Peer-to-peer (P2P) cryptocurrency exchanges have become an integral part of the advanced trader’s toolkit. At the moment, the P2P landscape is more dynamic than ever – an ecosystem reborn after the LocalBitcoins era ended and new giants emerged. (The pioneer LocalBitcoins shut down in early 2023 after a decade of service amid declining volumes.)

Meanwhile, platforms like Paxful weathered turmoil, even briefly suspending operations in 2023, before resuming to serve traders worldwide once again. Today’s top P2P exchanges, led by major players such as Binance and OKX, offer high liquidity, diverse payment methods, and robust escrow protections that appeal to professional crypto traders moving serious volume.

What makes the best P2P cryptocurrency exchange for an experienced trader? It goes far beyond basic buying and selling. Seasoned crypto traders demand deep liquidity, strong user protection, flexible fiat payment options, and efficient escrow systems that can handle large transactions with minimal risk.

These peer-driven platforms are the on/off-ramps that enable pros to swiftly convert between crypto and local currency, exploit arbitrage opportunities, and manage capital across global markets without relying on traditional banks. In a fast-paced prop trading environment, the right P2P exchange can be as crucial as a low-latency trading engine – it’s where you secure liquidity and cash flow in real time.

In this comprehensive guide, we’ll explore the top P2P crypto exchanges and dig into what sets them apart for professional traders. We’ll compare advanced features like escrow security, payment methods, regional coverage, user protection mechanisms, and overall liquidity.

You’ll discover the pros and cons of leading P2P platforms – from Binance P2P and OKX to regional hubs like WazirX – all with an eye toward the needs of a high-volume, security-conscious trader. We’ll also discuss key criteria for choosing a P2P platform as a pro and how to strategically integrate P2P trading into prop trading setups.

(Hint: Combining a prop firm like HyroTrader with P2P exchanges can unlock rapid scaling and seamless payouts.) By the end, you’ll have a clear view of which P2P exchanges are best suited to help you scale your crypto trading in 2025 and beyond.

Top P2P Cryptocurrency Exchanges

The P2P exchange arena is populated by both long-standing marketplaces and P2P services integrated into major exchange ecosystems. Below, we profile the leading platforms, each bringing unique strengths for peer-to-peer trading. From global giants with billions in volume to niche regional players, these are the P2P exchanges professional traders are turning to this year:

Binance P2P

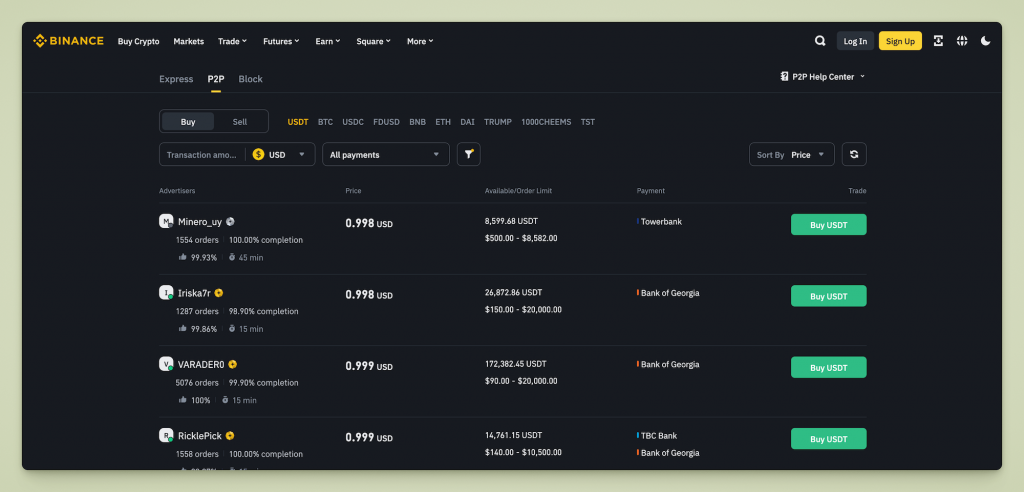

Binance P2P is the peer-to-peer platform of Binance, the world’s largest cryptocurrency exchange. Since its launch, it has quickly gained popularity and become one of the most notable P2P marketplaces globally. Binance P2P provides a wide range of fiat currency options and payment methods across over 100 countries, leveraging Binance’s extensive user base for liquidity. Users can buy or sell major cryptocurrencies (such as BTC, ETH, USDT, and BNB) directly with one another, with transactions protected by Binance’s escrow service, which holds the cryptocurrency until the fiat payment is confirmed.

For professional traders, the most significant advantage of Binance P2P is its substantial liquidity and market reach. With Binance’s strong brand reputation and an average daily trading volume exceeding $5 billion across all its services, there are plenty of counterparties available for large P2P trades. The platform interface is integrated into Binance’s main website and app, providing users access to advanced filtering tools. This allows traders to sort offers by price, payment method, region, and more to find the best deals. Additionally, Binance P2P supports a variety of payment methods, including bank transfers, e-wallets like Skrill, cash deposits, and more, making it convenient to find a suitable payment channel.

Notably, Binance P2P does not charge any fees for many popular trading pairs, allowing both makers and takers to transact at the posted prices without incurring extra charges. This fee-free model is advantageous for high-volume traders, as Binance generates revenue from ads and spreads instead.

Pros:

- Enormous liquidity and user base, making it easy to find buyers/sellers even for large amounts.

- No direct trading fees for most P2P trades.

- Supports dozens of fiat currencies and a variety of payment methods.

- Strong escrow service and dispute resolution backed by Binance’s support team.

Cons:

- Binance P2P operates under Binance’s KYC and regional restrictions; regulatory crackdowns in some countries mean the service isn’t accessible everywhere (e.g., Binance has faced bans in certain jurisdictions).

- The Binance interface can be complex for beginners, though experienced traders typically manage it well.

- There is always counterparty risk (e.g., bank reversals) associated with P2P transactions, although Binance’s escrow service helps mitigate this risk.

OKX P2P

OKX is a leading exchange that features an integrated P2P trading platform, well-regarded in Asia and Europe for its efficient system and support for a wide range of local currencies.

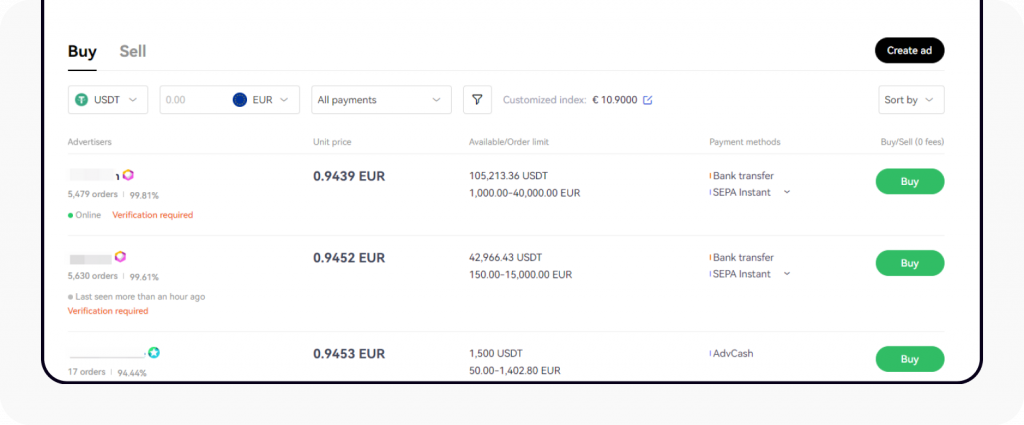

One of the standout features of OKX’s P2P marketplace is that it charges zero fees for P2P trades, allowing users to post or accept offers without paying any platform commission. This, along with competitive exchange rates, makes it appealing to frequent traders.

OKX supports trading in six major cryptocurrencies, including BTC, ETH, and USDT, against over 100 fiat currencies such as USD, EUR, INR, VND, NGN, and more. Additionally, OKX P2P provides an extensive selection of payment methods, with more than 900 options available globally. Whether you need SEPA or SWIFT bank transfers, mobile wallets, or services like Revolut and TransferWise, OKX has you covered. This wide array of payment options is particularly valuable for professional traders operating in multiple regions or seeking specific local payment channels.

Beyond the basics, OKX provides several advanced features that appeal to experienced users. For instance, the platform includes filtering tools to sort offers by price, payment method, region, and more, similar to Binance.

It also integrates with the larger OKX ecosystem – the exchange offers trading bots and yield products, though those are beyond the scope of P2P.

In terms of security, OKX P2P utilizes custodial escrow for crypto and has a verified merchant program (trusted sellers with deposits), which enhances trust in high-volume trades. Liquidity on OKX P2P is generally strong, particularly in Asian markets, although it lags slightly behind Binance in global reach.

Pros

User-friendly interface with quick matching; no P2P transaction fees; strong liquidity across Asia and Europe; supports an abundance of payment methods (900+) for global accessibility; advanced trading tools integrated under one roof for users of the OKX exchange.

Cons

OKX’s interface, while improved, may still feel somewhat complex for newcomers (less of an issue for pros). Accessibility can be limited in certain regions due to regulatory reasons (for example, like Binance, OKX is not available in the U.S.).

Additionally, the number of crypto assets available for P2P (a handful of major coins) is smaller compared to the hundreds of coins supported on its regular exchange, although the major coins are typically what pros require for fiat liquidity.

KuCoin P2P

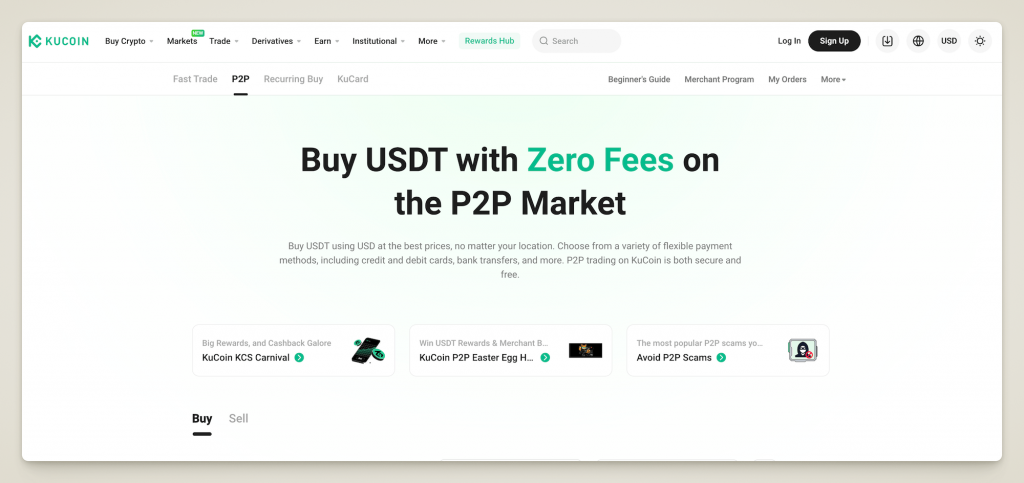

KuCoin, known as “the people’s exchange” for its altcoin selection, also offers a P2P trading section. KuCoin P2P is somewhat under the radar but provides a useful avenue for users to trade crypto directly for fiat. It supports over 50 fiat currencies, including USD, EUR, GBP, and INR, as well as popular cryptos like USDT, BTC, and ETH for P2P trades.

KuCoin’s appeal has always included relatively low fees, and this extends to its P2P market – trading fees on KuCoin P2P are extremely low or even zero for takers (buyers), with only advertisers (sellers posting ads) paying a tiny fee in some cases. In fact, the average effective fee on KuCoin P2P can be as low as 0.005% per trade, which is virtually negligible.

This means pro traders can execute large P2P trades on KuCoin without worrying about significant fees eating into arbitrage margins.

KuCoin P2P’s user interface is straightforward. It doesn’t have as many payment method options as Binance or OKX – the platform focuses mostly on bank transfers and a few e-wallets relevant to the supported currencies (the payment methods are somewhat limited, which is one of its downsides).

However, the basics for major fiat onramps are there. One advantage is that KuCoin historically allowed trading with minimal KYC for small amounts, but for P2P, larger trades, KYC verification is required to ensure security.

Liquidity on KuCoin P2P is moderate: you will find offers for common fiat/crypto pairs, but the depth is thinner than Binance or OKX. Pro traders might use KuCoin P2P when they already use KuCoin for altcoin trading or staking – it’s an easy way to cash in or out without leaving the platform.

Pros: Very low fees (essentially zero for many P2P trades); user-friendly interface; integrated with KuCoin’s ecosystem (helpful if you trade altcoins there); supports major fiat currencies worldwide.

Cons: Limited payment methods compared to larger P2P platforms, primarily bank transfers, which could create a bottleneck if you prefer alternative payment types. Liquidity is not as high as that of top competitors, so large orders might need patience or splitting into smaller trades. Additionally, while KuCoin is recognized for many altcoins, its P2P transactions mainly involve stablecoins and BTC/ETH, which may be suitable for fiat access but not for trading lesser-known coins via P2P.

Bybit P2P

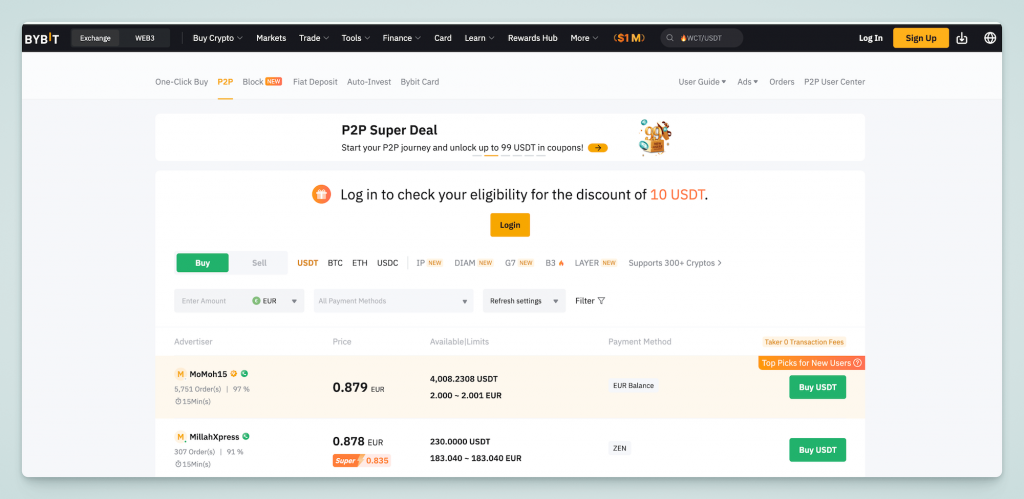

Bybit, a leading derivatives exchange, has more recently entered the P2P arena but has grown quickly. Bybit P2P is known for its user-friendly experience and strong focus on security.

The platform enables users to trade directly in major coins (BTC, ETH) and especially in stablecoins (USDT, USDC) with local currencies. One standout aspect for pro users is that Bybit charges no fees to either buyers or sellers in P2P trades – the prices you see are what you get, with Bybit acting purely as an escrow facilitator. This zero-fee model, similar to Binance’s, makes Bybit P2P attractive for cost-conscious, high-frequency traders.

Bybit P2P supports a decent variety of payment methods (bank transfers, PayPal, Payoneer, cash, etc.), though not as extensive as those offered by Binance or OKX. It shines in security and trust: Bybit implements features like two-factor authentication and even facial recognition for P2P sellers to prevent account takeovers.

They also offer a verified advertiser (merchant) program. For analysis-driven traders, Bybit provides an order book view of P2P offers and some conversion tools, which can be handy for gauging market demand. Moreover, if you’re already trading on Bybit’s futures or spot markets, the P2P section allows you to off-ramp profits directly in-app without transferring to another exchange.

Liquidity on Bybit P2P is growing rapidly. Although it may not have as many total users as Binance, Bybit’s popularity (daily volumes in billions across its exchange) ensures a steady flow of P2P traders, particularly in regions like Asia, Eastern Europe, and the Middle East. The platform is especially beneficial for obtaining stablecoins through local currency to use in Bybit’s trading contests or derivatives trading subsequently.

Pros

No fees for P2P trades (buyers and sellers transact free of charge) ; robust security features (2FA, verification checks) provide peace of mind; integration with Bybit exchange accounts allows for seamless transfers; growing liquidity and typically tight spreads on major pairs.

Cons

Fewer payment options compared to some competitors – you might not find obscure local e-wallets here, just the common methods. Bybit’s interface, while generally intuitive, may still feel a bit complex to absolute beginners (though experienced traders will navigate it easily).

Additionally, Bybit P2P focuses on a limited number of cryptocurrencies (primarily USDT, USDC, BTC, ETH), which covers most needs for fiat exchange, but you won’t find P2P trading for smaller altcoins.

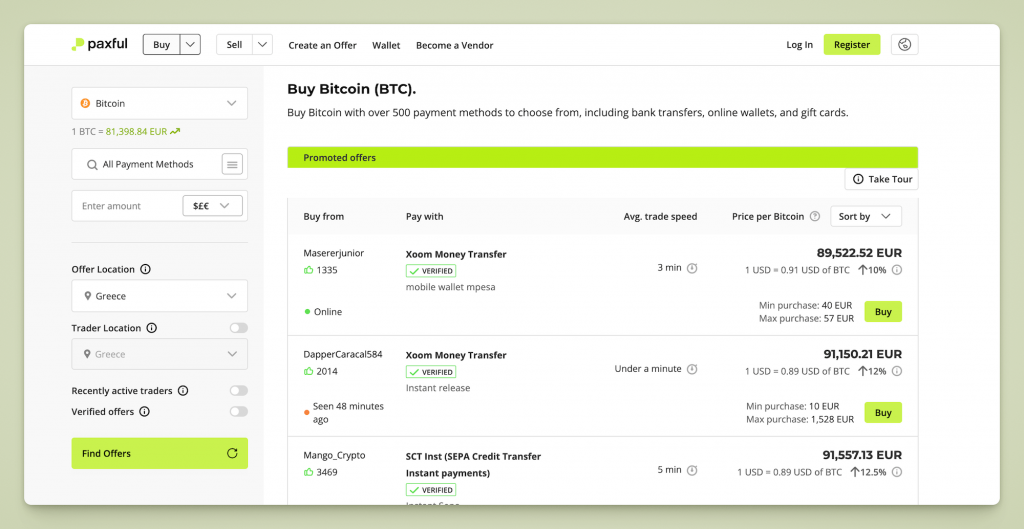

Paxful

Paxful is a veteran in the P2P crypto space, known for its open marketplace that connects buyers and sellers of Bitcoin and other cryptos. Unlike exchange-run P2P services, Paxful is a standalone peer-to-peer platform that has carved out a niche, especially in regions where banking access to crypto is limited.

On Paxful, users can trade Bitcoin, Tether (USDT), and USD Coin (USDC) with each other. While the coin selection is intentionally limited, Paxful makes up for it with over 350+ payment methods supported – an astounding variety ranging from bank transfers and mobile money (like M-Pesa) to gift cards, PayPal, cash in person, and more.

This flexibility in payment options has made Paxful a go-to platform in underbanked regions and emerging markets where paying for crypto is half the challenge. You can buy Bitcoin with an Amazon gift card or sell USDT for a Steam voucher on Paxful, which most other P2P exchanges don’t cater to.

For professional traders, Paxful can be useful in specific scenarios – for example, arbitraging price differences using unique payment methods or accessing markets where standard exchanges are unavailable.

Paxful’s escrow system is reliable: when a trade is initiated, the crypto is held in escrow by Paxful and won’t be released to the buyer until the seller confirms receipt of payment (and Paxful’s dispute resolution can mediate issues).

The platform also has a rating and reputation system; experienced traders on Paxful build up high feedback scores, and as a pro, you’d likely only deal with other highly-rated users to ensure smooth transactions. Paxful does not charge the buyer any fee; instead, the seller pays a 1% fee on the trade as Paxful’s commission. This means if you’re converting crypto to fiat, you’ll factor that into your price.

Paxful went through some trust concerns in 2023 when the platform temporarily suspended operations due to internal disputes and regulatory pressures, but it resumed service after about a month under new leadership. By 2025, Paxful will remain active and continue to be one of the most established P2P networks.

Pros

Supports an unparalleled range of payment methods (literally hundreds) , allowing creative trade opportunities; strong focus on underbanked regions and cash-based transactions; a long track record in P2P Bitcoin trading; escrow and dispute resolution are well-established and trusted by the community; no fees for buyers (sellers pay ~1%).

Cons

Limited cryptocurrencies (primarily BTC and stablecoins) , so not suitable if you need altcoins via P2P. The open marketplace model means potential for scammers – you must vet counterparties and be cautious, especially with reversible payment methods (Paxful’s rating system helps, but new traders could be at risk).

Paxful had a hiccup in operations in 2023, raising concerns over platform stability, but it has since stabilized. Overall liquidity can vary by region – in major markets, there’s plenty of activity, but obscure payment method trades might take time to find.

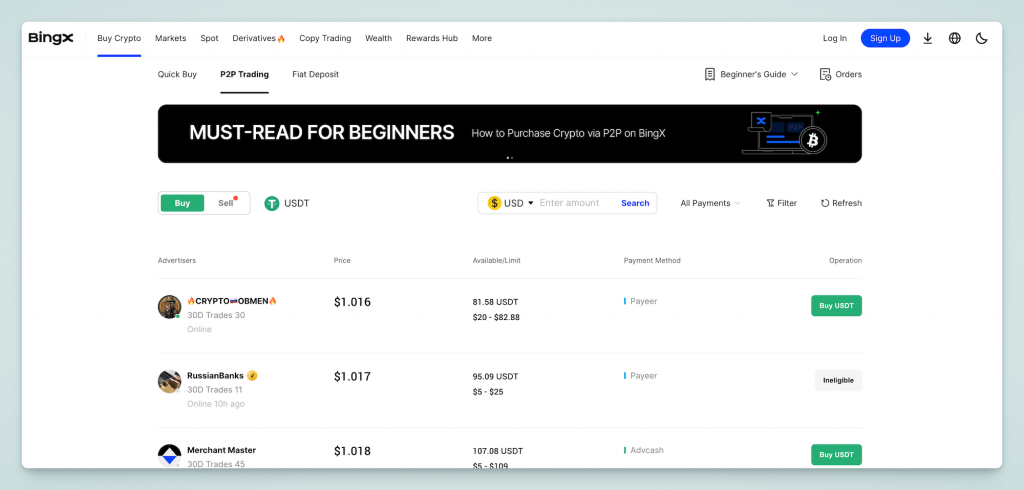

BingX P2P

BingX is a rapidly growing crypto exchange known for its social and copy trading features. Alongside its spot and derivatives markets, BingX offers a P2P trading platform for users to buy and sell crypto directly.

BingX P2P supports 30+ fiat currencies (including USD, EUR, GBP, NGN, IDR, PHP, ZAR, and more) and nearly 300 payment methods to accommodate a global user base. This puts it on par with many larger exchanges regarding payment flexibility – you can use various local bank transfers, e-wallets, and payment apps depending on your region.

For a pro trader, one intriguing aspect of BingX P2P is its integration with BingX’s copy trading ecosystem. Many users on BingX might be copy-trading or using the exchange for leverage, and P2P acts as a convenient gateway for them to fund their accounts or withdraw profits.

Liquidity on BingX P2P is decent, particularly in Asia and Africa, where BingX has been actively expanding. The platform often runs promotions to encourage P2P trading (e.g., zero-fee periods or rebates), so fees are generally low.

Typically, makers (advertisers) might pay a small fee while takers trade free, but BingX has kept fees very competitive to attract users. Security includes the standard escrow mechanism and a verification process for P2P merchants.

Because BingX is not as widely known as Binance or OKX, you might find fewer offers in less common fiat currencies. However, if you operate in one of the supported markets, BingX P2P can be an efficient option.

The user interface is clean and straightforward, which is advantageous for quick trades. Another benefit is that BingX has a reputation for fast customer support and an engaged community, meaning that resolving any P2P trade disputes can be relatively swift through their support channels.

Pros

Supports a wide range of fiats and payment methods (nearly 300 options), making it convenient for many regions; low trading fees (often zero for takers) and frequent promotions; straightforward interface; part of a larger exchange with 20+ million users, which provides liquidity and trust (BingX is an established name since 2018).

Cons

Liquidity continues to grow; however, in some less-popular currency pairs, you may not encounter as many offers or as tight spreads as found on Binance. The platform’s global presence is expanding, but still lags behind the top exchanges, resulting in variable counterparty availability.

Additionally, as a newer player in P2P, BingX’s reputation is still developing. While it has a solid overall exchange reputation, some professional traders might prefer sticking to the more established P2P platforms unless BingX demonstrates a clear advantage in their specific scenarios.

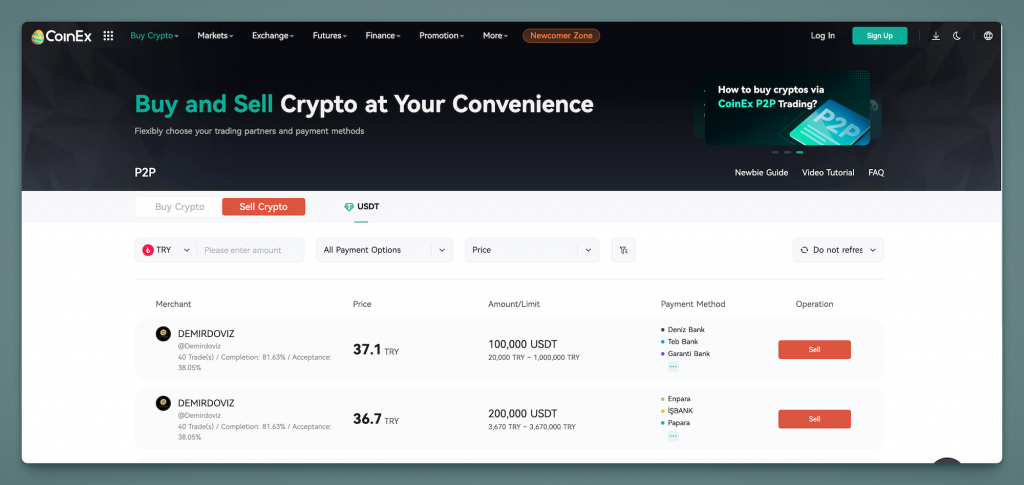

CoinEx P2P

CoinEx is a well-established crypto exchange (launched in 2017) that may not be as flashy as the giants but boasts a loyal user base. It has introduced a P2P trading section to facilitate fiat-to-crypto trades without intermediaries.

CoinEx P2P supports over 20 fiat currencies, focusing on markets in Asia, the Middle East, and parts of Africa. Users can trade common stablecoins like USDT and USDC, as well as Bitcoin and Ethereum, through the P2P desk.

One of CoinEx’s notable features is supporting over 300 payment methods for P2P trades. In practice, you’ll find options ranging from bank wires and AliPay/WeChat (popular for CNY trades) to Western Union and various local payment apps. This extensive payment support aims to position CoinEx on par with Paxful or Binance in terms of flexibility.

For professional traders, CoinEx P2P offers several notable features. The platform requires P2P merchants to place a security deposit and adhere to strict rules, which helps reduce fraud; if a merchant misbehaves, their deposit can be seized to compensate the victim. This serves as a useful trust mechanism when dealing with larger sums.

CoinEx has also historically been more lenient on KYC requirements compared to some competitors (depending on the region), meaning some smaller trades might not need full identity verification, although larger trades and merchant activities do require KYC for security purposes.

The trading interface is basic but effective: users can list or select offers much like on other P2P platforms. CoinEx’s overall trading fees are low, and this extends to P2P – often it’s free for the taker and has a small percentage for the maker, if any.

As of 2025, CoinEx is working to rebuild trust after a security incident (a hack in late 2023 on its exchange hot wallets), but its P2P platform was not directly affected, and the team’s response to reimburse users helped maintain credibility.

Pros

Supports hundreds of payment methods (broad accessibility); security deposits for merchants enhance safety; generally low or no fees for P2P transactions; CoinEx is available in many countries (where some larger exchanges face restrictions), giving it a niche user base.

Cons

Moderate liquidity – CoinEx P2P volumes are smaller, so large trades might take longer or require multiple smaller trades. The platform’s brand is not as globally recognized, which can be a consideration for trust (though its security mechanisms are solid).

Additionally, CoinEx’s focus is somewhat regional; if you need USD or EUR trades, you might find more offers on Binance/OKX, whereas CoinEx might excel for, say, Vietnamese Dong or Saudi Riyal, where it has communities. Recent security events on CoinEx (hack) might make some traders cautious, although P2P funds were safe and the issue was resolved.

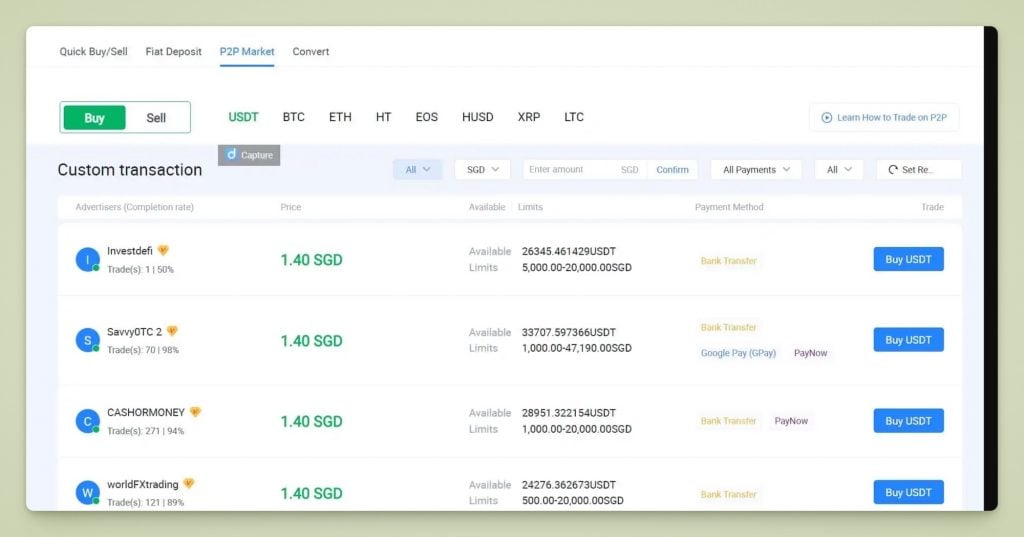

HTX (Huobi) P2P

HTX – the exchange formerly known as Huobi – remains a heavyweight in the crypto world, especially in Asia. Huobi rebranded to “HTX” in late 2023 (symbolically for its 10th anniversary), but its P2P marketplace continues the Huobi legacy of high liquidity in peer-to-peer trades. HTX P2P is popular in regions like China, Russia, and much of Southeast Asia, where users rely on P2P to move in and out of crypto due to local restrictions.

The platform supports trading of about six major cryptocurrencies (BTC, ETH, USDT, USDC, etc.) against fifty-nine different fiat currencies globally. Whether it’s CNY, RUB, VND, or KZT, you’ll likely find an HTX P2P market for it.

One significant advantage of HTX’s P2P is the liquidity in Asian markets – the exchange boasts approximately 45 million users worldwide, and many utilize the P2P feature. If you’re looking to execute a large trade in, say, Chinese yuan or Nigerian naira, HTX often has a substantial pool of offers.

The fee structure is standard: about 0.2% trading fee, but notably, users who hold Huobi’s token (now HTX token) receive fee discounts on P2P trades. This can reduce your costs if you frequently trade on HTX and take advantage of the loyalty program.

The escrow system is reliable as expected – HTX secures crypto during the transaction, and they have a dispute resolution team. Security is prioritized, with most funds stored in multi-signature cold wallets on the exchange side.

For professional traders, HTX P2P is a crucial platform in markets with a strong position. For instance, it’s widely recognized that many OTC (over-the-counter) brokers in China utilize Huobi/HTX P2P for substantial trades, avoiding detection by banking systems. Likewise, Russian traders have leveraged the platform to exchange rubles for USDT.

This “regional stronghold” feature presents a mixed advantage: HTX has a limited footprint in Western markets, resulting in less USD/EUR activity than other platforms. Additionally, the exchange has encountered regulatory challenges – Huobi has undergone ownership changes and increased scrutiny, and although it now operates from Seychelles, some traders remain wary.

Nevertheless, in 2025, HTX continues to rank among the leading P2P exchanges by trading volume.

Pros

There is very high liquidity in major Asian markets (ideal for CNY, RUB, etc.); fees are competitive (0.2% or lower, with VIP discounts); it supports various fiat currencies through reliable escrow; it has a solid reputation in the industry (founded in 2013); and it ensures strict security for funds.

Cons

Regulatory challenges and trust concerns exist in certain areas – the brand’s recognition is weaker in the US and EU, and there has been some instability; Western fiat liquidity on HTX is limited.

The platform’s interface and support are primarily designed for Asian users, which may pose a challenge for others, such as having fewer payment options for USD. Additionally, recent rebranding efforts and issues, including a wave of rumors in 2023 regarding Huobi’s financial status and a temporary withdrawal scare, have led some experts to approach HTX cautiously.

While it has shown resilience, it’s advisable to remain vigilant with any platform not fully regulated in key jurisdictions.

WazirX

WazirX is a prominent crypto exchange in India, primarily attracting users through its P2P platform. As direct banking methods to cryptocurrency were limited, WazirX’s P2P for INR (Indian Rupee) offered essential support to countless traders.

What sets WazirX P2P apart is its focus on linking buyers and sellers of USDT with INR – users engage in deposits or withdrawals through P2P by trading USDT, which can subsequently be exchanged for other cryptocurrencies on WazirX or Binance (with WazirX being a Binance affiliate).

The platform features an auto-matching mechanism: you specify the amount of USDT or INR to trade, and WazirX’s system identifies a counterpart. This setup ensures a fast and user-friendly experience, particularly for beginners, and incurs no fees on P2P transactions (WazirX P2P is entirely free to use). Instead, WazirX likely benefits indirectly when users transfer their USDT to the exchange for trading activities.

For professional traders in India, WazirX P2P is essential. It enables instant payments via popular methods like UPI, IMPS, and NEFT (real-time bank transfers and mobile payments), allowing you to complete fiat-to-crypto trades within minutes. The liquidity for INR<>USDT is quite robust – WazirX once reached volumes that positioned it among the world’s leading P2P markets for a single currency.

The platform offers a smooth user experience: upon matching, the buyer transfers INR to the seller’s bank/UPI; once the seller confirms, USDT is released from escrow. The auto-match feature eliminates the need to select offers manually; while this limits price negotiation, it standardizes the rates.

WazirX P2P generally features a slight premium on USDT prices in India, reflecting local demand, which is monitored closely by arbitrage traders. Moreover, WazirX operates on Binance’s backend (leveraging Binance’s liquidity and infrastructure), enhancing trust and reliability.

Pros

Simple and convenient INR on-ramp/off-ramp – likely the easiest method for Indian traders to switch fiat for crypto; no P2P fees; strong security and escrow (supported by Binance technology); significant trust and a vast user base within its market; quick settlement through Indian banking apps.

Cons

WazirX is primarily designed for India, focusing mainly on INR support. For international traders, the P2P service is not beneficial unless INR liquidity is needed. The platform offers limited payment options outside of India, targeting mainly Indian bank transactions.

Additionally, WazirX faced operational difficulties, including a public disagreement over ownership with Binance in 2022 and a major hack/cyberattack in 2023-24, which initiated a lengthy fund recovery process. While these issues did not directly impact P2P, they did undermine user trust.

Additionally, WazirX charges above-average fees for crypto withdrawals, leading many P2P users to transfer their USDT to Binance via the internal bridge created by WazirX’s integration with Binance to bypass these costs. Overall, it performs well for INR but is not as applicable for other fiat currencies.

Pros and Cons of Leading P2P Platforms

Let’s summarize the key advantages and disadvantages of the major P2P exchanges from a professional trader’s perspective:

- Binance P2P – Pros: Highest liquidity and global reach; no trading fees; many fiat and payment options; strong escrow protection. Cons: KYC is required; it is unavailable in certain countries due to regulations; it is a complex interface for new users.

- OKX P2P – Pros: No fees; 900+ payment methods; high liquidity internationally; advanced tools integrated. Cons: Not accessible in certain regions; interface can be a learning curve for some.

- KuCoin P2P – Pros: Ultra-low fees (~0% in many cases); decent global fiat support; part of a larger exchange ecosystem. Cons: Fewer payment method choices; liquidity is moderate; KYC is needed for large trades.

- Bybit P2P – Pros: Zero fees for buyers and sellers; high security (2FA, etc.); integrates with Bybit trading accounts. Cons: Limited payment method variety; still expanding user base, slightly lower liquidity than Binance.

- Paxful – Pros: Huge range of payment methods (350+ including gift cards); strong presence in cash-based markets; reputable escrow & dispute system. Cons: Only a few cryptos (mainly BTC); risk of scams with unconventional payments; had a recent service interruption (now resolved).

- BingX P2P – Pros: Supports ~30 fiat currencies and 300 payment methods; low fees; simple interface; tied to a growing exchange (social trading features as a bonus). Cons: Liquidity is still scaling up; it is not as well-known in the P2P sector, which may give some counterparty caution.

- CoinEx P2P – Pros: Wide payment flexibility (300+ methods); merchant security deposits for trust; low fees; available in many emerging markets. Cons: Lower overall volume; mid-tier exchange reputation; primarily active in certain regions.

- HTX (Huobi) P2P – Pros: Excellent Asian liquidity; supports many local currencies; competitive fees (with token discounts); long track record. Cons: Limited footprint in West; past regulatory uncertainties; recent rebrand/hack rumors have made some users cautious.

- WazirX P2P – Pros: Best option for INR on/off ramp; very fast and user-friendly for its target market; no fees. Cons: Only useful for Indian rupee trades; not relevant for other fiat; the exchange had some security incidents (unrelated to P2P but affecting trust).

Every platform caters to a specific niche. A professional trader may utilize various P2P exchanges to address different markets, such as Binance P2P for USD and NGN transactions, HTX for CNY trades, and WazirX for INR. The “best” P2P exchange is largely determined by your operating region and the features you prioritize, such as fees, speed, and anonymity. Next, we will explore a detailed comparison of these features.

Advanced Feature Comparison: Escrow, Payments, Protection & Liquidity

To truly evaluate P2P exchanges as a pro, we must go beyond the surface level and examine how they implement crucial features. Four key pillars stand out: the escrow mechanism (and overall security), available payment methods, user protection measures, and the liquidity and volume each platform offers. Let’s compare how the top exchanges stack up in each of these areas:

Escrow and Security Mechanisms

All reputable P2P crypto platforms utilize an escrow system to safeguard buyers and sellers. When a trade is initiated, the crypto being sold is automatically secured in escrow by the platform, preventing the seller from absconding with it after receiving payment and ensuring that the buyer cannot receive crypto without making a payment.

The differences arise in how this escrow is managed and what additional security layers are present:

Centralized Escrow

Exchanges like Binance, OKX, Bybit, and Huobi operate a centralized escrow, where the exchange holds crypto in a custodial wallet during trades. It is generally safe if the exchange is secure.

These platforms employ strong security measures such as cold storage and withdrawal whitelists. For example, HTX uses multi-sig cold wallets, while Binance invests significantly in security and has a SAFU fund as backup.

The escrow release can be either manual or automatic: the seller confirms receipt of fiat, clicks release, and the crypto transfers to the buyer. If issues arise, a dispute can be opened, and support will investigate, holding the escrow until resolution.

Decentralized / Multi-sig Escrow

A few P2P platforms, notably HODL, utilize non-custodial 2-of-3 multi-signature escrow, with a key for the buyer, seller, and platform. Most on our list use the traditional custodial model; however, Paxful has experimented with BitGo, maintaining a centralized third-party custodian.

All major platforms implement escrow to prevent direct peer-to-peer transactions without collateral, ensuring safe P2P trading. Traders should choose platforms with a reliable escrow system – all listed have years of operation.

Consider account security, exchanges like Bybit require P2P traders to enable two-factor authentication and facial recognition for certain actions, adding a layer that complicates impersonation in P2P trades.

Binance and others also mandate 2FA for P2P transactions and withdrawals. Some platforms allow a secret PIN for P2P releases. SMS/email confirmation for escrow releases can prevent social engineering attacks for large trades.

Escrow is crucial – never trade off-platform, regardless of a deal’s appeal, as you lose your safety net. All major exchanges offer solid escrow; security varies mainly with a platform’s stability (larger exchanges have more resources).

Don’t store all your capital on one P2P platform’s wallet to diversify risk. Transfer funds as necessary and withdraw excess crypto to your own secure wallet after trades. This way, your risk remains minimal even if an exchange encounters an issue.

Payment Methods and Fiat Options

One of the biggest differentiators among P2P exchanges is the variety of payment methods and fiat currencies they support. This determines where and how you can trade:

Global Coverage

Binance P2P and OKX P2P lead in supported fiat currencies and payment methods. Binance has 70+ currencies, while OKX offers over 100. OKX boasts 900+ payment methods, including bank transfers (SEPA, SWIFT), online wallets, and remittance services. Binance also covers options like Zelle in the US, M-Pesa in Kenya, and Paytm in India.

For professional traders operating internationally, these platforms provide flexibility with local payment options.

Niche and Underbanked Methods

Paxful excels in alternative payment methods, allowing users to trade gift cards, cash, and obscure mobile wallets. It supports Western Union, Amazon/Google Play gift cards, and various mobile money services. This facilitates converting those forms of money to crypto and vice versa.

HODLers in countries with currency controls often use gift cards or online vouchers on Paxful to acquire crypto, though these typically have less favorable rates due to higher risks.

Regional Focus

Some exchanges focus on regions: WazirX supports only Indian bank transfers (IMPS, UPI). Localbitcoins facilitated cash meetups in specific locales. HTX includes many Asian apps and some Western options like SEPA, but its user base favors methods popular in China (Alipay, WeChat) and Russia. CoinEx is prominent in certain Asian and Middle Eastern countries, offering popular local payment methods.

Pro traders benefit from multiple payment methods, creating arbitrage opportunities; for example, crypto could be cheaper via PayPal versus a bank transfer on Paxful.

If you can accept PayPal safely (though risky due to chargebacks), you could buy it cheaper from someone seeking it and sell it at a higher price via bank transfer.

However, caution is essential with reversible payments: advanced P2P traders typically avoid PayPal or credit cards unless they trust the counterparty, as a scammer can dispute the payment after receiving crypto. Many P2P platforms emphasize the high-risk methods for sellers.

To access fiat, trading in multiple currencies may require accounts on various P2P exchanges. For instance, Binance P2P provides USD and IDR liquidity, but for Argentine Pesos, consider LocalCryptos or a regional exchange due to Binance’s exit from ARS during crackdowns. Always check if the P2P platform has an active user base in your desired fiat, as liquidity is often specific to the currency.

User Protection and Dispute Resolution

While escrow is the first line of defense, top P2P exchanges also implement various user protection policies to create a safer trading environment, crucial for pros who can’t afford to waste time or money on fraudulent counterparties:

KYC and Verification

Most large P2P platforms (Binance, OKX, Bybit, etc.) require users to complete KYC (Know Your Customer) identity verification to use P2P beyond small limits. This deters many scammers because their ID is tied to the account. For example, KuCoin now requires KYC for P2P trades, whereas it used to allow more anonymity.

Paxful historically allowed pseudonymous trading, but they still encourage verification and will ban accounts involved in fraud. As a pro trader, you might prefer a platform where the counterparties are verified real persons or businesses – it adds confidence when doing large trades. The trade-off is privacy; some users may prefer less KYC.

If anonymity is a must, decentralized options (like HODL HODL, Bisq) exist, but with far lower liquidity.

Rating/Reputation System

Paxful and formerly LocalBitcoins depend significantly on user feedback ratings. After each transaction, you can rate your partner positively or negatively and leave a brief review. This process gradually creates a reputation score. As an advanced user, you would strive for 100% or close to it in positive feedback to indicate trustworthiness.

When selecting partners, you will likely engage with well-established accounts (for example, those with 50+ trades and all positive feedback).

On the other hand, Binance and similar platforms do not offer a public rating score in the same manner, but they display statistics such as the number of completed orders and the completion rate percentage.

For instance, on Binance P2P, a seller may have 1,000 orders with a 98% completion rate – this suggests reliability, while someone with only five orders may be new and somewhat riskier. Utilize this information to assess reliability.

Verified Merchants & Moderation

Numerous platforms feature verified merchant programs. Users who apply and fulfill specific criteria, such as enhancing their verification and maintaining a cash reserve, earn a badge (like “Merchant” on Binance or “Power Merchant” on Okx).

These merchants typically provide tighter spreads and greater availability. For professional traders, engaging with official merchants can lead to smoother transactions, as these traders essentially function like semi-professional traders or OTC desks who maintain a strong reputation on the platform.

They may also benefit from priority support services. Conversely, merchants might offer slightly wider spreads, which is how they generate earnings. Ultimately, it’s a trade-off between cost and trust.

Dispute Resolution

If a trade goes bad, like when you make a payment but the seller refuses to release the crypto, every major P2P exchange features a dispute resolution process. Generally, you can initiate a dispute after a certain period if the other party isn’t cooperating.

Support will then intervene, assess the evidence (such as transaction receipts and chat logs), and determine whether to release the escrow to the appropriate party. For example, Paxful’s dispute team reviews evidence like payment screenshots or proof of fraud, while Binance P2P offers live chat support for mediation.

The effectiveness of dispute resolutions can differ: larger platforms have more resources but face a higher volume of disputes, while smaller exchanges might provide more tailored assistance.

Ideally, from a professional perspective, you should aim to avoid disputes by following proper procedures: never release crypto before confirming payment in your bank, and always keep records of payment. However, it’s reassuring to know that if any issues arise, the platform supports you.

Consult user guides; for instance, Binance and CoinEx share anti-scam tips and practical rules (like “don’t trade outside the platform chat” and “verify proof of payment before placing trust”). Adhering to these guidelines typically ensures that any disputes are resolved in your favor, provided you acted in good faith.

Customer Support

Time is money for pro traders. Quick customer support is a blessing if an issue arises (like a stuck transaction or a fraudulent buyer). Exchanges like Binance have 24/7 support chat, though sometimes response times can be slow due to volume.

Smaller platforms like WazirX or BingX often have active Telegram communities and support that may respond faster to simple queries. It’s worth testing a platform’s support or reading reviews to see how they handle P2P issues.

Overall, user protection on the leading P2P exchanges has improved significantly in recent years, especially as they attract more mainstream users. The environment in 2025 is much more professional and safer than the wild-west P2P markets of a few years ago.

Still, as an experienced trader, you should exercise caution and utilize all these protective features – verify counterparties, keep communication on-platform, use platform escrow only, and don’t hesitate to involve support if something seems off.

Liquidity and Market Depth

Liquidity is paramount for a trader. A P2P exchange may have excellent features, but it becomes quite ineffective if there aren’t enough buyers or sellers for your target trades. In the context of P2P, liquidity refers to whether there are sufficient counterparties and volume to execute your trade promptly at a fair price.

- Top Tier Liquidity: Binance P2P likely offers the deepest global liquidity, with tight spreads for major fiat markets like USD<>USDT and NGN<> USDT. You can trade hundreds of thousands with minimal slippage. OKX and HTX also have strong liquidity in their regions, benefiting from their connections to large exchanges, funneling users into P2P for fiat needs, ensuring a constant flow.

- Regional Liquidity Hubs: WazirX is highly liquid for INR, while Paxful was very liquid for Nigeria, Kenya, and China (BTC trades). However, liquidity can drop outside these hubs; for instance, trading Japanese Yen on Paxful might show few offers. Choosing a platform that specializes in your region ensures better liquidity.

- Emerging Platforms: BingX and CoinEx are gaining liquidity. They may not match Binance yet, but could be competitive in certain areas. Traders can leverage this by becoming market makers if gaps exist. For instance, if there’s no activity for a currency on BingX P2P, you might create your market and command a larger spread.

- Volume and Speed: Liquidity also relates to trade execution speed. Competitive offers are taken within seconds on high-liquidity exchanges, while low-liquidity exchanges may take hours or days. Professional arbitrage traders need quick turnover, thus gravitating towards top platforms, which enhances their liquidity.

One strategy to gauge liquidity is to conduct a small test trade on each platform of interest. Observe how many offers appear and how quickly your trade completes. Check the 24-hour traded volume if the platform displays it.

Some third-party sites track P2P market volumes (e.g., CoinDance used to track LocalBitcoins volumes in different countries, and now sites like UsefulTulips track Paxful volumes). These resources can provide a sense of which platform dominates in each country.

In summary, Binance P2P and other major exchanges offer the most consistent liquidity globally, whereas specialized platforms like Paxful or WazirX excel in specific markets. A savvy trader will leverage this to their advantage, utilizing the liquid market for entry or exit while exploring niche markets for arbitrage opportunities or to meet unmet demand.

Integrating Prop Trading Platforms (HyroTrader) with P2P

A growing trend involves a crypto prop trading firm that focuses on cryptocurrency, such as HyroTrader, which offers proficient traders access to funded accounts.

These firms enable traders to manage substantial capital, often reaching tens or hundreds of thousands of dollars, on major exchanges, frequently with a profit-sharing model.

How does P2P come into play?

Take, for instance, a trader at HyroTrader who has recently earned significant profits trading on Bybit through HyroTrader’s platform. HyroTrader takes pride in providing real-time access to exchanges, allowing traders to operate directly on live exchange order books via API, and facilitating instant crypto profit payouts.

Consequently, when the trader decides to cash out, they receive their profit share in cryptocurrency (such as USDT) almost instantly, eliminating the need to wait for monthly disbursements. The trader might convert the USDT to cash using a P2P exchange to utilize those profits.

They could go to a buyer in their local currency on Binance P2P or another platform, enabling money to reflect in their bank account within hours of closing their trading session.

This combination supports rapid monetization of trading achievements. Previously, a trader at a prop firm might wait weeks for a wire transfer of profits; now, thanks to crypto prop firms and P2P off-ramps, they can access spendable cash on the same day.

Conversely, if a prop trader needs to add funds (say to pay a challenge fee or margin top-up), they can use P2P to obtain the needed crypto (like USDC) and send it to the prop platform.

In fact, HyroTrader integrates directly with Bybit and the CLEO platform (which provides access to Binance liquidity). This deep integration means the trading is happening in a real exchange environment.

HyroTrader allows scaling an account up to $1 million USDT in capital for top performers – at that scale, moving money in and out efficiently is vital. P2P networks become the highways through which these large sums travel between the trader’s bank and the trading account.

A trader scaled to a seven-figure account might routinely use P2P to rebalance funds, withdraw profits, or even arbitrage between the prop account and personal accounts if certain spreads appear.

Efficiency Tips for Pros: To maximize efficiency using P2P, pros often employ a few tactics:

- Maintain multiple bank accounts to avoid transfer limits and ensure backups if one method is slow. If one bank experiences downtime, you can use another for P2P payments.

- Keep some funds in stablecoins readily available to deploy, allowing you to act as a buyer or seller on P2P to take advantage of a favorable price (almost market-making).

- Use alerts or bots: For example, if you are waiting for a specific P2P rate (perhaps you only want to sell BTC if the local premium is above X%), you could set an alert through the exchange’s app or a third-party tool that notifies you when offers meeting your criteria appear.

- Stay updated on local regulations: Prop traders must remain compliant. They monitor any new laws related to crypto trading in the regions where they operate. If a country announces a bank freeze on crypto-related transfers, a prop trader might temporarily pause P2P activities in that area or seek alternative routes. Being proactive prevents funds from getting stuck.

In conclusion, P2P exchanges function as the circulatory system for prop trading by swiftly moving capital. They enable traders and firms to scale without traditional banking bottlenecks, offering global flexibility, 24/7 market responsiveness, and risk management through fund movement.

It’s crucial to approach P2P with the same professionalism as a trading strategy, emphasizing due diligence, risk management, and strategic planning to maximize benefits from P2P crypto exchanges.

Conclusion

The peer-to-peer crypto exchange landscape in 2025 is a robust ecosystem for both hobbyists and professional traders. Major platforms like Binance P2P, OKX, KuCoin, Bybit, Paxful, BingX, CoinEx, HTX (Huobi), and WazirX offer unique features.

For experienced traders, the “best” P2P exchange is often context-dependent, based on liquidity, fees, or specific payment methods. A combination of platforms often empowers pro traders to operate at full capacity.

Escrow security, payment flexibility, user protections, and liquidity are the cornerstones of these platforms. Top exchanges excel by offering secure escrow systems, quick dispute resolution, and hundreds of payment options, enforcing KYC to deter bad actors and aggregating users for large volume trades with minimal friction.

By grasping the pros and cons, a professional trader can optimize fiat on-and-off ramps, reduce costs, and identify arbitrage opportunities.

We explored how prop traders use P2P trading strategically. In high-stakes trading, moving money 24/7 is crucial. Platforms like HyroTrader extend a trader’s reach with funded accounts, while P2P networks provide immediate liquidity and payout options. This synergy enables traders to scale to six- or seven-figure capital levels while remaining nimble, cashing out profits quickly or taking advantage of cross-market price discrepancies.

P2P crypto exchanges have evolved from fringe marketplaces to essential crypto finance infrastructure. They embody decentralization, allowing global direct trading while meeting professional standards.

As a seasoned trader in 2025, using the best P2P exchanges lets you trade anywhere, anytime, with available liquidity. Choose the right platform: use Binance P2P for volume, Paxful for unconventional payments, WazirX for the Indian market, etc.

Armed with insights from this guide, you should be equipped to choose the best P2P cryptocurrency exchanges that align with your trading strategy. The crypto landscape will evolve, but one constant remains – the ability to trade peer-to-peer, on your own terms. For professional crypto traders, P2P exchanges are a powerful ally in pursuing profit and financial freedom.