each side.

Ensure the order book volume can support your trade size without slippage; buying too much at once may push the price up and erase the gap. Plan to trade a quantity that the order books can handle without major price impact.

Buy the cryptocurrency on a cheaper exchange

First, place a buy order for the undervalued asset. Time is crucial, so consider a market order for immediate execution, even if it incurs higher fees for speed. A limit order just below the ask price may save on fees but risks not filling if the market changes. As a beginner arbitrageur, opt for a market order for speed unless the market is too illiquid.

In our LTC example, purchase 50 LTC at $95 on Exchange X. Once the order is filled, you will have 50 LTC more on Exchange X, spending approximately $4,750 worth of USD or USDT.

Sell the cryptocurrency on the more expensive exchange

Immediately execute the second leg: sell the equivalent amount on the overpriced exchange. Ideally, you have the asset available there.

On Exchange Y, sell 50 LTC at $97 using a market order for quick execution (assuming sufficient liquidity). After selling, you will have about $4,850 in cash or stablecoin on Exchange Y (minus fees), and your LTC balance will have decreased by 50.

Congratulations – you’ve captured the arbitrage spread!

You bought at $95 and sold at $97, earning approximately $2 profit per LTC, totaling roughly $100 on 50 LTC before fees. With trading fees (0.1% each way, ~+$4.75 on the buy and -$4.85 on the sell), your net profit is around $90.

This trade takes a minute or less. The quicker you execute both legs, the more likely prices will hold. If you hesitate, the gap might close – other traders may push prices down or up, reducing your profit. Many arbitrageurs execute both legs simultaneously or use automation.

Rebalance your funds after arbitrage trades, as you’ll typically have an asset imbalance.

For example, you might have more cash on Exchange Y and more LTC on Exchange X than before. To prepare for the next arbitrage round, transfer assets: send 50 LTC from Exchange X to Y, and $4,850 (or another stablecoin) from Y back to X. Once these transfers clear, you’ll restore your original allocation but with about $90 profit (excluding withdrawal fees).

However, transferring funds takes time, which can hinder quickly capturing other opportunities unless you maintain additional reserves. Some arbitrageurs avoid immediate transfers, running smaller cycles until a reset is necessary, while others pre-fund exchanges to allow multiple trades before rebalancing. After rebalancing, repeat the process when you see another price gap. Monitor net profitability by comparing all trading and transfer fees against gross profit to ensure actual gains.

That’s the basic workflow of cross-exchange arbitrage. It might seem like a lot of moving parts at first, but it becomes a cycle: scanning for opportunities, executing buys and sells, shuffling funds, repeating.

In a fast-moving environment, you’ll quickly see why doing this manually is challenging. Many traders eventually automate parts or all of this process using software (scripts or bots), which we’ll discuss next.

But even if you use a crypto arbitrage trading bot, understanding each step is crucial – you need to set the right conditions and know what the bot is doing on your behalf.

Automation and Crypto Arbitrage Bots

Given the speed-dependent and repetitive nature of arbitrage trading, it’s no surprise that most serious arbitrageurs rely on automation.

In fact, automation will not only be an advantage – it will be almost a necessity for achieving consistent arbitrage profits.

This section will explore the reasons behind this situation, how crypto arbitrage trading bots play a role, and how you, as a beginner with some technical proficiency, might use them. We will also examine an alternative option: using platforms that can assist or even provide capital for arbitrage trading, such as proprietary trading firms like HyroTrader that support algorithmic crypto strategies.

Why Speed and Automation Are Key

Consider the step-by-step process outlined above. Now, imagine trying to accomplish all of that faster than a dozen other traders who have spotted the same price discrepancy. The first individual to complete the buy-low, sell-high round trip wins; everyone else either misses out or ends up with a smaller spread.

Human reflexes and manual clicks cannot reliably compete with algorithms that execute in split seconds. This is why many arbitrage opportunities seem to vanish almost as soon as they arise.

High-frequency trading firms and hobbyist programmers alike have bots that constantly scan for price differences and pounce on them.

Automation brings several crucial advantages:

- 24/7 Vigilance: A bot never sleeps or takes lunch. You can monitor numerous markets around the clock, which is crucial because a significant arbitrage opportunity might last only 30 seconds at 4 AM – blink and you’ll miss it.

- Instant Calculations: An automated system can continuously calculate potential profits after fees for numerous pairs across multiple exchanges at the same time. The instant the numbers appear favorable, it can take action. As a human, you might be able to monitor a few markets manually, but you will never seize all opportunities on your own.

- Precision and Discipline: Bots execute exactly as programmed. They don’t hesitate due to fear or greed. When the parameters are met (for instance, a 1% net gain window), they execute. If not, they hold back. This discipline prevents you from impulsively chasing deals that don’t actually result in profit once costs are taken into account.

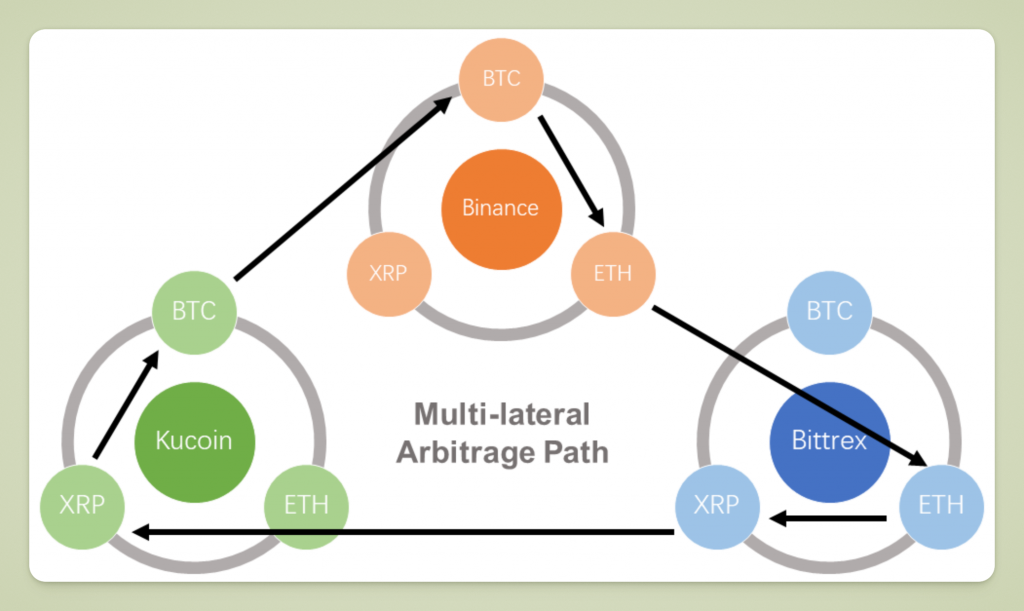

- Multi-tasking: With coding, one can deploy multiple arbitrage strategies simultaneously. For example, one bot monitors cross-exchange arbitrage for BTC/ETH, another oversees triangular arbitrage on Exchange B, and a third keeps watch on a DeFi pool versus CEX price. As a single trader, you would find it challenging to manage all of these tasks at once.

In summary, speed is crucial in arbitrage, and automation is the key to achieving that speed. This doesn’t mean you need to be a coding wizard to succeed (though it does help).

There are various tools and platforms available that we will discuss. However, even if you utilize off-the-shelf solutions, remember that any widely accessible bot could be employed by many others – suggesting that the competitive advantage may be minimal.

Customizing your approach- whether it’s adjusting parameters or coding your own script- can sometimes yield better results than a generic solution.

Using a Crypto Arbitrage Trading Bot

A crypto arbitrage trading bot is simply a program (script, piece of software, or a full platform) that executes arbitrage trades for you according to predefined logic. There are a few ways to get one:

Build it yourself: If you have programming skills (or are willing to learn some Python, JavaScript, etc.), you can create a bot using exchange APIs. Most major exchanges offer API trading, allowing your program to fetch price data and place orders automatically. Writing your own bot means you can tailor it precisely to your strategy – for example, “if price on Exchange A minus price on Exchange B is greater than 1% then execute trade sequence. ” Additionally, there are open-source arbitrage bots available on GitHub that you can study and modify. Keep in mind that running a bot 24/7 requires a reliable computer or server and careful management of API keys to ensure security.

Consider using an arbitrage bot service or software. Several commercial services and software solutions promote automation in crypto arbitrage. They may offer user-friendly interfaces that allow you to connect your exchange accounts and establish specific rules.

Exercise caution: not all services fulfill their promises, and some may be outright scams. Always conduct thorough research and, if possible, start testing with small amounts. Additionally, if many people use the same bot and strategy, they might compete against one another, ironically making it more challenging for any individual to profit.

Leverage trading platforms with automation features: Some trading platforms, such as advanced trade terminals or specific exchange functionalities, enable you to set up automated spreads or algorithmic orders. For instance, you may discover an exchange that allows you to execute a simultaneous buy/sell order across two different markets with a single trigger. While these can be useful, they often necessitate advanced settings.

When using a crypto arbitrage bot, you will configure parameters such as which exchanges to connect to, which trading pairs to monitor, what minimum price difference to act upon, and the maximum trade size, among others. It’s crucial to also include safety checks – for example, stopping if one leg of the trade fails, or refraining from trading if an exchange’s liquidity drops below a certain threshold.

One common pitfall occurs when a bot buys on one exchange but fails to sell on the other due to an unfilled order or rapid price movement; the trader might find themselves holding an asset on one platform while having none on the other, effectively achieving “half an arbitrage,” which can result in losses. Well-designed bots aim to execute both legs almost simultaneously or incorporate cancellation logic if one side doesn’t go through.

Another consideration is latency: the speed at which your bot retrieves data and sends orders. If your server is in Europe trading on a U.S. exchange, even a slight delay could put you behind a competitor’s bot hosted on a server in the same data center as the exchange.

High-end arbitrage operations locate their servers as close as possible to the exchange servers (a practice called colocation) to gain those precious milliseconds of advantage. As a beginner, you don’t need to go to those lengths, but it demonstrates how far one can push this.

Leveraging Platforms Like HyroTrader for Arbitrage

What if you possess the skills to identify arbitrage opportunities or have access to a good bot, but are constrained by your trading capital?

After all, an arbitrage yielding a 1% profit is not very exciting if you can only invest $1000 – that’s just a $10 gain, not even accounting for fees. This is where crypto prop trading firms come into play, with HyroTrader being one example. Prop firms offer skilled traders larger pools of capital to trade with, typically in exchange for a share of the profits while adhering to risk limits.

HyroTrader is a proprietary trading platform focused on cryptocurrency, allowing traders to qualify to manage accounts significantly larger than their personal funds. Essentially, you demonstrate your ability to trade profitably (often through an evaluation or demo stage), and then HyroTrader funds you with, for example, a $50,000 or $100,000 account. You can then implement your strategies – including arbitrage trading – on that account and retain a substantial portion of the profits (with HyroTrader taking a percentage as the firm backing you).

How does this help an arbitrage trader?

First, it amplifies your gains. A 1% arbitrage trade could yield $500 on a $50k account instead of just $10 on a $1k account. Second, a firm like HyroTrader may offer a professional trading environment, potentially providing superior trading infrastructure, support, and risk management guidance.

For instance, they provide faster API access to various exchanges or advanced tools that you can utilize. They often promote algorithmic crypto trading, which means if you have a strong arbitrage bot, you can deploy it on the funded account (following the firm’s rules).

HyroTrader specifically provides access to legitimate crypto exchanges like ByBit, CLEO, etc. and supports strategies like arbitrage and scalping, which not all prop firms allow.

The promotion here is organic: using a platform like HyroTrader can be a smart choice for an experienced trader with a solid strategy but insufficient capital. It’s not an escape from learning – you still need to understand what you’re doing, and prop firms will typically have evaluations to ensure you’re not merely gambling their money.

However, as you refine your arbitrage skills, this is a path worth considering. It effectively utilizes “other people’s money” to enhance your returns from arbitrage crypto trading without assuming all the risk on your personal account.

In summary, automation and tools – whether through self-built bots or supportive platforms – are likely to become integral to your arbitrage journey. Many beginners start manually to grasp the concept, but quickly realize the necessity of bots to stay competitive.

Meanwhile, collaborating with platforms like HyroTrader can help address the capital and infrastructure aspects, allowing you to concentrate on refining your strategy.

Navigating Risks and Challenges

If arbitrage is often referred to as “low risk” or even “risk-free profit, ” what could possibly go wrong? As it turns out, a lot – if you’re not careful. Successful arbitrage trading involves mitigating risks and overcoming practical challenges just as much as it involves finding opportunities. Let’s break down some major risks and hurdles you need to navigate:

Fees, Slippage, and Network Delays

Transactional costs are the primary profit killer in arbitrage. Every trade you make incurs an exchange fee, and if you transfer assets between exchanges, you’ll likely pay a blockchain network fee or withdrawal fee. These costs can turn a seemingly profitable arbitrage into a net loss.

For example, if you made a $50 profit from a price difference but spent $20 on exchange fees and another $40 to withdraw and transfer coins, you actually lost money. The best practice is to calculate the full round-trip cost before executing an arbitrage trade. Be sure to include maker/taker fees for buying and selling, along with any withdrawal fees for rebalancing afterward.

Some arbitrageurs even factor in the differences in deposit/withdrawal processing times – for instance, you might use a coin with low fees (like Litecoin or XRP) to transfer value between exchanges instead of Bitcoin or Ethereum, which have higher fees and slower times.

Slippage presents another hidden threat. Slippage refers to the difference between a trade’s expected price and the price it executes. In fast-moving or low-liquidity markets, the price may move unfavorably by the time your order executes.

In arbitrage, if you anticipate selling at $101 but your order executes at $100.50, that $0.50 decline represents slippage that erodes your profit. To minimize slippage, trade assets with good liquidity (thick order books) and avoid engaging in arbitrage with amounts so large that you influence the market.

Sometimes, splitting an order into several smaller parts can reduce slippage, although it may slightly increase execution time.

Network and withdrawal delays can harm an arbitrage attempt if not carefully considered. Blockchain confirmation times can be unpredictable when moving funds (such as cryptocurrency transfers) as part of your arbitrage cycle.

Imagine buying on one exchange with the expectation of quickly sending the asset to another exchange for sale – if the network is congested or the exchange is slow in crediting deposits, the price gap might disappear or reverse before you are able to sell. This is why the most effective cross-exchange arbitrages minimize the need for immediate transfers (by pre-funding, as previously discussed).

However, you will eventually need to move funds to reset positions. Aim to utilize faster blockchains or even off-chain transfer methods, if available (some exchanges offer internal transfers or use the Lightning Network for Bitcoin, among others). Plan accordingly so that even if a transfer takes longer, you won’t be left holding one asset without the capability to trade.

Liquidity Constraints and Market Volatility

Crypto markets can be highly volatile. A price gap present now can widen or close in seconds if a big player enters the market or if news breaks. Volatility is a double-edged sword: it creates arbitrage opportunities but also renders them unpredictable.

You might start an arbitrage sequence thinking you’ll achieve a 2% profit, but mid-trade the prices swing, and you end up barely breaking even or even holding an unbalanced position as the market moves away. To manage this, it’s important not to assume a price gap will hold.

Learn: Crypto swing trading

Execute as quickly as possible and be prepared for plan B. For instance, if after buying an asset, the target exchange’s price suddenly drops before you sell, you may choose to quickly sell at a smaller profit (or even a tiny loss) rather than risk holding that asset, which could fall further. In worst-case scenarios, you might have to abandon the arbitrage and exit the trade to cut losses, effectively doing a normal trade instead of arbitrage.

Liquidity is crucial for arbitrage. If you attempt to arbitrage a thinly traded altcoin, you may not find enough buyers or sellers on the other side to match your trade. Low liquidity results in large spreads and can cause your trade to move the price significantly, leading to slippage.

Many arbitrageurs stick to major coins or at least to exchanges where the volume is decent for the asset. It’s a balance: the most popular assets (like BTC and ETH) have tight prices across exchanges, making it harder to find a significant gap, whereas smaller-cap coins might present larger gaps but are riskier to trade quickly.

Always check the order book depth on both sides. If you notice that you can only sell, for instance, 5 ETH, at the target price before the next orders are significantly lower, don’t plan to sell 50 ETH at that price – you’ll likely receive a much worse average price.

Security and Regulatory Considerations

In the pursuit of arbitrage profits, don’t overlook security. By its nature, arbitrage might tempt you to keep funds on multiple exchanges simultaneously, which exposes you to exchange-related risks. An exchange could get hacked, freeze withdrawals without warning, or impose sudden restrictions (perhaps regulatory) that trap your funds. To mitigate this:

- Only use reputable exchanges that have a proven track record of security and solvency when holding significant funds.

- Diversify across exchanges; don’t put all your capital on a single platform.

- Withdraw your profits regularly to your secure wallet as needed, instead of leaving everything online.

- Consider security features like IP whitelisting for API keys if using bots (so only your server can use the API, reducing hack risk).

Regulation is another factor. Arbitrage often involves transferring money across borders (if exchanges are based in different countries) and converting between currencies. Be aware of any legal or tax implications. In some regions, frequent trading or transferring large sums can trigger inquiries from banks or tax authorities.

Additionally, profits from arbitrage are typically taxable, just like any other trading gains. Keep records of your trades – there can be numerous transactions, so good accounting is crucial to avoid headaches later. Some jurisdictions may require licensing if you engage in arbitrage as a business (though, as an individual trader, that’s usually not an issue).

Another challenge is that some exchanges may ban arbitrage or view it as suspicious behavior. For instance, if an exchange has strict rules for market makers or imposes capital controls (some exchanges in countries with currency restrictions may not appreciate you constantly moving funds out).

Always read the terms of service. Most major crypto exchanges permit arbitrage (it increases volume, after all), but be cautious if any platform appears to discourage it.

Lastly, competition poses an indirect challenge: you’re rarely the only one trying to arbitrage. It’s a game where numerous bots and traders are racing against you. This isn’t a risk per se, but it signifies that you’ll experience diminishing returns over time with any single straightforward strategy.

You might take advantage of a particular price disparity for a week, only to suddenly find it’s no longer profitable as others jump in. Be prepared to adapt and continuously refine your methods, possibly shifting to different currency pairs or exploring other types of arbitrage as necessary.

Advanced Tips for Successful Arbitrage

Having covered the what, how, and risks of crypto arbitrage trading, let’s explore some best practices and advanced tips to help you maximize your success. These lessons come from experienced arbitrageurs and can save you time, money, and headaches:

Start Small and Scale Gradually

It’s tempting to go big once you spot a “surefire” arbitrage opportunity. However, especially at the beginning, start with small trade sizes to test the waters. Execute a trial arbitrage with a minimal amount, perhaps even the smallest trade size, just to ensure all the steps work as expected: your orders execute, transfers go through, calculations are correct, etc.

This practice run might yield trivial profit (or even a small loss after fees), but it provides invaluable insight. Think of it as paying a small tuition fee to the markets. Once you’re comfortable, gradually increase your trade size.

Scaling up isn’t just about your comfort; it’s also about the market’s capacity. An arbitrage that works with $1,000 might not work with $100,000 due to liquidity constraints and market reactions.

As you increase size, constantly reassess slippage and speed. Additionally, larger trades might attract more attention; some exchanges implement anti-arbitrage measures if they notice unusual trading patterns or large, quick in-and-out movements – they might adjust fees or rate limit your API if they believe you’re straining their system. Therefore, grow gradually and find that sweet spot where profits are worthwhile, but you’re not hitting the limits of the market or the platform.

Diversify Exchanges and Strategies

The saying, “Don’t put all your eggs in one basket,” applies in several ways here. First, as mentioned, spread your arbitrage activity across multiple exchanges. This approach ensures you’re not overly exposed to issues on any single exchange, while also increasing the universe of opportunities you can seize.

Perhaps today the best gap is between Exchange A and B, but tomorrow it could be between B and C, or C and D. Maintaining accounts (with some funds) on a wide range of reputable exchanges is akin to having a broader fishing net.

Second, consider diversifying the types of arbitrage you engage in. While your main focus may be cross-exchange arbitrage on major cryptocurrencies (BTC, ETH, etc.), that’s great, but also watch for other opportunities.

For example, during periods of low cross-exchange spreads, you might discover that triangular arbitrage on a specific exchange yields better returns. Alternatively, a DeFi arbitrage opportunity could arise if the launch of a new token creates a significant AMM price imbalance. Being knowledgeable about various arbitrage methods (as you are becoming by reading this guide) allows you to pivot when one strategy dries up.

This doesn’t mean you should recklessly attempt every arbitrage strategy simultaneously. However, having a few go-to tactics ensures you’re not dependent on a single market condition. It also keeps you agile; arbitrage is an ever-evolving game, and the “hot” strategy from six months ago could be obsolete now.

By diversifying, you’ll be in a position to capture value wherever the market currently offers it.

Conclusion and Next Steps

Crypto arbitrage trading can be an incredibly rewarding strategy for those who master it, transforming market inefficiencies into steady profits.

As we’ve discussed, it’s not the “free money” hack that it might seem at first glance. There are advanced considerations, rapid decision-making, and technical tools required to stay ahead of the competition. However, for traders with some experience, arbitrage crypto trading offers a way to leverage market knowledge and agility for often low-risk gains.

In this advanced beginner’s guide, we covered why arbitrage opportunities persist even in the fast-paced markets, explored several types of arbitrage strategies (from straightforward cross-exchange trades to complex triangular and cross-market plays), and walked through how to conduct crypto arbitrage trading step by step.

We also emphasized the importance of automation and how a crypto arbitrage trading bot – such as platforms like HyroTrader – can improve your performance by offering speed and capital. Importantly, we explored the risks (as nothing is truly risk-free) and shared best practices to help you navigate and mitigate those challenges.

As a next step, consider applying what you’ve learned in a controlled manner. Try a small arbitrage trade between two exchanges with which you’re comfortable. Experience the process in real-time. Then, if it intrigues you, explore setting up a basic script or using an arbitrage service to automate the detection of opportunities.

You might also want to check out resources or communities focused on algorithmic trading – many algo traders start with arbitrage as a foundation.

Remember, the landscape will evolve. Arbitrage opportunities that exist today may disappear, and new ones will emerge. Maintain an experimental mindset and stay curious.

Whether you remain a solo arbitrageur capitalizing on occasional mispricings or you scale up using a platform like HyroTrader to access greater resources, the key is continuous learning and adaptation. By doing so, you’ll be well-positioned to profit from crypto market inefficiencies over the long term.