Crypto derivatives, like futures, perpetual swaps, and options, allow traders to predict price movements, protect against risks, and increase their positions using leverage. Understanding these tools is crucial for experienced traders who want to improve their strategies.

This guide will explain how crypto derivatives work, share helpful tips for using them, and show how seasoned traders use futures, swaps, and options for hedging, speculation, arbitrage, and portfolio management.

We won’t spend time defining derivatives. Instead, we’ll focus on key details that experienced traders care about, like the funding rate of perpetual swaps and the specifics of options strategies. By the end, you’ll understand how to use crypto derivatives effectively.

Are you ready to get started?

Let’s explore the main derivatives markets and how they work for savvy crypto traders.

Futures and Perpetual Swaps

Crypto futures were among the first derivatives to gain popularity in the digital asset markets. They provide a way to speculate on an asset’s future price without actually holding the asset. Today, futures and their counterpart, the perpetual swap, dominate trading volumes on major exchanges. These instruments allow traders to go long (bet on rising prices) or short (bet on falling prices) using leverage, enabling potential profits in both bull and bear markets. Before exploring various trading strategies, it is essential to understand how futures and perpetual contracts function and what drives their value.

Crypto Futures

A futures contract sets a price today for a deal that will happen on a specific future date. In cryptocurrency, futures have set expiration dates, like weekly or quarterly. For example, a trader might buy a Bitcoin futures contract that expires next quarter to secure today’s price. They might do this to speculate or to prepare for a future purchase. As the expiration date gets closer, the futures price will align with the current market price of Bitcoin. This alignment happens during the settlement process; when the contract expires, it is either settled with actual Bitcoin (rarely) or with cash based on the market price.

Traders need to know that futures prices can be different from spot prices before expiration. In a strong bull market, futures often cost more than the spot price. This situation, called contango, shows the positive market sentiment and the cost of capital. On the other hand, backwardation happens when futures cost less than the spot price, usually during a bear market or when there is high demand for borrowing an asset.

These price differences create chances for arbitrage. For instance, if a quarterly Bitcoin futures contract is priced 5% higher than the spot price, a trader can sell the futures contract and buy the same amount of Bitcoin on the spot market. They can lock in a profit of about 5% when the prices meet at expiration (minus any fees). This strategy, known as a cash-and-carry trade, can help capture profits from overpriced futures contracts. Crypto hedge funds and arbitrage traders often use these strategies, sometimes achieving double-digit annual returns during times of high futures premiums.

Futures also allow for high leverage. Exchanges let traders take large futures positions by only posting a small percentage as margin. For example, some platforms require only 10% of the position’s value to go long, meaning they use 10x leverage. This can magnify both profits and losses. If Bitcoin’s price rises by 1%, a 10x long position can yield a 10% profit. Conversely, if the price drops by 1%, that same position would result in a 10% loss.

Because of this leverage, traders must manage risk carefully. They need to monitor their margin levels closely. If the market moves too far against a leveraged position and the margin falls below a certain level, the exchange will close the position to prevent further losses. No one wants to get a liquidation notice, so smart traders use stop-loss orders and avoid over-leveraging to stay in control.

Crypto futures come in various types. Besides standard USD-settled contracts, many exchanges offer coin-margined futures (where Bitcoin is used as collateral) and even physically delivered futures on institutional platforms. However, the most popular crypto derivative is the perpetual futures contract, a new option that has quickly become popular in the market.

Perpetual Contracts (Perpetual Swaps)

Perpetual futures contracts, also known as perpetual swaps, are a new type of trading in the crypto world. A perpetual contract is similar to a standard futures contract, except that it never expires. This allows traders to hold their positions for as long as they like, which is very convenient. But without an expiry date to align with the market price, how do perpetual contracts stay close to the true value of the asset? The key is the funding rate.

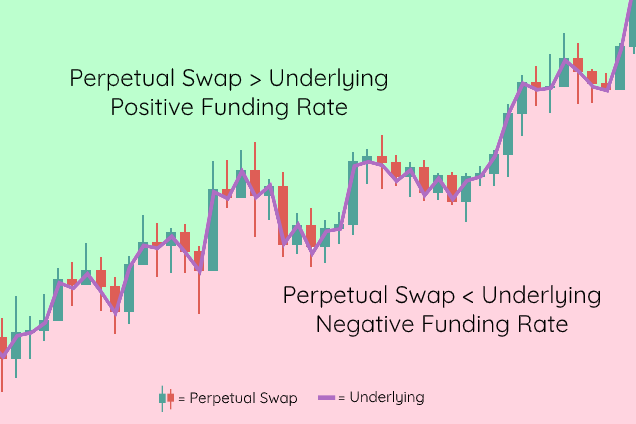

The funding rate is a fee that goes back and forth between buyers (longs) and sellers (shorts) in a perpetual swap. This fee typically gets charged every 8 hours, although it can differ by platform. It is based on the difference between the price of the perpetual contract and the actual spot market price. The funding rate is positive if the perpetual price is higher than the spot price. This means that buyers pay sellers a fee at each funding interval, which encourages some buyers to close their positions and some sellers to open new ones, helping to lower the perpetual price toward the spot price. If the perpetual price is lower than the spot price, the funding rate is negative, and sellers pay buyers. This encourages sellers to close or new buyers to enter, pushing the price up. Funding rates help keep the perpetual price in sync with the spot price.

Funding rates have real effects on traders. They are not just a detail but an ongoing cost or income related to your position. For example, you might think that’s small if you hold a long position in a Bitcoin perpetual swap and the funding rate is +0.01% every 8 hours. However, over a month, you could end up paying around 0.9% in fees, which can hurt your profits if Bitcoin’s price doesn’t rise enough to cover this cost. On the flip side, if you are short and the funding rate is positive, you earn that 0.9%, which can help your overall returns.

Traders need to monitor funding rates closely. A high positive funding rate often means too many people hold long positions and pay a lot in fees, which can signal a market downturn. Conversely, a very negative funding rate points to aggressive short-selling and fear in the market; going long during such times can be profitable if prices rebound.

Another benefit of perpetual swaps is that you don’t have to worry about rolling over your position. With traditional futures contracts, if you want to maintain a position after expiry, you must close the old contract and open a new one, sometimes at a different price. Perpetual swaps remove this hassle. You can maintain a long-term leveraged position without worrying about expiration dates, as long as you can cover the funding fees.

However, trading perpetual contracts requires careful management of your margin and understanding of risks. Just like any leveraged position, a perpetual contract can be liquidated if the market moves against you and your margin isn’t enough. During extreme price changes, funding rates can also vary widely or be temporarily controlled by exchanges to avoid chaos. Some exchanges have systems that automatically reduce large positions if they can’t be liquidated entirely, meaning a well-planned trade can still be affected by other traders’ bankruptcies.

It’s clear that perpetual contracts have become crucial to crypto trading. They make up a large portion of trading volume on exchanges, providing liquidity at all hours. When people talk about margin trading in crypto, they often mean trading perpetual contracts with leverage. For advanced traders, understanding the details of perpetual swaps—from funding rates to liquidation risks—is essential for success in the crypto derivatives market.

Crypto Options

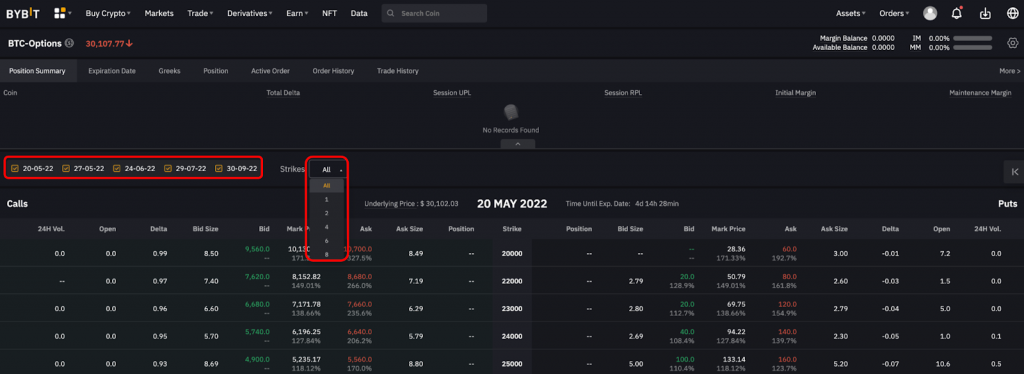

Options are a key type of crypto derivative that have a different risk and reward profile compared to futures. An option gives the holder the right to buy or sell an asset at a set price (called the strike price) on or before a certain date (the expiry). In crypto trading, the most common options are European-style, which can only be exercised at expiry, and these are usually based on major coins like Bitcoin and Ethereum. There are two main types of options: call options (which give the right to buy) and put options (which give the right to sell).

What sets options apart is their asymmetric payoff. The buyer’s loss is limited to the premium paid upfront, while the profit potential is significant. This nonlinear payoff allows traders to create more complex strategies that consider not just direction but also probability and volatility.

For experienced traders, crypto options provide tools for detailed market strategies. Instead of merely betting on price movement, traders can also trade on volatility itself or design positions that only pay off under certain conditions. The pricing of options mainly depends on implied volatility, which is the market’s expectation of how much the asset’s price will fluctuate during the option’s life. Crypto markets are known for their volatility, often resulting in high premiums on options. For example, Bitcoin options may reflect expectations of large price swings, creating a distinct volatility smile, where extreme moves lead to higher implied volatility.

Another important part of options is the “Greeks.” These are metrics that show how an option’s price changes with various factors. For example, delta measures how sensitive an option is to the asset’s price changes (a delta of 0.5 means the option acts like half a unit of the coin), while vega measures sensitivity to volatility. Advanced option traders closely monitor these metrics and use delta hedging to manage their risk, so they can focus on capturing movements in volatility or the effects of time decay.

Now, let’s look at how crypto traders actually use options in real situations.

Hedging with Options

One valuable use of options is as insurance for your crypto portfolio. If you own a lot of cryptocurrency, buying put options can protect you from a sharp price drop. For example, if you hold 10 ETH and worry that the market might go down in the next three months, you can buy an ETH put option. This option has a strike price close to the current market price and expires in three months. If ETH drops below that strike price by the expiration date, your put option will increase in value (or you can sell ETH at the strike price), helping to offset your losses. This put option acts like a safety net, ensuring a minimum selling price. The cost for this protection is the premium you pay for the option, similar to an insurance premium.

More experienced traders might use protective puts or create collars to minimize hedging costs. A collar involves buying a put for protection while also selling a call at a higher strike price. The money earned from selling the call helps reduce the cost of the put. The downside is that you may miss out on some gains above the call’s strike price if the price increases. However, this strategy offers downside protection at a lower overall cost. It is useful for miners or long-term investors who want to secure profitable prices for their coins without fully selling their holdings.

Generating Income with Options

One popular way to earn extra income with your crypto holdings is by using options. If you own an asset and think its price will stay about the same or rise slowly, you can sell call options on it. This strategy is called writing covered calls. When you write a covered call, you sell a call option at a strike price higher than the current market price and collect the premium upfront. If the asset’s price remains below the strike price until the option expires, you keep the premium as profit. This boosts your overall return. If the price goes above the strike, you must sell the asset at that price (or settle the difference if it’s cash-settled). In this case, your profit is capped at the strike price plus the premium. Covered calls can help you earn income from holding crypto, especially when the market is stable or gently rising. Many investors use this strategy as a way to gain passive income from their long-term assets.

Another strategy is selling options to buy assets at a discount. When you sell a put option (often called a cash-secured put if you have cash or stablecoins set aside to buy the asset), you agree to buy the asset at the strike price if the option is exercised. In return, you get a premium upfront. If the asset stays above the strike price, the put option expires worthless, and you keep the premium. If the asset’s price drops below the strike price, you’ll end up buying it at that price. However, your effective cost is lower because of the premium you received. This can work out well for traders who want to own more of the asset at a cheaper price. They can earn income if the price stays high or get the asset at a discount if the price falls. There is some risk, though. If the asset falls far below the strike price, you could buy it for more than it’s worth in the market. This strategy is best for those who are comfortable owning the asset for the long term.

Both covered calls and cash-secured puts are considered conservative options strategies because they involve real holdings or cash. They show that options aren’t just for high-risk plays; they can also help you improve your portfolio returns in a safe way.

Speculating on Volatility with Options

Options allow traders to make more complex bets beyond just buying or selling. They offer leverage and have a unique payoff structure, which means you can speculate on big price moves while risking little capital. For example, if you think Bitcoin will rise significantly, you might buy call options instead of buying Bitcoin directly or using futures. A call option that is far out-of-the-money (with a strike price above the current price) can cost much less than purchasing Bitcoin outright. If Bitcoin’s price rises above the strike price, that option can yield a large profit, often many times the initial cost. If the price does not rise, your loss is limited to the premium you paid, which is often less than what you might lose with futures.

Options also let traders bet on price swings without choosing a direction. If you expect a crypto asset to move significantly but aren’t sure which way, you could use a straddle strategy. This involves buying both a call and a put option with the same strike price. If the asset moves a lot in either direction, you can profit since one option will be worth a lot. If the price does not change, both options will expire worthless, and you will lose the total cost of both options. You can also use variations like strangles or different spreads to adjust how much movement you need to profit.

There are also more complex strategies like spreads and butterflies that experienced traders might use to manage their risk and reward. For example, if a trader expects moderate price movements, they might use an iron condor. This means selling an out-of-the-money call and put while buying further out-of-the-money options for protection. This setup lets the trader earn a steady premium if the price stays within a certain range. While we won’t cover every detail of each strategy here, it’s clear that crypto options provide a unique flexibility. They let you create payoff structures that fit nearly any market viewpoint, whether you are bullish, bearish, or just anticipating some market turbulence.

Leverage and Margin in Crypto Trading

Leverage in the crypto market has both advantages and risks. It can increase your profits but can also lead to bigger losses. Experienced traders understand that knowing how margin works is just as crucial as finding good trades.

In simple terms, leverage means using borrowed money to expand your trading position beyond your own funds. For example, if a trader has $1,000 and uses 10x leverage, they can take a position worth $10,000. Crypto exchanges allow this by requiring you to provide a margin, which is a small percentage of the full position, while they lend the rest.

While this can lead to larger gains, it also means that small market changes can wipe out your investment if you’re not careful.

Next, we will explain how margin and leverage work on crypto exchanges, the different ways to use margin, and how to manage risks. We will also discuss how traders can access more capital for leveraged trading, including how crypto proprietary trading firms help by providing funded accounts.

Cross vs. Isolated Margin

When you trade crypto derivatives, exchanges typically offer two ways to manage your margin: cross margin and isolated margin. Understanding these options is important for managing your risk.

In cross-margin mode, all the money in your margin account is combined to support all your open positions. If one position loses a lot, it can use funds from your entire account to stay active. This helps avoid quick liquidations for one position since more money is available. However, the risk is that a big loss in one trade could wipe out your whole account. While cross margin provides a safety net for each trade, it requires discipline to prevent a single bad trade from causing overall account losses.

In isolated margin mode, you set aside a specific amount of margin for each position. Each trade is separate, so if a position fails, you only lose the amount you allocated for that trade. For example, if you open a high-leverage trade on an altcoin with $500 in isolated margin and it goes badly, you would only lose that $500 (plus any profit in that position), while the rest of your funds remain safe.

Isolated margin helps limit the risk for each trade, but there’s a trade-off. If you don’t set aside enough margin and the trade needs more to survive a temporary downturn, it might get liquidated even if you have extra funds that could have helped if you used cross margin. Many experienced traders use a combination of both: they usually rely on cross margin for flexibility and efficient use of capital, but switch to isolated margin for high-risk or high-leverage trades to protect their other funds.

Regardless of which margin mode you use, keep in mind that high leverage combined with a small buffer can lead to quick liquidations. Exchanges typically liquidate your position when your account equity falls below the maintenance margin requirement—the minimum needed to keep the position open. They will close the position before losses exceed your set collateral. As a trader, you want to avoid reaching this point by managing your positions actively: add margin or reduce exposure if a trade goes against you, and use stop-loss orders to limit your losses.

Managing Leverage and Avoiding Liquidations

Trading cryptocurrencies with leverage requires careful risk management. A common mistake among inexperienced traders is using the highest leverage available, which can be 50x, 100x, or even more on some platforms. Although the temptation to turn a small amount of money into large profits is strong, high leverage offers little room for market fluctuations. Even a 0.5% drop in price can liquidate a position with 200x leverage. Experienced traders generally use lower leverage for most strategies and only use very high leverage for short-term trades with strict risk controls, if at all.

To avoid liquidation, plan your trade and risk from the beginning. Decide how much the price can move against you before hitting your stop-loss or liquidation point, and choose your leverage so that this move is a manageable loss rather than a total loss. For instance, if you are trading Bitcoin and your analysis shows that the trade is invalid if the price drops by 5%, don’t use leverage that would liquidate you on a 1% move. Instead, consider using 5x leverage or less, so that a 5% move would reduce your position value by about 25%—a loss you can manage or manually exit before full liquidation.

Another strategy is to adjust your margin actively. If you believe in your trade’s long-term potential but it’s moving against you, you can add margin to reduce your leverage and allow the position more room to move. This action can help move the liquidation price further away. However, be careful; adding margin to a losing trade can lead to more losses if you are wrong. It’s often better to stick to your stop-loss and re-enter later than to over-leverage and hope the market improves.

Always use stop-loss orders when trading with leverage. A stop-loss is your safety net before the exchange’s liquidation system takes over. It enables you to exit a trade at a specific price to limit your loss. By doing this, you stay in control of your results, assuming normal market conditions.

Combining reasonable leverage, adequate margin, and strict stop-losses can greatly lower the chance of being force-liquidated.

Accessing More Capital with Prop Trading

What if you have good trading skills but not enough money to use them fully?

This is where proprietary trading firms, or prop firms, can help. Crypto prop firms give talented traders access to more capital, letting them trade with a larger amount without risking all their own money. For example, HyroTrader is a crypto prop firm that offers funded accounts. You can trade with a substantial account (often worth tens of thousands of dollars) provided by the firm, and you share a portion of the profits while the firm covers losses beyond your initial investment or fee.

In simple terms, working with a prop firm allows you to use leverage with a bigger amount of capital. Instead of just turning 1 BTC into 1.2 BTC with good trades on your own, you could trade with a 10 BTC account from a firm like HyroTrader and earn more significant returns, even using less leverage. Prop firms usually have an evaluation process to ensure traders can manage risks. You’ll need to show consistent profits and follow risk limits. Once you’re funded, you can keep most of the profits (often 70-90%) while the firm takes a portion. Importantly, the firm covers losses beyond your account’s drawdown limit.

For experienced derivative traders, joining a prop program can help you grow without looking for outside investors or borrowing money. It gives you the power of leverage, backed by someone else’s capital. Still, trading a funded account requires discipline, maybe even more than trading your own money. Firms will set rules (like maximum daily loss or leverage limits) to protect their capital.

If you believe in your strategy and just need more funds to enhance it, a prop firm like HyroTrader can be a helpful partner. It’s a modern way to increase not just your trades but your entire trading business by providing more capital.

Real-World Use Cases of Crypto Derivatives

We’ve talked about how different crypto derivatives work. Now, let’s see how they are used in real trading situations. Derivatives are not just theoretical tools; they have practical uses for different market players. For example, a miner might use them to protect against price drops, a day trader might bet on quick price changes, an arbitrageur might seek risk-free profit, and a fund manager might adjust their portfolio. This section will discuss four main uses: hedging, speculation, arbitrage, and portfolio management. Each example shows why futures, swaps, and options are essential in cryptocurrency trading.

Hedging: Protecting Value and Reducing Risk

Hedging protects against losses by using derivatives, which are financial tools that help offset potential declines in your main investments. In the volatile world of cryptocurrency, holders of significant amounts often look for ways to safeguard their assets.

For example, a long-term investor in Bitcoin or a crypto mining operation naturally holds a strong position in Bitcoin. If the price suddenly drops by 20%, that would result in a loss. To hedge against this risk, you could take a short position in Bitcoin futures or perpetual swaps that equal your holdings. If Bitcoin’s price goes down, the gain from your short position can help balance out the loss on your coins, keeping your overall value more stable. You essentially lock in a price, similar to how a farmer uses futures to guarantee the selling price of their crops.

Options provide another way to hedge. Instead of shorting Bitcoin, the holder could buy put options for insurance. If the price drops, the puts increase in value, offsetting losses from the spot market. The advantage of options is that if the market doesn’t fall, you don’t have to sell; you simply lose the premium, similar to an insurance payment. This method appeals to those wanting to protect against potential losses while still enjoying the upside of holding the asset.

Hedging isn’t only for long-term holders; short-term traders use it too. For instance, if you’ve invested in an altcoin that you think will rise, but Bitcoin’s price seems unstable and could pull the market down, you might hedge that risk by shorting a small amount of Bitcoin or buying put options on Bitcoin. If the market drops, your hedge can offset losses. If it doesn’t drop, the cost of the hedge is just part of your trading expenses. The key to hedging is finding the right balance; you want enough protection to guard against major losses, but not so much that you erase all your potential gains.

Speculation is a common way to use crypto derivatives. Traders aim to profit from price changes, and derivatives offer flexible tools for this. With futures or perpetual swaps, a trader can use leverage to increase gains from expected price movements—going long if they anticipate a rise and short if they expect a fall. For example, if you believe Ethereum’s price will increase due to an upcoming upgrade, you could buy ETH perpetual futures with leverage. This way, your earnings increase with ETH’s rise (though your risks also increase). The ability to short through derivatives is also important; when you think a price will drop, you can profit from the decline by shorting a futures contract, which isn’t possible by simply selling what you don’t own in the spot market.

Options also present speculative chances. A trader might buy call options to bet on a price increase, risking only the premium if they’re wrong, or buy put options to bet on a fall. Options are attractive because they allow for greater potential profits while limiting potential losses for the buyer. They’re particularly appealing for high-risk situations, such as potential ETF approvals or major market announcements. There’s even a strategy for options that focuses on volatility—like buying options ahead of a significant event if you expect big price fluctuations.

Most speculative trading in crypto happens over short timeframes, like within a day or over several days. Fast traders often prefer perpetual swaps due to high liquidity and round-the-clock market access. They might switch between long and short positions many times, using derivatives as a way to trade efficiently. However, using derivatives for speculation, especially with high leverage, requires strict discipline. Without good risk management, speculative trades can lead to significant losses. Successful speculators respect leverage and set clear rules for when to exit a trade to limit losses or take profits.

Arbitrage in crypto derivatives takes advantage of price differences across markets for low-risk profits. Since crypto markets exist on many exchanges, price discrepancies can happen. A simple arbitrage example is when a Bitcoin futures price is higher than the spot price. A trader can short the futures and buy the spot asset. When the futures expire or prices align, the trader closes both positions, earning the difference as profit. This process works because the futures were overpriced compared to the underlying asset.

Conclusion

Crypto derivatives have revolutionized trading by offering ways to manage risk and seek profits beyond spot markets. Instruments like futures, perpetual swaps, and options are essential for experienced traders, but they require careful understanding. We discussed their mechanics, such as funding mechanisms and leverage, along with real-world uses like hedging, speculation, arbitrage, and portfolio management.

These derivatives provide flexibility beyond basic buying and selling, enabling you to hedge portfolios, trade on margin, earn yields, or lock in future prices. However, they also come with risks, so solid risk management and ongoing education are crucial.

As the crypto market evolves, derivatives will lead innovation, with new products and platforms emerging for those who use them wisely. A deep understanding of these tools is vital for advanced traders aiming to protect or grow their crypto wealth. With knowledge and discipline, you can thrive in the dynamic world of crypto derivatives.